Michael Saylor’s Strategy Qualifies For S&P 500, May Spark $16 Billion Inflows: Bloomberg

Michael Saylor’s Strategy meets all the criteria for inclusion in the S&P 500 index, which could lead to $16 billion in inflows for the company’s stock, Bloomberg reported.

That’s after the company achieved a $14 billion unrealized gain the last quarter, delivering the profitability needed to be included in the index under current rules.

In addition to meeting the profitability requirements, Strategy’s shares are the most actively and efficiently traded of all of the 26 possible candidates for inclusion in the index at the next quarterly rebalancing, the story said. Other candidates include AppLovin Corp, Robinhood Markets, and Carvana Co.

If Strategy (MSTR) were to be included in the S&P 500, passive funds that track the index would be forced to buy up nearly 50 million shares, which is worth around $16 billion, according to analysis by Stephens Inc that was referenced in the report.

Institutional Validation

The inclusion would also bring institutional validation for Saylor’s bold Bitcoin accumulation plan, which has been pilloried by critics over the years for being too reckless, the report said. It would also turn pension funds into indirect holders of the king of cryptos.

While Strategy has already been added to the Nasdaq 100 in December, inclusion in the S&P 500 will be a much bigger milestone given it is nearly double the size of the Nasdaq 100 with close to $10 trillion in passive capital tracking it.

Bloomberg’s report said Strategy’s inclusion in the S&P 500 may still be “a long shot for now,” but added that MSTR joining the index is now within the realm of possibility, noting that it was unthinkable even a year ago.

Volatility may be one problem for its inclusion, with Bloomberg highlighting that Strategy’s 30-day price swings run at around 96%, substantially more than Nvidia’s 77% and Tesla’s 74%.

The S&P committee maybe reluctant to include MSTR on that basis, according to the report.

The S&P committee has the final say when it comes to which companies are added to the index, which could mean candidates that meet liquidity requirements are still left out.

Technology stocks currently dominate the index, but the committee’s recent inclusion of US crypto exchange Coinbase Global Inc and Jack Dorsey’s fintech firm Block Inc suggests the committee is starting to acknowledge the growing footprint of the crypto space, the report said.

Doubts Over Sustainability Of Strategy’s Corporate Treasury Model

Despite the possibility of S&P 500 inclusion, there has been growing skepticism around the sustainability of Strategy’s corporate treasury model.

The company relies on debt financing to accumulate BTC, a strategy that comes with risks, especially if the company’s stock price, or Bitcoin, fall steeply.

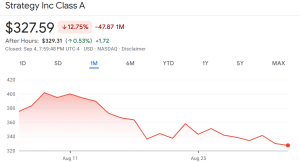

MSTR share price (Source: Google Finance)

Over the past month, MSTR’s price has plummeted over 12%. During this same period, BTC has slipped 1%, and trades at $112,710.44 as of 3:20 a.m. EST, data from CoinMarketCap shows.

However, Strategy’s share price is still up over 6% on the 6-month time frame, and MSTR remains more than 13% in the green YTD.

Strategy BTC holdings (Source: SaylorTracker)

Strategy Is Biggest Bitcoin Treasury Firm

Strategy is the leading Bitcoin treasury company and is often seen as a proxy for the price of BTC given the company’s high concentration in the digital asset.

According to data from Bitcoin Treasuries, Strategy holds 636,505 BTC on its balance sheet. The company is sitting on an unrealized gain of more than $25.98 billion, or around 57%, since the firm kicked off its BTC accumulation back in 2020. At current prices, Strategy’s Bitcoin stash is valued at $71.45 billion.

The company’s most recent Bitcoin purchase was on Sept. 2, when it bought another 4,084 BTC worth around $449.3 million at an average price of $110,81, according to an X post by Saylor.

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim