21Shares Partners with BitGo for Enhanced Crypto Custody and Staking

TLDR

- 21Shares has expanded its partnership with BitGo to include custody and staking services for its crypto ETPs.

- BitGo will offer regulated custody, trading, execution services, and integrated staking infrastructure for 21Shares’ products.

- The partnership will support 21Shares’ US exchange-traded funds and global crypto ETPs across both the US and Europe.

- BitGo’s services will be delivered through its OCC-approved trust bank in the US and MiCA-licensed operations in Europe.

- 21Shares manages over $5.4 billion in assets across 59 exchange-traded products listed on 13 global exchanges.

21Shares has announced an expansion of its partnership with BitGo to enhance its custody and staking services. The collaboration will support 21Shares’ crypto exchange-traded products (ETPs) across the United States and Europe. BitGo will provide regulated custody, trading, execution services, and integrated staking infrastructure for these products.

This agreement allows 21Shares to offer investors seamless access to its US exchange-traded funds (ETFs) and global ETPs. BitGo will also provide liquidity across various electronic and over-the-counter markets.

The services will be offered through BitGo’s regulated entities in both the US and Europe. This includes the federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and MiCA-licensed operations authorized by Germany’s Federal Financial Supervisory Authority.

BitGo to Support 21Shares’ US and Global ETPs

The expanded partnership will enable BitGo to offer a range of services that support 21Shares’ exchange-traded products. BitGo’s services will include both custody and staking solutions for 21Shares’ clients. With a presence in the US and Europe, BitGo’s platform offers strong compliance with regulatory standards. This includes its OCC-approved US trust bank and MiCA-licensed European operations.

21Shares, a subsidiary of FalconX, is one of the world’s largest crypto ETP issuers. As of February 11, the company manages over $5.4 billion in assets across 59 products listed on 13 exchanges. This move marks another milestone in BitGo’s ongoing efforts to provide institutional-grade services to crypto investors.

21Shares Benefits from BitGo’s Custody and Staking Infrastructure

The partnership will also enhance 21Shares’ ability to tap into the growing demand for yield-generating crypto infrastructure. Staking services have become a key feature for institutional investors seeking enhanced returns from their crypto holdings. BitGo’s fully regulated framework will offer these investors access to secure custody and staking services.

This move comes just weeks after BitGo began trading on the New York Stock Exchange under the ticker BTGO. The crypto industry has seen a rise in staking services, with platforms like Coinbase and Anchorage Digital also expanding their staking offerings. The growing interest in liquid staking, which allows users to stake while maintaining liquidity, further supports the demand for BitGo’s services.

The post 21Shares Partners with BitGo for Enhanced Crypto Custody and Staking appeared first on Blockonomi.

You May Also Like

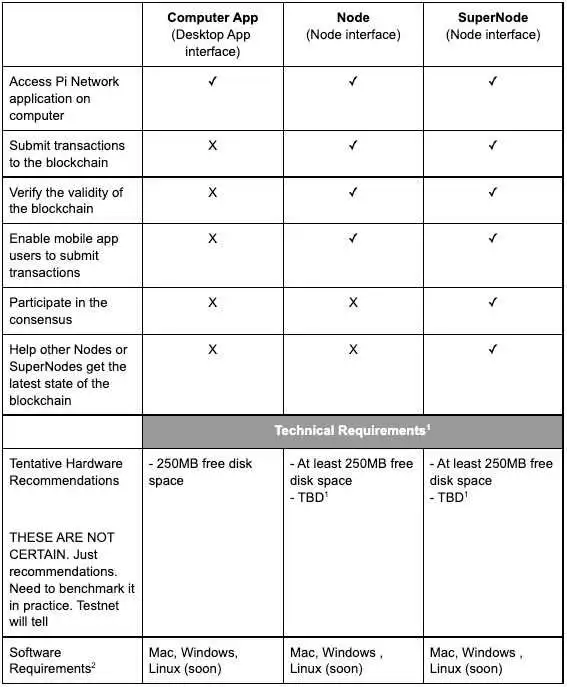

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade