Gladstone Commercial Maintains Industrial Focus Through Strategic Portfolio Management in 2025

Stonegate Capital Partners has updated its coverage on Gladstone Commercial Corp., highlighting the company’s strategic portfolio management during 2025. The real estate investment trust maintained its focus on industrial assets while executing a capital recycling strategy that balanced acquisitions with dispositions.

During the fourth quarter of 2025, Gladstone Commercial ended with 151 properties across 27 states, comprising 17.7 million square feet of rentable space. The company generated quarterly revenue of $43.5 million, with funds from operations of $0.37 per share and adjusted funds from operations of $0.25 per share, reflecting continued operational stability throughout the period.

Throughout fiscal year 2025, the company expanded its portfolio by acquiring 19 fully-occupied properties totaling approximately 1.57 million square feet for $206.7 million. These acquisitions were completed at a capitalization rate of 8.88%, demonstrating the company’s focus on industrial assets. Simultaneously, Gladstone Commercial executed its capital recycling strategy by selling two non-core properties for an aggregate amount of $8.0 million and completing the sale transaction on one non-core industrial property for $18.5 million.

The company’s financial maneuvers included upsizing its credit facility and establishing a new term loan, providing additional flexibility and liquidity for ongoing operations and potential future acquisitions. These strategic moves underscore Gladstone Commercial’s emphasis on maintaining a disciplined approach to portfolio management while reducing exposure to non-core properties.

Stonegate Capital Partners, which provides the coverage update, is a leading capital markets advisory firm offering investor relations, equity research, and institutional investor outreach services for public companies. The full announcement with additional details is available through Stonegate’s website.

The company’s performance during 2025 demonstrates how real estate investment trusts can navigate market conditions through strategic portfolio adjustments. By focusing on industrial properties while divesting non-core assets, Gladstone Commercial has positioned itself to potentially benefit from ongoing trends in industrial real estate demand while maintaining financial stability through careful capital management.

This news story relied on content distributed by Reportable. Blockchain Registration, Verification & Enhancement provided by NewsRamp . The source URL for this press release is Gladstone Commercial Maintains Industrial Focus Through Strategic Portfolio Management in 2025.

. The source URL for this press release is Gladstone Commercial Maintains Industrial Focus Through Strategic Portfolio Management in 2025.

The post Gladstone Commercial Maintains Industrial Focus Through Strategic Portfolio Management in 2025 appeared first on citybuzz.

You May Also Like

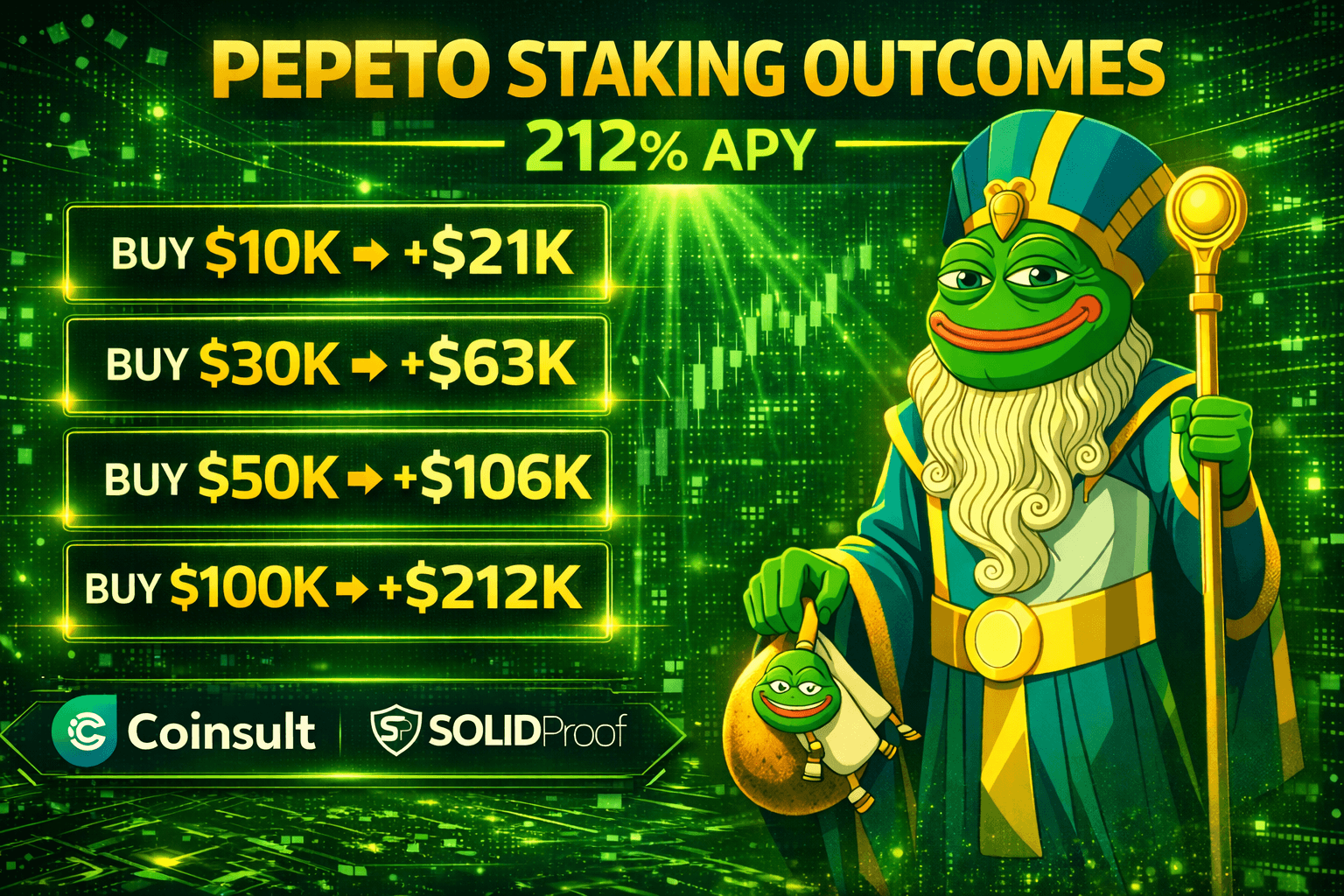

Top 100x Coin to Buy: Pepeto, XRP, Dogecoin, and Solana Lead the Market Pulse This February

Top 4 Altcoins to Buy Before the Next Bull Run: Pepeto, Shiba Inu, MemeCore, and Pepe