XRP and Solana ETFs: Why October 2025 Could Be a Turning Point

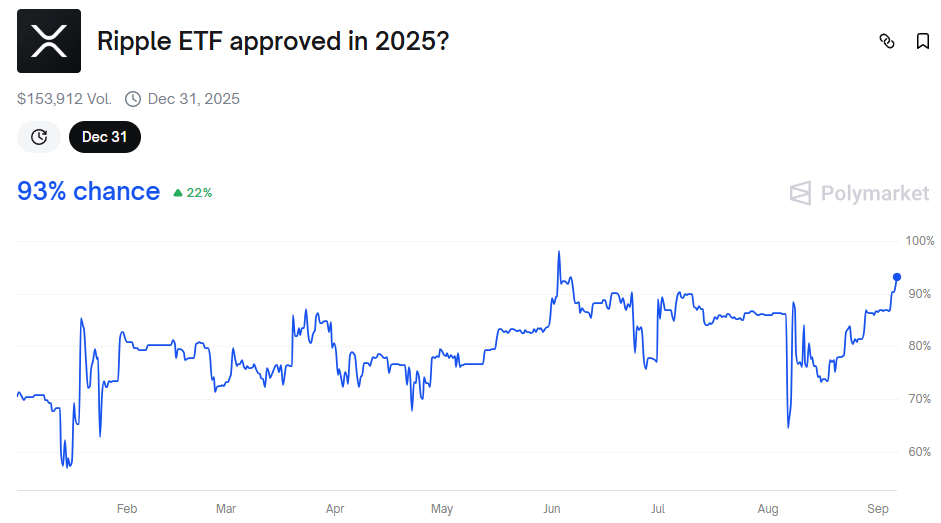

Betting markets give them a 95% chance of success, and institutional interest is building by the day.

Asset managers including Grayscale, Franklin Templeton, Bitwise, and VanEck have filed applications, with analysts noting a wave of amended S-1 forms—often a sign that regulators and issuers are close to final terms. Market watchers say the process feels less like speculation and more like a countdown.

Why Solana and XRP Are Different Stories

Despite being grouped together, the two tokens face very different regulatory backdrops.

- Solana: With unmatched throughput—reportedly 65,000 transactions per second—and dominance in decentralized exchange activity, Solana looks like a natural candidate for institutional adoption. Yet the lingering shadow is the SEC’s earlier claim that SOL may be an unregistered security. A May 2025 ruling on custodial staking helped, but the question hasn’t gone away.

- XRP: Here the advantage is legal clarity. A federal court decision established that public XRP sales are not securities offerings, giving the token firm ground that Solana lacks. On top of that, regulated XRP futures on CME have already broken records, hitting $1 billion in Open Interest faster than any other product. For Wall Street, that signals readiness.

What Approval Could Mean

Analysts expect an approval wave to unleash billions in inflows. Forecasts suggest $5–8 billion into XRP ETFs in the first year alone, while Solana could see its price climb toward $335.

READ MORE:

Wall Street Meets Dogecoin – First DOGE ETF Set to Debut

Constant ETF-driven demand would provide a more stable liquidity base, tighten spreads, and reduce volatility in spot markets. The derivatives side—futures and options used to hedge ETF flows—would likely see a surge as well, creating deeper markets and better price discovery.

Risks of Overexcitement

History warns that crypto doesn’t always rally in a straight line. XRP has a track record of spiking on good legal news only to dip as early holders lock in profits. A “sell the news” pullback for both tokens is possible even if ETFs are approved.

Beyond Solana and XRP

Approval would be about more than just two coins. It would mark a turning point for the entire altcoin sector, signaling that the U.S. is willing to bring multiple blockchains into mainstream finance. Other top projects would likely rush to pursue ETFs of their own, sparking fresh competition for transparency and institutional adoption.

The Bigger Picture

Europe already offers products from issuers like 21Shares, but the American market is the real battleground. With the SEC holding the keys, October could decide whether Solana and XRP make the leap from promising projects to institutional mainstays.

A green light wouldn’t just funnel billions into these two tokens—it would mark a new chapter in crypto’s march into traditional finance.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post XRP and Solana ETFs: Why October 2025 Could Be a Turning Point appeared first on Coindoo.

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets