Bitcoin (BTC) Price: Whales Accumulate While ETFs Post $88M Inflows After Three-Day Losing Streak

TLDR

- Bitcoin whales added 236,000 BTC since December 2025, recovering to pre-October 2025 levels

- Whale exchange flows into Binance hit $8.24 billion over 30 days, a 14-month high

- Bitcoin ETFs recorded $88 million in net inflows on February 20, ending a three-day outflow streak

- BlackRock’s IBIT and Fidelity’s FBTC were the only ETFs to record flows on February 20

- Four weeks of ETF outflows total roughly $2.48 billion, with BTC trading around $67,800

Bitcoin is trading around $67,800 as on-chain data shows large holders have been quietly rebuilding their positions over the past three months.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Wallets holding between 1,000 and 10,000 BTC — commonly called whales — increased their total balance from 2.86 million BTC on December 10, 2025, to 3.09 million BTC. That is a 236,000 BTC addition that brings reserves back to levels seen before the October 10, 2025 market crash.

Source: CryptoQuant

Source: CryptoQuant

Crypto analyst caueconomy noted that 98,000 BTC of that accumulation happened in just the last 30 days, fully reversing a distribution phase that began after Bitcoin hit $124,000 in August 2025.

Average BTC order sizes on spot markets have ranged between 950 and 1,100 BTC throughout 2026. That is the most consistent stretch of large-ticket buying since September 2024.

Whale Exchange Flows Hit 14-Month High

CryptoQuant analyst maartunn reported $8.24 billion in whale BTC flows into Binance over the past 30 days, the highest level in 14 months. Retail flows came in at $11.91 billion but have flattened over the same period.

Source: CryptoQuant

Source: CryptoQuant

The retail-to-whale ratio now sits at 1.45 and is continuing to fall as larger deposits grow.

Glassnode data shows gross exchange whale withdrawals averaging 3.5% of total exchange-held BTC over a rolling 30-day period. That is the strongest pace since November 2024.

Based on current exchange balances, that translates to roughly 60,000 to 100,000 BTC in withdrawals over the past month.

Net exchange balances have remained relatively stable as incoming flows are largely offset by these outbound transfers.

Bitcoin ETFs Return to Inflows

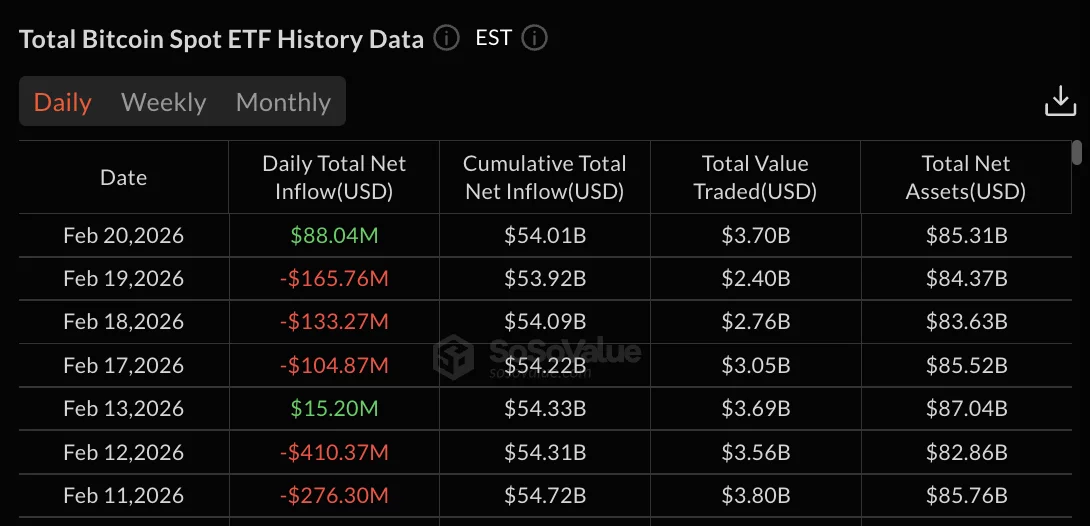

Bitcoin ETFs recorded $88.04 million in net inflows on February 20, ending three straight days of outflows that totaled $403.90 million.

Source: SoSoValue

Source: SoSoValue

BlackRock’s IBIT led with $64.46 million. Fidelity’s FBTC added $23.59 million. All other ETFs posted zero flows on the day.

February 19 was the worst single day of the streak, with $165.76 million in redemptions. February 18 saw $133.27 million leave, followed by $104.87 million on February 17.

Total net assets across Bitcoin ETFs stood at $85.31 billion on February 20, down from $87.04 billion on February 13.

The four-week outflow period from January 23 through February 20 totals approximately $2.48 billion. Weekly trading volume came in at $11.91 billion for the period ending February 20, down from $18.91 billion the prior week.

BlackRock’s IBIT holds $61.30 billion in cumulative net inflows. Fidelity’s FBTC stands at $10.96 billion.

The post Bitcoin (BTC) Price: Whales Accumulate While ETFs Post $88M Inflows After Three-Day Losing Streak appeared first on CoinCentral.

You May Also Like

Ripple CEO Reveals When the CLARITY Act Could Officially Pass

The “Sustainable Silicon” Mandate: Greening the AI Revolution