Billionaire Ray Dalio Warns of Dollar Decline and Pushes Bitcoin, Fueling the Bitcoin Hyper Frenzy

Dalio believes that this will fuel limited-supply assets like Bitcoin and gold.

His statements were a response to Financial Times misrepresenting his views during an interview. Dalio retaliated by making the entire interview public, where he mentioned:

—Ray Dalio, X post

As Dalio sees it, Bitcoin and cryptos in general are gaining ground over fiat currencies, including the US dollar. This creates a conducive climate for utility-based projects like Bitcoin Hyper ($HYPER), which is already running a $13.7M presale.

Courts May Deem Trump’s Tariffs Illegal; Trump Seeks to Appeal

Trump’s tariffs are under scrutiny after a federal court stated that Donald Trump misused his authority when instituting the tariffs and that only the Congress would have that power.

Trump’s administration is getting ready to appeal the court, but, until then, the tariffs remain in effect, as the president himself said on his Truth Social platform.

This is an ongoing problem for Trump’s tariff plan, after the Federal Court initially blocked it in May, with the judge saying that the tariffs lacked ‘any identifiable limits.’

This, combined with the confusion caused by the several delays and modifications to the tariff plan, plunged the stock and crypto markets into chaos. As a result, the US dollar’s aura weakened, which caused investors to look for more stable and promising assets.

Paradoxically, they started migrating to Bitcoin and other cryptos, which explains why Bitcoin’s volatility index has almost flatlined between June 2025 and today; Bitcoin is growing stronger, more stable, and more reliable.

As expected, Bitcoin Hyper ($HYPER) is also likely to gain massively from the investors’ migration into the crypto sphere and the presale numbers already reflect that.

How Bitcoin Hyper (HYPER) Turns Bitcoin Transactions Faster and Cheaper

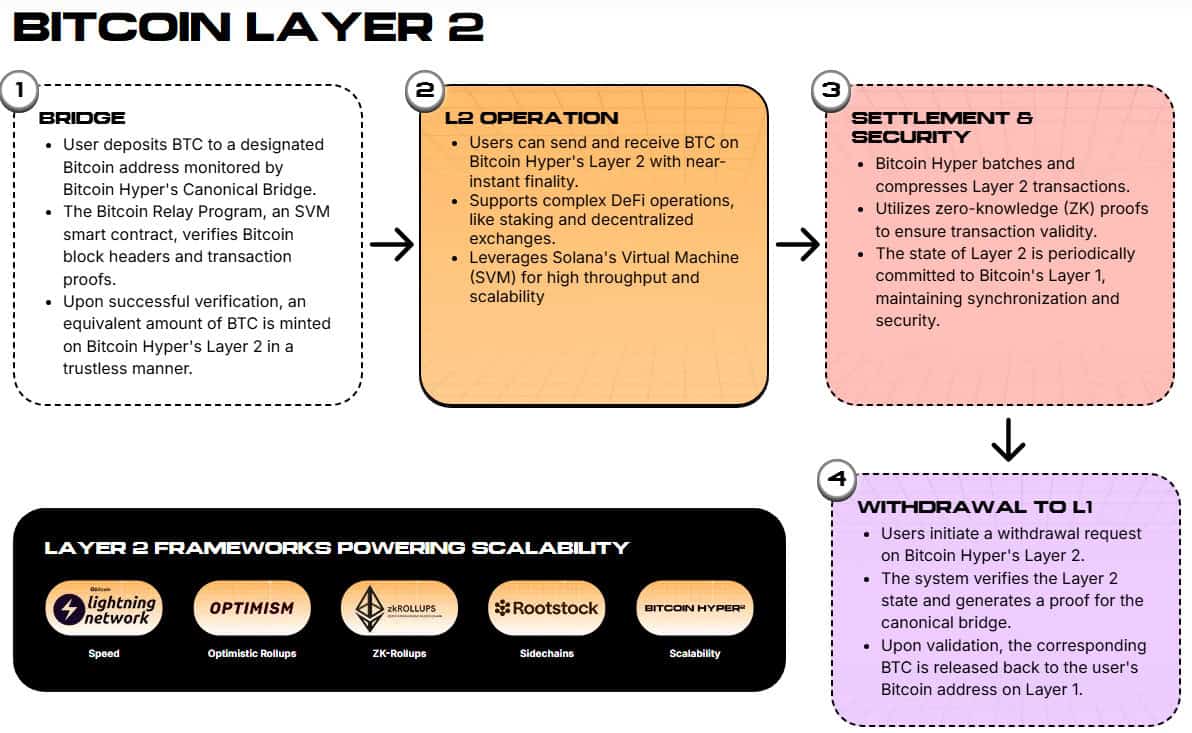

Bitcoin Hyper ($HYPER) is the Layer 2 upgrade that promises faster and cheaper Bitcoin transactions by circumventing Bitcoin’s limitation of 7 transactions per second (TPS).

This performance limitation is what makes Bitcoin unfeasible for large institutional investors and payment processors who perform thousands of transactions per second.

Hyper seeks to change that with the help of tools like the Canonical Bridge and the Solana Virtual Machine.

This process decongests Bitcoin’s native layer, ensuring near-instant finality and smoother performance, as confirmation times go for hours to just seconds.

The result is a faster and vastly more scalable Bitcoin, now capable of processing thousands of transactions per second, which is Bitcoin’s ticket to mainstream and widespread institutional adoption.

The Solana Virtual Machine also ensures the ultra-fast execution of smart contracts and DeFi apps, offering users a smoother experience.

The presale has raised over $13.7M since its start with $HYPER sitting at $0.012855 and it’s still going. With the presale starting in May, this three-month performance should already tingle your investing senses, given that $HYPER’s post-launch potential is massive.

These are also educated predictions based on $HYPER’s perceived utility and public appeal, but the token could go a lot higher a lot faster if it sees mainstream adoption.

If you want to join the hype train, learn how to buy $HYPER here, go to the presale page, and get your tokens today.

The Bitcoin Bull is Almost Here

Investors trust Bitcoin more by the day and we see this in the coin’s performance. Historically speaking, Bitcoin should dip in September, but that doesn’t seem like the case anymore.

Between investors shifting from fiat to cryptos, Trump’s GENIUS Act ramping up its implementation process, and names like Ray Dalio and Michael Saylor feeding the Bitcoin hype, we may see the bull soon.

If that happens, expect the Bitcoin Hyper ($HYPER) presale to rack in big numbers in preparation for its public launch.

You May Also Like

XMR price pumps as a rare pattern points to Monero hitting $1,000

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets