Top 9 Crypto Miners in Red as New Nasdaq Rules Spark Stocks Sell-off

Nasdaq announced new measures requiring some companies to seek shareholder approval before issuing new shares to finance new cryptocurrency purchases. The stricter oversight aims to curb attempts by firms to boost valuations by rebranding into crypto-focused stocks.

According to The Information, Nasdaq could suspend trading or delist companies that fail to comply. This additional scrutiny poses significant short-term regulatory risks to the corporate crypto adoption buzz that has dominated US markets under President Trump’s second-term administration.

The policy shift threatens to delay deals and create uncertainty for firms seeking to rapidly build strategic crypto reserves. The timing is critical as multiple companies have been racing to acquire tokens, hoping to anchor investor interest as proxy plays for specific cryptocurrencies.

Top Miners Lead Crypto Stock Declines

The rule change triggered immediate market consequences. Bitcoin BTC $110 769 24h volatility: 1.2% Market cap: $2.21 T Vol. 24h: $36.25 B fell 2% intraday before recovering near $110,000 at press time. However, crypto miners and related stocks saw heavier bearish impact.

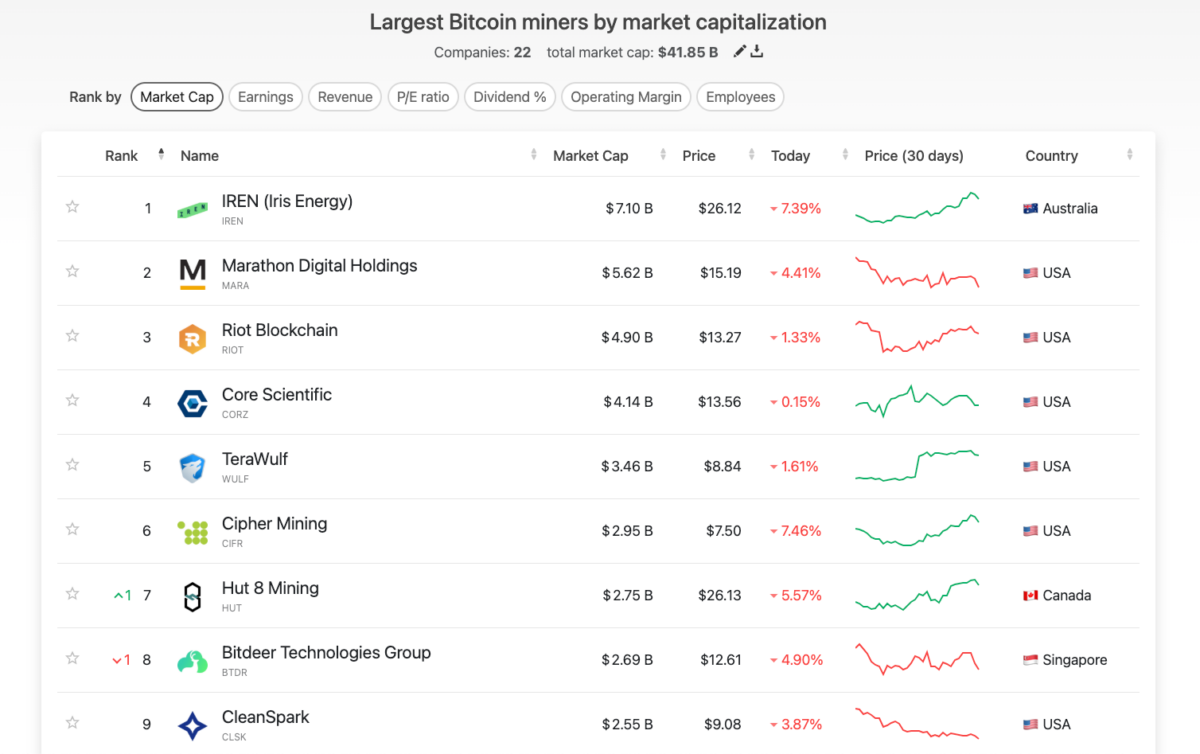

Data from Companiesmarketcap showed all top nine publicly listed miners booked Thursday losses. Iris Energy (IREN) declined 7.39% to $26.12, while Marathon Digital (MARA) slid 4.41% to $15.19. Riot Blockchain (RIOT) dipped 1.33%, and Core Scientific (CORZ) closed 0.15% lower.

Crypto Miners Stock Price Performance | Companiesmarketcap

Other miners faced steeper declines. Cipher Mining (CIFR) dropped 7.46%, Hut 8 Mining (HUT) fell 5.57%, Bitdeer Technologies (BTDR) slid 4.90%, and CleanSpark (CLSK) retreated to $9.08. TeraWulf (WULF) slipped 1.61%.

Bitmine Immersion Technologies Inc. Stock Price Performance on September 4, 2025 | NASDAQ

Major corporate Bitcoin buyers, such as Strategy (MSTR) and Bitmine Immersion (BMNR) also saw significant intraday losses. The sector-wide sell-off reflected investor caution in response to Nasdaq’s tightening regulatory procedures around crypto acquisition.

Best Wallet Presale Gains Traction Amid Market Volatilit

While Nasdaq’s oversight introduces fresh regulatory risks in crypto stocks, traders are increasingly leaning toward direct blockchain exposure through projects like Best Wallet (BEST). Offering compatibility with Ethereum, Dogecoin, Bitcoin, and other leading tokens, Best Wallet is optimized for state-of-the-art, multi-chain crypto asset management.

Best Wallet Presale

The multi-chain storage project has already raised over $15 million in its ongoing presale, attracting users with low transaction fees and high staking rewards. Visit the Best Wallet website to get in early before the next price uptick.

nextThe post Top 9 Crypto Miners in Red as New Nasdaq Rules Spark Stocks Sell-off appeared first on Coinspeaker.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

XRP Treasury Firm Evernorth Prepares Public Listing to Boost Institutional Exposure