The EU starts a stablecoin war: 21 issuers compete, Circle takes the lead, and Tether supports "agents"

Author: Weilin, PANews

The EU's "Markets in Crypto-Assets Act" (MiCA) came into effect on June 30, and is scheduled to be fully implemented on December 30 this year. As the EU's first complete regulatory framework for the crypto industry, the implementation of MiCA not only affects the euro stablecoin market, but also provides a certain reference for the global stablecoin regulatory model.

However, USDT issuer Tether faces urgent challenges in this context. As it has not yet obtained a stablecoin issuance license under the MiCA framework, Tether is actively looking for ways to deal with it by investing in emerging projects. On November 18, Tether announced an investment in the Dutch company Quantoz, which will launch two MiCA-compliant stablecoins.

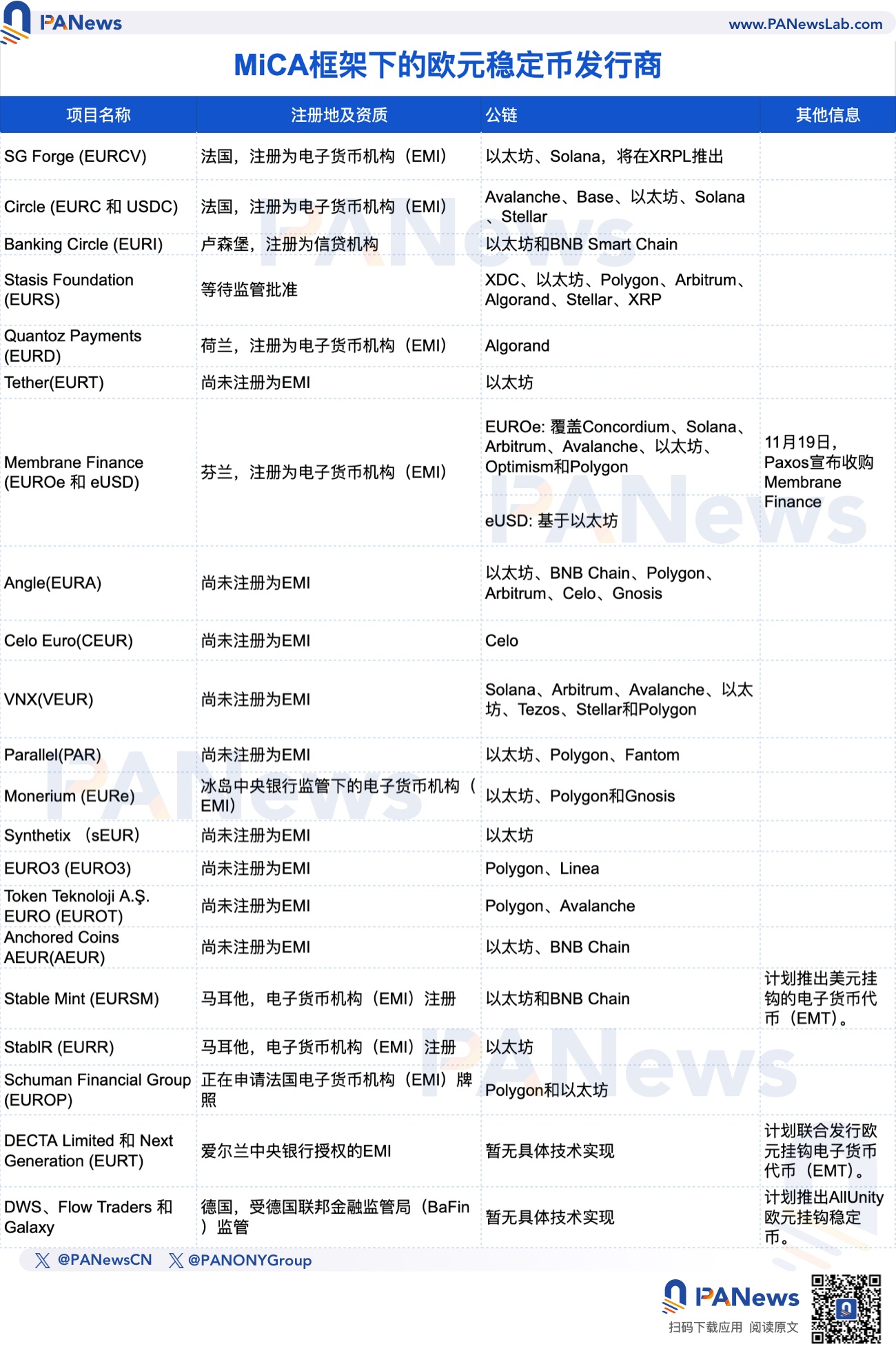

Circle takes the lead in compliance, 21 issuers compete for the market

On November 18, Dutch blockchain company Quantoz announced the launch of two stablecoins, USDQ and EURQ, which comply with the EU regulatory MiCA standards and are anchored to the US dollar and the euro respectively. These stablecoins will be listed on exchanges Bitfinex and Kraken on November 21. It is reported that Tether, Kraken and Fabric Ventures have invested an undisclosed amount of money in Quantoz.

Quantoz's compliance layout shows that Tether is trying to expand its presence in the euro stablecoin market by supporting projects that comply with MiCA regulation. This investment may be seen as a key step for Tether to find an "agent" in the euro stablecoin field.

As of November 20, according to Coingecko data, the top five players in the Euro stablecoin market by market capitalization are:

- Stasis (EURS): Market cap $131 million

- Circle (EURC): Market capitalization $89.49 million

- Societe Generale subsidiary SG-Forge (EURCV): market value $41.91 million

- Tether (EURT): Market cap $26.99 million

- Angle(EURA):Market capitalization $21.18 million

According to Coingecko data, as of November 20, based on the total market value of Euro stablecoins of $326 million, Circle's EURC and SG-Forge's EURCV together account for 40% of the Euro stablecoin market. This market concentration poses challenges for new players, but also provides an entry point for Quantoz, which has compliance advantages.

MiCA imposes strict requirements on stablecoin issuers, including the following key provisions: First, the licensing requirement: the issuer must obtain an Electronic Money Institution (EMI) license or register as a credit institution in at least one EU member state. Second, the reserve asset requirement : at least 60% of the reserve assets must be held in European banks. In addition, there are transaction volume restrictions: if the daily transaction volume of a stablecoin exceeds 1 million transactions, or the daily transaction amount exceeds 200 million euros, the issuer will be prohibited from continuing to issue more stablecoins.

Major issuers such as Circle and SG-Forge have met the above requirements by registering for an EMI license in France. For example, SG-Forge's EURCV runs on Ethereum and recently announced plans to launch on Ripple's XRP Ledger (XRPL) to expand its market coverage.

With Tether’s investment in Quantoz, Tether may have the opportunity to further stabilize its share in the Euro stablecoin market through “agents.” Looking for new companies holding EMI licenses has also become a new trend.

On November 19, Paxos, a blockchain and tokenized infrastructure platform, announced that it has agreed to acquire Membrane Finance (Membrane), a licensed electronic money institution (EMI) headquartered in Finland. The acquisition is subject to regulatory approval. Upon completion of the acquisition, Paxos will become a fully licensed EMI in Finland and the European Union.

Tether CEO expresses concerns about MiCA, more companies seek competing “agents”

For Tether, the new requirements brought by MiCA are urgent challenges. According to previous public reports, Coinbase Global Inc. will remove all unauthorized stablecoins from its European crypto exchange by the end of the year, which may have an impact on Tether's USDT and other tokens.

Currently, major cryptocurrency exchanges, including Uphold, Bitstamp, Binance, Kraken, and OKX, are taking steps to comply with the EU's new cryptocurrency regulations. OKX has delisted all USDT trading pairs in Europe. Other major exchanges, such as Binance and Kraken, have not yet delisted USDT, but are considering limiting its functionality.

Tether CEO Paulo Ardoino previously said that Europe's upcoming regulatory framework will bring banking-related issues to stablecoin issuers, which may threaten the stability of the wider crypto market. Because according to MiCA regulations, stablecoin issuers must hold at least 60% of their reserve assets in European banks. Ardoino said that considering that banks can lend up to 90% of their reserves, this may introduce "systemic risks" for stablecoin issuers.

Some major stablecoin issuers have faced bank-related issues in the past. For example, in March 2023, Circle’s USD Coin (USDC) experienced a decoupling event from the U.S. dollar. At the time, Circle was unable to withdraw $3.3 billion worth of reserves from Silicon Valley Bank, which previously managed $40 billion in reserve funds for the stablecoin issuer, and the bank subsequently ceased operations.

In Ardoino's view, the bank reserve requirements imposed by MiCA mean that an increasing portion of stablecoin reserves will be held on bank balance sheets. This will have significant implications if a bank fails. Ardoino pointed out: "You deposit 1 million euros in a bank account in Europe, and this bank has federal deposit protection up to 100,000 euros. If the bank fails, you can get 100,000 euros back, and the rest of the funds will go into bankruptcy liquidation procedures because the money you deposited is already on the bank's balance sheet."

However, Ardoino added that under the new MiCA rules, stablecoin issuers can protect themselves from potential bankruptcy risks through securities: “The protection is to buy securities like treasury bills or government bonds. If the bank goes bankrupt and you have securities, they are nominal assets, so they are returned to you and you just transfer them to another bank.”

Crypto industry calls for extension of MiCA transition period

Recently, the crypto industry wrote to the European Securities and Markets Authority (ESMA), pointing out that ESMA has been slow to finalize the details of the rules, making it difficult for companies to complete the certification process in a short period of time and they may be forced to suspend services.

During the implementation process, MiCA currently has an 18-month regulatory transition period, but the length of time chosen by each member state varies. For example, France and Greece are 18 months, while Lithuania is only 5 months, which may lead to the interruption of cross-border services, affect users' trading capabilities and bring financial losses.

In addition, the crypto industry group said that the uneven implementation of MiCA rules threatens the "passport mechanism". The core advantage of MiCA lies in the "passport mechanism", that is, after a company obtains certification in one member state, it can provide services throughout the EU. However, the inconsistency of rule enforcement may weaken this advantage.

Crypto industry representatives called on ESMA to extend the authorization transition period to the end of June 2025, or require member states to coordinate a unified timetable to ease compliance pressure on companies and avoid service interruptions.

According to previous speculation, the entry into force of MiCA is expected to drive significant growth in the euro-backed stablecoin sector. By 2025, the market value of euro stablecoins is expected to reach at least 15 billion euros, increase to 70 billion euros by 2026, and may exceed 2 trillion euros in 2028.

In general, with the full implementation of MiCA, traditional financial institutions such as Societe Generale, blockchain companies such as Circle and Stasis, and emerging issuers such as Quantoz are actively making plans to compete for this market. In the future, compliance and technological innovation will become the key factors in market success or failure. It can be said that for stablecoin issuers, MiCA is a turning point where risks and opportunities coexist.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Sunrun Shares Plunge 28% Following Disappointing 2026 Cash Flow Forecast