Crypto Market Sentiment Plunges to Extreme Fear: Matrixport Reveals This Could Signal a Lucrative Entry Point

BitcoinWorld

Crypto Market Sentiment Plunges to Extreme Fear: Matrixport Reveals This Could Signal a Lucrative Entry Point

Singapore, March 2025 – A new analysis from crypto financial services giant Matrixport suggests the prevailing atmosphere of extreme fear gripping cryptocurrency markets may, paradoxically, be flashing a green light for strategic investors. The firm’s latest report, detailed by Cointelegraph, indicates that such severe pessimism often precedes market inflection points where selling pressure exhausts itself. This development arrives during a period of significant volatility across digital asset classes, prompting both caution and scrutiny from the global financial community. Consequently, understanding the mechanics of market sentiment becomes crucial for navigating these turbulent waters.

Decoding Extreme Fear in the Crypto Market Sentiment

Matrixport’s team of analysts has identified a critical shift in investor psychology, marking a descent into what market metrics classify as “extreme fear.” This sentiment is not merely anecdotal. It is frequently quantified by tools like the Crypto Fear & Greed Index, which aggregates data from volatility, market momentum, social media, surveys, and trading volume. Historically, prolonged periods of extreme fear correlate with potential market bottoms. The firm’s research meticulously compares current data against previous crypto cycles, including the bear markets of 2018 and 2022. For instance, the 2022 downturn following the collapse of several major industry players saw similar sentiment readings, which later preceded a sustained recovery phase for Bitcoin and other major assets.

Market sentiment acts as a powerful, self-reinforcing mechanism. Widespread fear typically leads to several observable market behaviors:

- Increased selling volume from retail investors capitulating.

- Reduced on-chain activity as holders move assets to cold storage.

- Negative media coverage dominance, further amplifying anxiety.

Matrixport’s report carefully distinguishes between short-term panic and sustained structural fear. The current analysis suggests characteristics of the former, where emotional selling may be overdone relative to underlying fundamentals. Therefore, this environment demands a disciplined, data-driven approach rather than a reactive one.

The Historical Precedent for Market Reversals

Financial history, both within and outside cryptocurrency, provides a compelling backdrop for Matrixport’s observation. Traditional finance has long recognized concepts like “maximum pain” and “capitulation,” where the last sellers exit the market, clearing the way for a new equilibrium. The crypto market, while younger, has demonstrated this pattern with notable consistency. Analysts often reference specific past events where extreme fear signaled a turning point.

Historical Crypto Fear Extremes and Subsequent Performance| Period | Catalyst | Sentiment Reading | 6-Month Forward Return (BTC) |

|---|---|---|---|

| Q1 2019 | Post-2018 Bear Market Bottom | Extreme Fear | +165% |

| March 2020 | COVID-19 Global Liquidity Crisis | Extreme Fear | +80% |

| June 2022 | Luna/Terra & Celsius Collapse | Extreme Fear | +25%* |

*Performance measured from the local low following the sentiment extreme. Past performance is not indicative of future results.

The key insight from Matrixport is not a prediction of an immediate V-shaped recovery. Instead, the firm emphasizes that these zones present a statistically improved risk-reward profile for long-term investors. The analysis explicitly cautions that further short-term declines remain possible, as sentiment can stay “extreme” for extended periods. However, the probability of entering at a relative long-term low increases substantially during these phases. This nuanced view separates the report from simplistic bullish calls.

Expert Insights on Sentiment as a Contrarian Indicator

The principle of being “fearful when others are greedy and greedy when others are fearful,” popularized by Warren Buffett, finds a direct application in crypto analytics. Independent market strategists and behavioral economists often corroborate this view. They argue that crowd sentiment is an excellent contrary indicator because the majority of market participants are typically wrong at emotional extremes. When social media discourse becomes overwhelmingly negative and trading volumes are driven by sell-offs, it frequently indicates that the weak hands are exiting. This process lays the foundation for stronger, more conviction-driven buyers to establish positions, often leading to a stabilization and eventual upward trend. Matrixport’s report aligns with this established financial theory, applying it to the unique, 24/7 trading environment of digital assets.

Navigating the Current Crypto Investment Landscape

For investors considering Matrixport’s perspective, context is paramount. The “attractive entry point” thesis does not exist in a vacuum. It interacts with several concurrent macroeconomic and regulatory factors shaping the 2025 landscape. Global interest rate trajectories, the adoption of clear digital asset frameworks in major economies like the EU with MiCA, and institutional adoption rates all provide fundamental backing—or headwinds—to any sentiment-driven recovery. A prudent strategy involves dollar-cost averaging (DCA) to mitigate timing risk, thorough fundamental research on specific assets beyond just Bitcoin, and robust security practices for asset storage. The report serves as a macro-level indicator, not a substitute for project-specific due diligence.

Furthermore, the nature of “entry” varies. For institutional players, it may mean initiating or scaling up treasury allocation programs. For retail investors, it could involve restarting regular accumulation plans that were paused during market euphoria. The core message from the analysis is one of strategic opportunity emerging from pessimism. It underscores the importance of a disciplined investment framework over emotional decision-making, a lesson repeatedly validated across asset classes.

Conclusion

Matrixport’s analysis of the current extreme fear in crypto market sentiment offers a data-rich perspective for investors navigating uncertainty. By framing severe pessimism as a potential precursor to opportunity, based on historical precedent and behavioral finance principles, the report provides a counter-narrative to prevailing anxiety. While it wisely avoids guaranteeing short-term gains and acknowledges ongoing risks, it highlights a critical juncture where strategic patience may be rewarded. Ultimately, the extreme fear gripping markets today may indeed be sculpting the attractive entry point that disciplined investors seek for the next cycle, reminding all participants that market psychology is often a more reliable guide than fleeting price movements.

FAQs

Q1: What does “extreme fear” mean in crypto markets?

“Extreme fear” is a quantitative measurement of overall market sentiment, typically derived from indices that analyze volatility, trading volume, social media buzz, and survey data. It indicates a state of widespread pessimism and risk aversion among investors.

Q2: How does Matrixport determine that an entry point is “attractive”?

Matrixport bases this assessment on historical analysis, comparing current sentiment extremes to past market cycles. Periods of similar extreme fear have frequently coincided with medium-to-long-term market lows, presenting a statistically improved risk-reward ratio for accumulation.

Q3: Does extreme fear guarantee the market will go up immediately?

No, it does not. Matrixport explicitly states that further short-term declines cannot be ruled out. Sentiment can remain depressed for some time. The analysis suggests it is a zone for strategic consideration, not a timing signal for an instant rebound.

Q4: What are the risks of investing during a period of extreme fear?

Primary risks include continued price depreciation, high volatility, potential for negative regulatory news, and broader macroeconomic downturns affecting all risk assets. Any investment should be sized appropriately to one’s risk tolerance.

Q5: Is this analysis only relevant to Bitcoin, or the broader crypto market?

While sentiment indices often track the overall market, which is heavily influenced by Bitcoin, the principle applies broadly. However, altcoins may exhibit higher volatility and individual project risks, so careful fundamental research on specific assets remains essential.

This post Crypto Market Sentiment Plunges to Extreme Fear: Matrixport Reveals This Could Signal a Lucrative Entry Point first appeared on BitcoinWorld.

You May Also Like

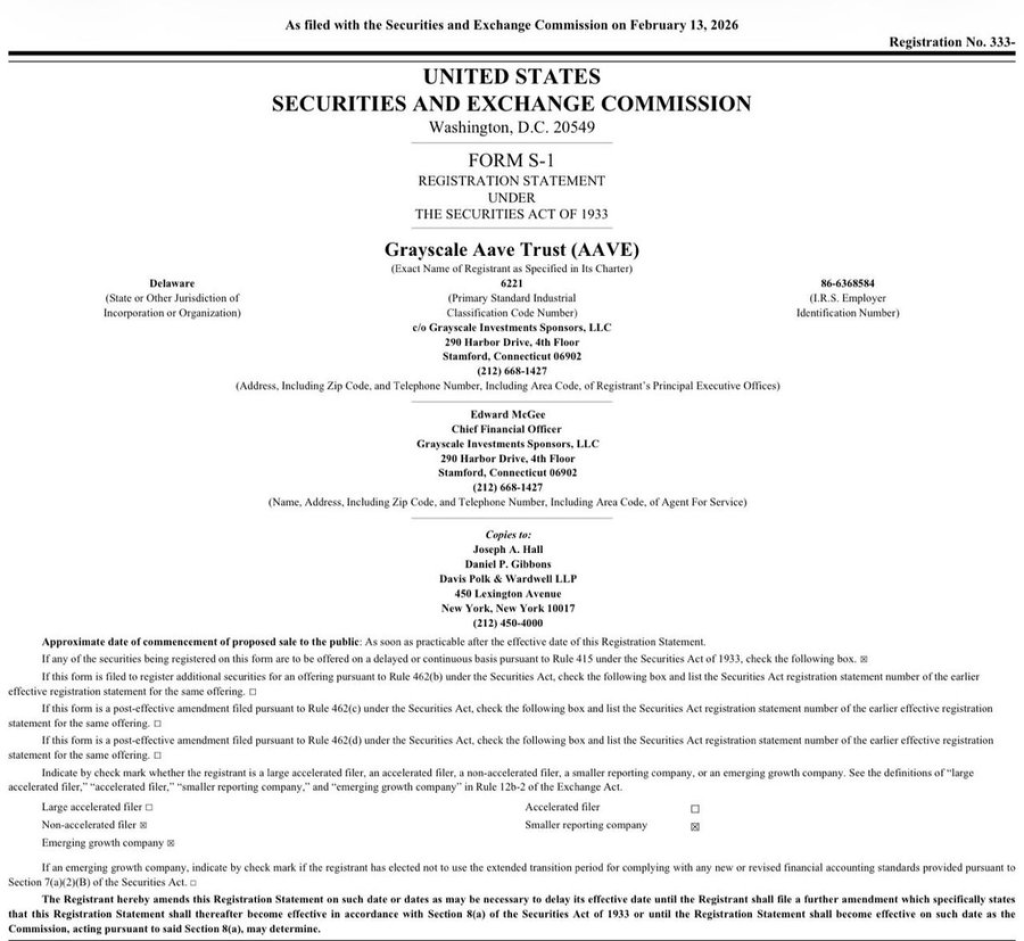

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More