Ethereum Treasury Firm SharpLink Launches $1.5B Stock Buyback

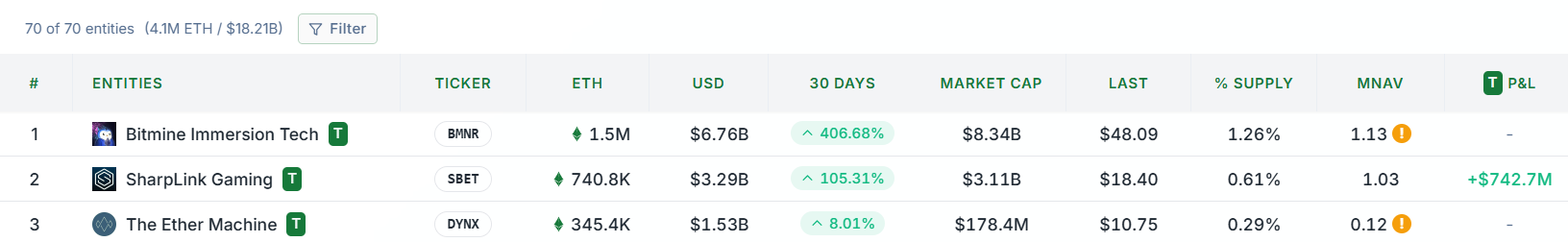

SharpLink Gaming, one of the largest corporate holders of Ethereum (ETH), has announced a $1.5 billion stock buyback program. In a press release today, the Minneapolis-based company said its board gave the green light to the plan as part of a strategy to manage capital more effectively and strengthen long-term shareholder value. SharpLink Launches Stock Buyback Program The company explained that the program gives it room to repurchase shares whenever market conditions make sense. SharpLink pointed out that if its stock trades at or below the net asset value of its Ethereum holdings, issuing new equity could reduce the ETH value attached to each share. In that case, buying back stock would present a smarter and more rewarding approach for shareholders. Notably, Co-Chief Executive Officer Joseph Chalom said the program ensures the company can move quickly when opportunities arise. He added that SharpLink views the plan as a way to provide stability in the market, use capital more efficiently, and show its commitment to sustainable growth. Per the press release, SharpLink also clarified that it has several options for carrying out the buyback. Specifically, the company may buy shares directly from the open market, negotiate private transactions, or use other legal methods. It did not set a fixed number of shares to repurchase. Instead, it said the scale of the program will depend on market trends, stock price, and trading activity. The company also reserved the right to pause or end the program at any time. SharpLink Continues to Expand Its Ethereum Treasury Meanwhile, market data shows that SharpLink boasts a strong financial standing. Its stock (SBET) currently trades at $18.4, with a net asset value ratio of 1.03 tied to its Ethereum reserves. According to data provider SER, the company has already made a profit of $742.7 million from its ETH holdings. Interestingly, the stock buyback plan comes just days after SharpLink made a massive ETH purchase. On Aug. 19, the company purchased 143,593 ETH for $667 million, lifting its total Ethereum holdings above the $3 billion mark. SharpLink now holds around 740,800 ETH worth about $3.11 billion, securing its spot as the second-largest Ethereum treasury company in the world. Only BitMine holds more, with 1.5 million ETH valued at $6.76 billion. Speaking on the company's position, Ethereum co-founder Joseph Lubin said SharpLink could grow faster than many of its peers in the Ethereum treasury race. Lubin, who also serves as SharpLink's chairman, has supported the company's decision to align its treasury reserves with Ethereum. Remarkably, data from SER shows that SharpLink is part of a wider trend of corporations building ETH reserves. At the moment, 69 companies hold a combined 4.102 million ETH, which equals about 3.4% of Ethereum's total circulating supply of 120.7 million tokens.  SharpLink Ethereum Holdings and NAV SERSharpLink Ethereum Holdings and NAV | SER

SharpLink Ethereum Holdings and NAV SERSharpLink Ethereum Holdings and NAV | SER

You May Also Like

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk

XRP Plunges: Historic MACD Signal Sparks Alarm