Why Blockchain’s Math Doesn’t Translate Into Financial Stability

:::info Author:

(1) Nassim Nicholas Taleb, Universa Investments, Tandon School of Engineering, New York University Forthcoming, Quantitative Finance.

:::

Table of Links

- Introduction/Abstract

- The Blockchain

- Vulnerability of Revenue-Free Bubbles

- Success in Wrong Places

- Principles for a Currency

- The Difficult with Inflation Hedges

- Some Additional Fallacies

- Conclusion and References

INTRODUCTION/ABSTRACT

This discussion applies quantitative finance methods and economic arguments to cryptocurrencies in general and bitcoin in particular —as there are about 10, 000 cryptocurrencies, we focus (unless otherwise specified) on the most discussed crypto of those that claim to hew to the original protocol [1] and the one with, by far, the largest market capitalization.

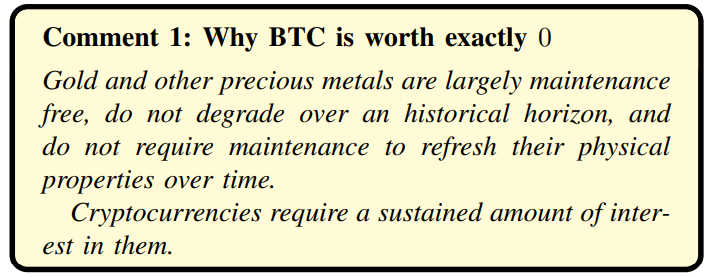

\ In its current version, in spite of the hype, bitcoin failed to satisfy the notion of "currency without government" (it proved to not even be a currency at all), can be neither a short nor long term store of value (its expected value is no higher than 0), cannot operate as a reliable inflation hedge, and, worst of all, does not constitute, not even remotely, a safe haven for one’s investments, a shield against government tyranny, or a tail protection vehicle for catastrophic episodes.

\ Furthermore, bitcoin promoters appear to conflate the success of a payment mechanism (as a decentralized mode of exchange), which so far has failed, with the speculative variations in the price of a zero-sum maximally fragile asset with massive negative externalities.

\ Going through monetary history, we show how a true numeraire must be one of minimum variance with respect to an arbitrary basket of goods and services, how gold and silver lost their inflation hedge status during the Hunt brothers squeeze in the late 1970s and what would be required from a true inflation hedged store of value.

\

THE BLOCKCHAIN

First, let us consider what cryptocurrencies do by examining the notion of blockchain and its intellectual and mathematical appeal.

\ What the blockchain added, thanks to the hash function, is the condition that r(.) must be functionally and probabilistically bijective: no two seeds should produce the same output (or should produce a vanishingly low probability of that happening), what, in computer science terminology, is called collision.

\ This hard-wired attribute and absence of supervision of the blockchain allow the storage of activities on a public ledger to facilitate peer-to-peer commerce, transactions, and settlements. The blockchain concept also allows for serial record keeping. This is supposed to help create what the original white paper [1] described as:

\ A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

\ From that paper, bitcoin makes use of three existing technologies: 1) the hash function, 2) the Merkle tree (to chain blocks of transactions tagged by the hash function), and 3) the concept of proof of work (used to deter spam by forcing agents to use computer time in order to qualify for a transaction) — technologies that, ironically, all came out of the academic literature[3]1 . The idea provides a game theoretic approach to mitigate the effects of the absence of custodian and lack of trust between participants in the maintenance of a permanent shared public ledger — attenuating or circumventing the coordination quandary known as the "Byzantine general problem".

\ The bitcoin transactional currency (BTC) system establishes an adversarial collaboration between the so-called "miners" who validate transactions by getting them on a public ledger; as a reward they get coins plus a fee from the underlying transactions, transfers of coins between parties. The proof of work method has an adjustable degree of difficulty based on the speed of blocks, which aims, in theory, to keep the incentive sufficiently high for miners to keep operating the system. Such adjustments lead to an exponential increase in computer power requirements, making at the time of writing onerous energy demands on the system — energy that could find alternatives in other computational and scientific uses.

\ Miners derive their compensation from both seignorage (the market value of a bitcoin minus its mining costs) and transaction fees upon validation — with the plan to switch to transaction fees as the sole revenues upon the eventual depletion of the coins, which are limited to a fixed number.

\ A central attribute is that bitcoin depends on the existence of such miners for perpetuity.

\ Note that the entire ideological basis behind bitcoin is complete distrust of other operators — there are no partial custodians; the system is fully distributed, though prone to concentration[2]. Furthermore, by the very nature of the blockchain, transactions are irreversible, no matter the reason.

\ Finally, note that bitcoins are zero-sum by virtue of the numerus clausus.

\ As we will see, mathematical and combinatorial qualities do not necessarily translate into financial benefits at either individual or systemic levels.

\ \

\

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[1] As this discussion is focused on proof of work, we exclude from it Ethereum and other cryptocurrencies.

You May Also Like

Historic Debut: U.S. Sees Launch of Spot ETFs for DOGE and XRP

Now You Don’t’ New On Streaming This Week, Report Says