ZIM Integrated buyout by Hapag-Lloyd faces some major hurdles

ZIM Integrated stock price has jumped in the past few months as the odds of an acquisition have risen. It ended the week at $22.20, up by over 115% from its lowest level in 2025. This surge has brought its market capitalization to over $2.6 billion.

ZIM Integrated stock has soared | Source: TradingView

ZIM Integrated stock has soared | Source: TradingView

Hapag-Lloyd may acquire ZIM Integrated Shipping

ZIM stock will likely continue the rally when the market opens on Tuesday after Bloomberg reported that Hapag-Lloyd was in talks to acquire the company, a move aimed at boosting its market share in the highly competitive industry.

Bloomberg noted that the two may sign the deal as soon as this week, a move that will benefit its shareholders since the acquirer has to pay a premium. The sale will likely see the company receive a valuation of over $3.7 billion.

Still, the ZIM stock price may experience some volatility as the odds of a deal remain 50-50. For one, the company’s union workers in Israel have opposed the deal and have gone on strike.

Most importantly, the Israeli government may oppose the deal because of Hapag-Lloyd’s ownership. While Hapag is a German company, it has ties to Qatar and Saudi Arabia. Qatar Investment Authority and Saudi Arabia’s PIC holds about 35% of Hapag.

Israel has tense relations with Qatar and Saudi Arabia

Israel has always had an issue with Qatar, which it believes funds Hamas, which controls Gaza. Tensions between the two countries rose last year when Israel attacked Qatar, targeting Hamas leaders in the country.

Israel has also had tense relationship with Saudi Arabia, which still does not recognize it. Saudi Arabia’s talks to join the Abraham Accords stalled after Hamas attacked Israel.

One option under consideration is to separate ZIM’s operations in a way that will make it difficult for Israel to block the deal. For example, routes operating to and from Israel will be sold to FIMI, while the international business will be sold to Hapag.

At the same time, there are concerns that the European Union may block the deal as it will continue to consolidate the shipping industry.

The most recent results showed that the company’s revenue and profitability dipped in the third quarter. Its revenue tumbled by 36% to $1.78 billion, while its net income plunged by 89% to over $123 million. Its guidance was that the full-year adjusted EBITDA would be between $2 billion and $2.2 billion.

ZIM Integrated has always been loved because of its strong dividends. It has a dividend yield of nearly 20% and has paid over $5.7 billion in payouts since its IPO in 2021.

The post ZIM Integrated buyout by Hapag-Lloyd faces some major hurdles appeared first on Invezz

You May Also Like

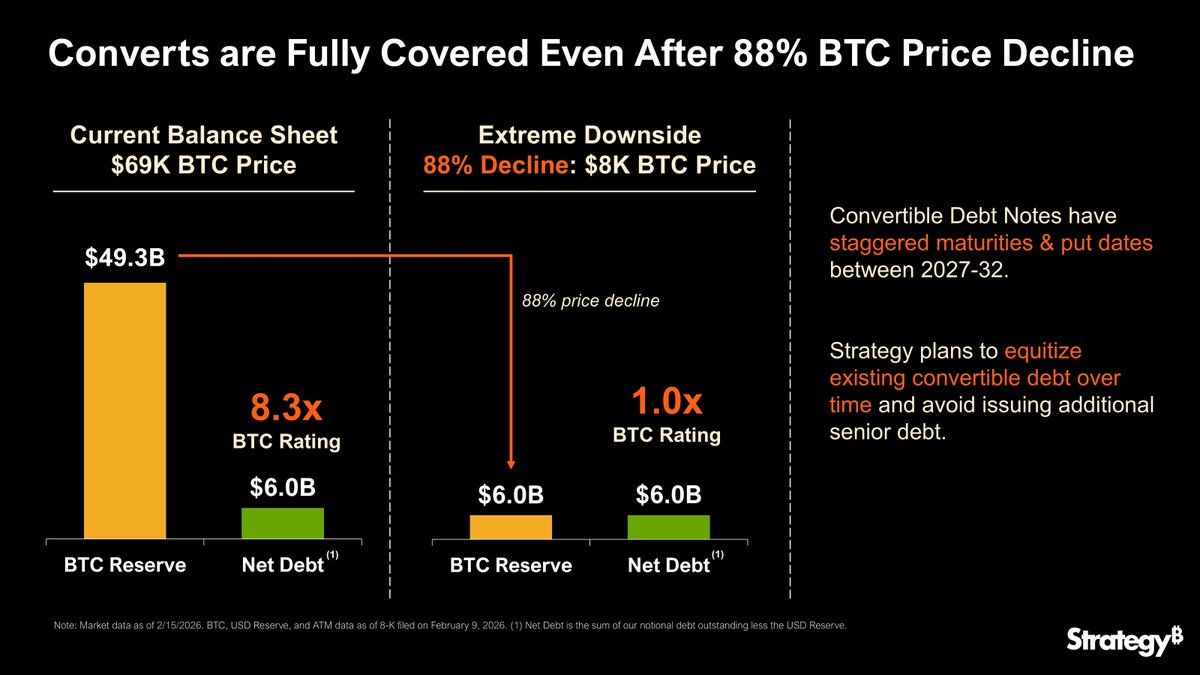

Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

Positive Pay: Strengthening Business Security Against Check Fraud