Crypto Is Going Mainstream: So Why Are Banks Still Blocking It?

Cryptocurrency may be going mainstream, but traditional banks are still struggling to keep pace, and the disconnect is becoming increasingly visible.

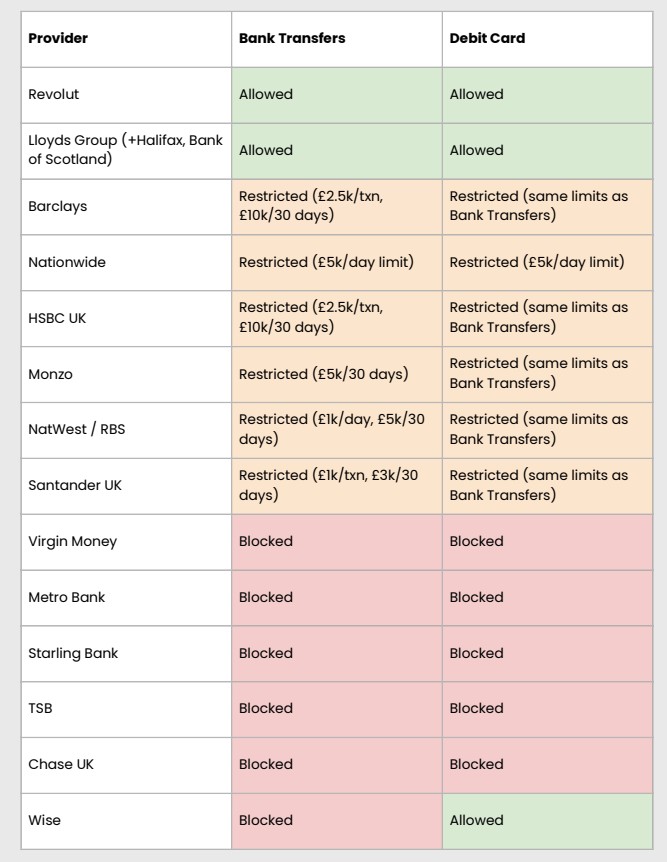

Recent data comparing major UK banks shows a fragmented and often restrictive approach toward crypto transactions. While some institutions allow both bank transfers and debit card purchases, many impose strict limits, and several block crypto-related payments altogether.

Source: https://x.com/Cointelegraph/status/2024732196293267600

Source: https://x.com/Cointelegraph/status/2024732196293267600

UK Banks: Restrictions and Blocks

Among UK providers, Revolut and Lloyds Group (including Halifax and Bank of Scotland) currently allow crypto transactions through both bank transfers and debit cards. However, others are significantly more restrictive.

Barclays and HSBC UK impose transaction limits such as £2,500 per transaction and £10,000 per 30 days. Nationwide caps activity at £5,000 per day. NatWest and Santander apply even tighter monthly thresholds.

Several major names, including Virgin Money, Metro Bank, Starling Bank, TSB, and Chase UK, have outright blocked crypto-related transactions through both bank transfers and debit cards. Wise blocks bank transfers but still allows debit card purchases.

The pattern suggests that while crypto access exists, it is often throttled by internal risk controls rather than fully integrated into banking services.

U.S. Banks: Limited Bitcoin Services

The situation in the United States reflects a different but related constraint.

Among the top 25 U.S. banks, Bitcoin trading and custody services remain limited. JP Morgan Chase has announced trading support, but custody is not yet available.

Citigroup is exploring custody solutions, and several banks, including Wells Fargo, Goldman Sachs, and Morgan Stanley, restrict crypto trading to high-net-worth clients only.

Retail access remains constrained, and full custody services are largely absent across major institutions.

A Structural Gap

The contrast is clear: crypto markets operate 24/7 globally, spot Bitcoin ETFs are live, and tokenized assets are expanding rapidly, yet mainstream banking rails remain hesitant, limited, or outright closed.

Banks cite fraud risk, regulatory ambiguity, and consumer protection concerns. However, the restrictions also highlight an operational lag. Traditional banking systems were not built for decentralized, always-on digital assets, and integration has proven slower than adoption.

As institutional capital increases exposure to digital assets, the friction between banking infrastructure and crypto markets becomes more visible. While crypto has moved into exchange-traded products and sovereign-level discussions, many consumers still face limits or blocks at the bank level.

The post Crypto Is Going Mainstream: So Why Are Banks Still Blocking It? appeared first on ETHNews.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SEC approves generic listing standards, paving way for rapid crypto ETF launches