500,000 ETH in Just 1 Week: Is Ethereum’s Price Gearing up for Another Big Rally?

TL;DR

- The evident shift from exchanges toward self-custody methods and the renewed accumulation from whales suggest ETH could be getting ready for another price pump.

- Optimists argue ETH has bottomed and is primed for an “up only” trajectory, while skeptics warn about a potential drop to $3,800 if momentum weakens.

Green Days Incoming?

Ethereum (ETH) was at the forefront of gains in August, hitting a new all-time high of almost $5,000 towards the end of the month. Since then, though, the price headed south and is now hovering below $4,400 (per CoinGecko’s data).

Certain factors signal that the bulls might enjoy a new resurgence soon. The popular X user Ali Martinez revealed that 500,000 ETH (worth more than $2.1 billion) have been withdrawn from crypto exchanges in the past week alone.

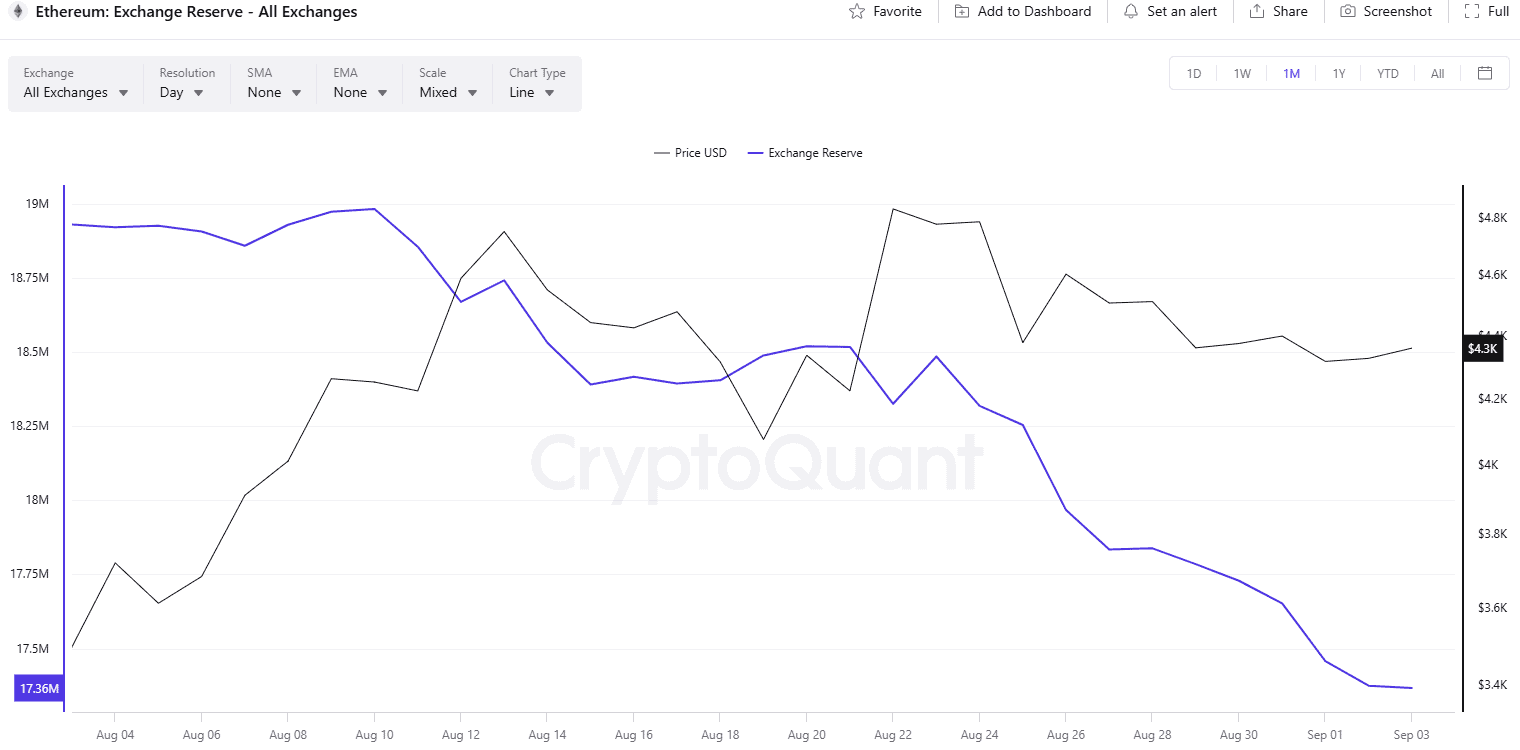

Data compiled by CryptoQuant shows that currently, the total stash stored on such platforms is around 17.3 million tokens, which represents the lowest level witnessed since the summer of 2016. This is a clear sign that investors have been shifting from centralized exchanges toward self-custody methods, which in turn reduces the immediate selling pressure.

ETH Exchange Reserve

ETH Exchange Reserve

Meanwhile, ETH whales continue to show a huge appetite for the asset. Earlier this week, those large investors (holding between 10,000 and 100,000 coins each) accumulated 260,000 tokens in just a single day. As a result, they increased their total holdings to 29.62 million ETH, which accounts for nearly a quarter of the asset’s circulating supply.

Such efforts leave fewer coins available on the open market and could push the price up (assuming demand doesn’t diminish). The whales are dominant market participants, and their activities are often followed by retail investors who might decide to mimic their move and distribute additional capital into the ecosystem.

The Analysts’ Take

Many crypto enthusiasts on X seem optimistic about ETH, believing it has enough fuel left to post additional gains. The analyst with the moniker Mister Crypto thinks the price has reached its local bottom in April when plunging below $1,400 and is now headed for an “up only” trajectory.

On the other hand, Ted made a somewhat bearish forecast. He noted that ETH continues to hold the $4,200 level but claimed that the price “doesn’t look very strong” and envisioned a potential drop to $3,800 as “a final support target for the correction.”

The post 500,000 ETH in Just 1 Week: Is Ethereum’s Price Gearing up for Another Big Rally? appeared first on CryptoPotato.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

XRP Treasury Firm Evernorth Prepares Public Listing to Boost Institutional Exposure