Saylor Doubles Down on Bitcoin Amid Brutal Crash

Key Insights

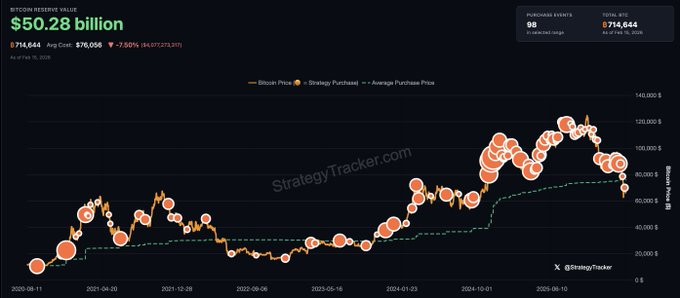

- Michael Saylor signaled another Bitcoin buy.

- Strategy extended its 12-week accumulation streak.

- mNAV fell below 1 amid Q4 losses.

Michael Saylor signaled another Bitcoin buy on Sunday as markets remained under pressure. He posted Strategy’s accumulation chart on X, a pattern that historically preceded new purchases. The signal arrived during a broad sell-off that pushed Bitcoin below the firm’s average acquisition cost.

The move kept focus on Strategy’s Bitcoin strategy at a time when crypto treasury models faced strain. Bitcoin price volatility intensified after an October flash crash cut valuations across the sector. Despite the downturn, Strategy maintained its buying cadence, reinforcing its position as the largest corporate Bitcoin holder.

Market Data Show Continued Accumulation

Strategy disclosures showed the company bought 1,142 BTC for over $90 million last Monday. That transaction lifted total holdings to 714,644 BTC, valued near $49.3 billion at publication. The purchase marked the twelfth consecutive week of additions.

Source: X

Source: X

The market reaction remained mixed because equity investors weighed balance sheet risk. Strategy reported a fourth-quarter loss of $12.4 billion earlier this month. Shares fell about 17% after the earnings release before closing Friday at $133.88.

That sequence reflected pressure across crypto-linked equities rather than isolated company risk. Broader weakness in digital assets weighed on treasury firms whose valuations are tied to Bitcoin exposure.

Technical Pressure Below Cost Basis

Market data showed Bitcoin traded beneath Strategy’s average cost basis of $76,000 during the recent downturn. The October flash crash erased over 50% from the asset’s peak above $125,000. This decline placed treasury operators under scrutiny as leverage risks resurfaced.

Bitcoin price chart. Source: CoinMarketCap

Bitcoin price chart. Source: CoinMarketCap

Standard Chartered warned in September 2025 that multiple on-net asset value ratios were deteriorating. Strategy’s mNAV slipped to 0.90, signaling that shares traded below the value of underlying holdings. That metric influences financing access because companies with premiums above 1 issue equity more easily.

When mNAV falls under 1, markets assign a discount to corporate crypto exposure. This dynamic constrained capital flexibility across several treasury firms. Even so, Strategy continued acquisitions rather than pausing deployment.

Treasury Model Faces Structural Test

Corporate filings showed Strategy leaned on preferred stock offerings to fund prior Bitcoin purchases. The approach relied on sustained equity demand and favorable valuation spreads. That structure faced pressure as digital asset prices corrected and investor appetite narrowed.

Analysts had speculated the company might slow purchases during a prolonged downturn. Instead, Saylor’s chart post suggested further accumulation was imminent. The upcoming transaction would represent the firm’s ninety-ninth disclosed Bitcoin purchase.

This persistence differentiated Strategy from other treasury companies that curtailed activity after equity declines. While several firms saw funding conditions tighten, Strategy signaled continuity. The move aligned with Saylor’s long-held thesis that volatility does not alter long-term allocation plans.

Outlook

Short-term attention now centers on confirmation of the next purchase and equity market response. Traders will watch whether Bitcoin reclaims levels above corporate cost averages or extends weakness. If volatility persists, treasury balance sheets may face renewed stress. Strategy’s next filing will clarify how it financed the forthcoming buy and whether preferred issuance expanded further.

The post Saylor Doubles Down on Bitcoin Amid Brutal Crash appeared first on The Coin Republic.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

The Italian banking giant held approximately $96 million worth of Bitcoin spot ETFs last December, hedged with Strategy put options.