Bitcoin ETF inflows reach $333m, strongest in two weeks

Spot Bitcoin ETFs saw a resurgence in demand, with $332.7 million in daily net inflows, the strongest level in two weeks.

- Spot Bitcoin ETFs see $332.7 million in daily net inflows, best since mid-August

- The market cap for spot Bitcoin ETFs is at $109 billion, near historic highs

- Renewed appetite from Bitcoin exposure comes from macroeconomic tailwinds

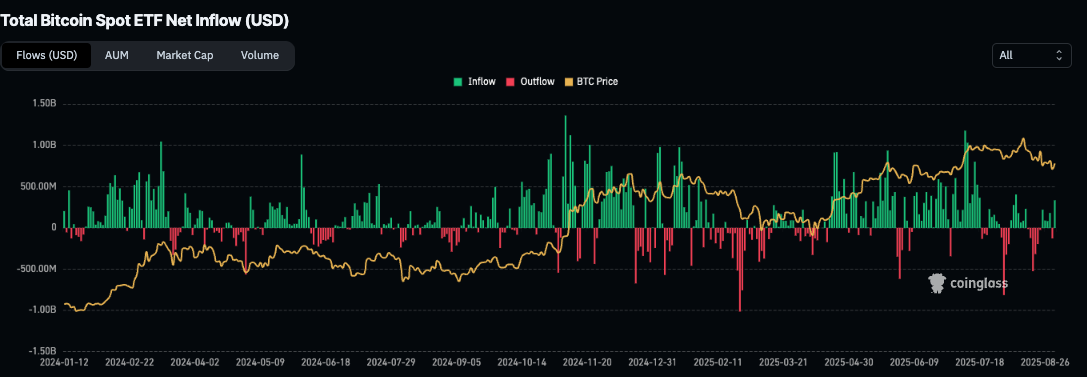

Institutional interest in Bitcoin (BTC) exposure is once again on the rise. On Tuesday, September 2, spot Bitcoin ETFs have recorded $332.7 million in net inflows, according to data from CoinGlass. This marks the largest daily increase in two weeks, last seen in mid-August.

The move follows last week’s milestone of $440 million in total ETF inflows. This indicates that despite recent price volatility, investors are buying the dip. Currently, Bitcoin spot ETFs control a total of $109 billion worth of Bitcoin, near historic highs. The iShares Bitcoin Trust ETF dominates, controlling $82.8 billion in Bitcoin holdings.

Meanwhile, increased institutional interest, especially when it comes to Bitcoin treasury firms, is keeping its price sticky even when ETF inflows fall.

Macro tailwinds boost Bitcoin ETFs

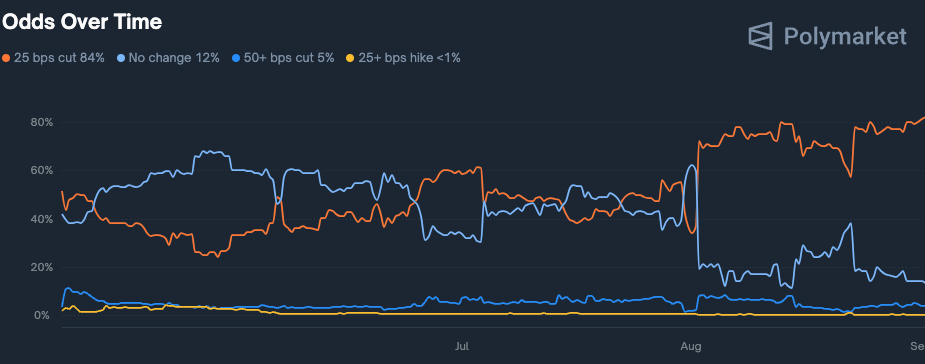

Renewed interest in Bitcoin ETFs shows that risk-on sentiment is picking up. One likely reason for this is the changing macro environment, likely a reaction to monetary policy. Notably, investors are increasingly pricing in Federal Reserve rate cuts that could come as early as mid-September.

Notably, Polymarket traders are pricing in an 84% chance that the Fed will cut rates at its Sept. 17 FOMC meeting. The odds for no cuts are at just 12%. This is significant, as Fed rate cuts would make borrowing easier and Treasury yields lower, incentivizing investors to move into riskier assets.

You May Also Like

DeFi Leaders Raise Alarm Over Market Structure Bill’s Shaky Future

Cardano Latest News, Pi Network Price Prediction and The Best Meme Coin To Buy In 2025