Japanese Company Metaplanet Hits 20,000 Bitcoin Milestone While Issuing Millions of New Shares

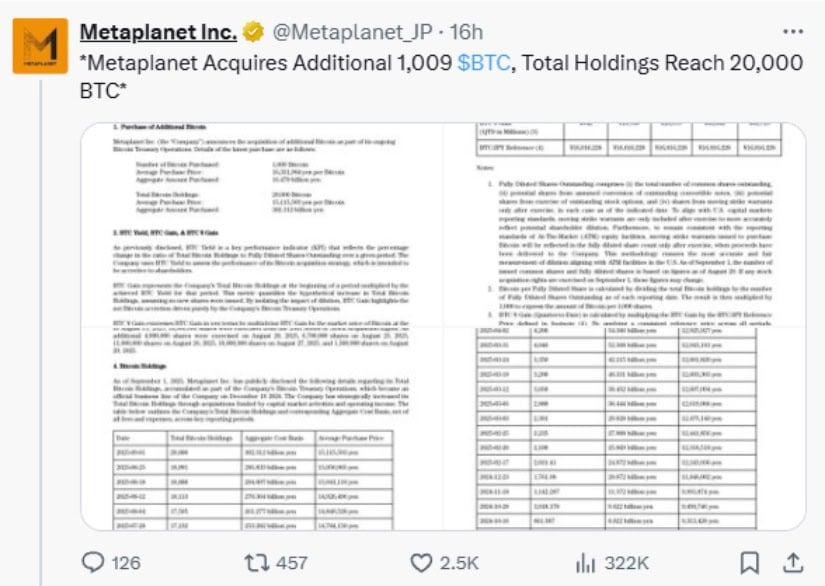

Metaplanet announced on September 1, 2025, that it now holds exactly 20,000 Bitcoin after buying 1,009 more coins for $112 million.

The company also issued 11.5 million new shares when an investor used special buying rights called warrants. This investor, Evo Fund, paid about $65.73 million for these shares. Metaplanet used this money to pay back $20.4 million in bonds it had issued earlier.

Bitcoin Strategy Pays Off Despite Stock Drop

Metaplanet now ranks as the sixth largest corporate Bitcoin holder in the world. The company paid an average of $103,138 for each Bitcoin it owns, making its total investment about $2.06 billion. With Bitcoin trading higher than this average price, Metaplanet is making money on paper from its Bitcoin bet.

The company started buying Bitcoin in April 2024 when it was a struggling hotel business. The COVID-19 pandemic hurt its hotel operations, so leaders decided to copy a strategy used by American company MicroStrategy. They began putting most of their money into Bitcoin instead of running hotels.

This plan worked well for investors. Metaplanet’s stock price went up over 4,000% over 12 months, making it one of the best-performing stocks globally. But the stock has fallen 54% since June 2025, even though Bitcoin prices stayed fairly steady. This drop makes it harder for the company to raise money through its warrant system.

Ambitious Plans for More Bitcoin

Metaplanet wants to own much more Bitcoin in the future. The company’s “21 Million Plan” aims to hold 210,000 Bitcoin by 2027. This would equal more than 1% of all Bitcoin that will ever exist and could make Metaplanet the second biggest corporate Bitcoin owner globally.

To reach this goal, shareholders voted on September 2, 2025, to approve selling up to 555 million preferred shares. This could raise as much as $3.7 billion for buying more Bitcoin. The company also wants to raise about $880 million through overseas share sales.

CEO Simon Gerovich explained that these preferred shares will work like bonds but be backed by Bitcoin. The company plans to offer two different types of preferred shares, though specific yield details are still being finalized.

High-Profile Support and Global Attention

Eric Trump, son of U.S. President Donald Trump, joined Metaplanet as an advisor in March 2025. He attended the company’s shareholder meeting in Tokyo on September 1-2, 2025, to support the Bitcoin strategy. Trump said he believes in “companies with great leadership” and called Gerovich “a wonderful leader,” while praising Bitcoin as “a wonderful product.”

The Trump family is getting more involved in cryptocurrency businesses. Eric Trump and his brother Donald Trump Jr. started a Bitcoin mining company called American Bitcoin, which plans to list on the Nasdaq stock exchange soon.

Metaplanet also got recognition from major stock indexes. The company was upgraded from a small company to a mid-sized one and added to the FTSE Japan Index in September 2025. This means more investment funds that follow these indexes will automatically buy Metaplanet shares.

Strong Financial Results But Growing Risks

The Bitcoin strategy has helped Metaplanet make money. The company reported 41% revenue growth in the second quarter of 2025, earning $75.1 million in profit. Much of this came from selling options on its Bitcoin holdings and normal business operations.

Metaplanet measures success using “BTC Yield,” which shows how much Bitcoin it gains per share over time. The company achieved 486.7% BTC Yield for all of 2025 so far, though this number dropped to 30.7% in the most recent quarter.

Source:@Metaplanet_JP

The company’s Bitcoin buying has been steady and large. Since July 2024, Metaplanet grew its holdings from under 200 Bitcoin to the current 20,000. It funds these purchases by selling bonds and issuing new shares.

However, the falling stock price creates problems. The company relies on investors using warrants to buy new shares, which gives Metaplanet money to buy more Bitcoin. When the stock price drops, these warrants become less attractive, making it harder to raise money.

What This Means Going Forward

The involvement of the Trump family and inclusion in major stock indexes shows that traditional finance is paying attention to corporate Bitcoin strategies. Other companies in Asia and around the world might copy Metaplanet’s approach if it continues to work.

For now, Metaplanet has achieved its goal of holding 20,000 Bitcoin while building new ways to raise money for buying more. Whether it can reach its ambitious target of 210,000 Bitcoin by 2027 will depend on Bitcoin prices, investor interest, and the company’s ability to keep executing its complex financial strategy.

You May Also Like

Ethereum ETFs Lead on Jan 15 as Bitcoin Wins the Week

BlackRock Increases U.S. Stock Exposure Amid AI Surge