Circle Launches Native USDC on HyperEVM, Explores Hyperliquid Validator Role

The post Circle Launches Native USDC on HyperEVM, Explores Hyperliquid Validator Role appeared first on Coinpedia Fintech News

Circle has hit a major milestone with the Hyperliquid ecosystem.

This marks a significant step in its commitment to the network, strengthening partnerships with developers, builders, and the broader community.

Native USDC and CCTP V2 Now Live on HyperEVM

In a latest blog post, it announced the official launch of Native USDC and CCTP V2 on HyperEVM. This brings the world’s most reliable and liquid dollar stablecoin directly to the Hyperliquid community.

Developers, institutions, and traders can now access the world’s largest regulated stablecoin on HyperEVM, with the ability to securely make cross-chain deposits from more than a dozen blockchains.

In the coming weeks, direct deposits and CCTP interoperability for Hyperliquid USDC on HyperCore will also go live.

With native USDC on HyperEVM, CCTP V2 interoperability, and upcoming HyperCore support, Hyperliquid users and developers can easily move digital dollars across the entire crypto ecosystem. Fintechs, on/off-ramp providers, and other services can also integrate seamlessly with Hyperliquid with the most liquid digital dollar in the world.

Circle: A Direct Stakeholder in Hyperliquid

Notably, Circle is now a direct stakeholder in the Hyperliquid ecosystem with their first HYPE token investments alongside a comprehensive program to collaborate with the most innovative HIP-3 and HyperEVM builders. The team is also exploring the possibility of becoming a Hyperliquid Validator.

Circle said in the blog post that connecting with the Hyperliquid core team and many startups and developers building on HyperEVM and HIP-3 over the past few months has been a real pleasure. “This is clearly one of the most impressive communities and platforms in the entire crypto ecosystem,” it said.

“Strong Validation of Hyperliquid”

VanEck’s Matthew Sigel reacted to the news, calling it a major milestone. He described it as a clear validation of Hyperliquid’s status as an independent Layer 1.

Analyst DeFiyst highlighted this as a “last-ditch effort” to save the $5.3 billion USDC on Hyperliquid that is expected to be swapped into USDH. He notes that while this represents only about 7% of USDC in circulation, it could account for 12–15% of Circle’s revenue once fees paid to exchanges and chains are considered.

USDH Set to Launch

This comes ahead of Hyperliquid’s upcoming native stablecoin, USDH. Native Markets secured the USDH ticker after a community-led governance process and a competitive bidding phase that included major firms like Paxos, BitGo, Ethena, and Frax, highlighting strong community support.

You May Also Like

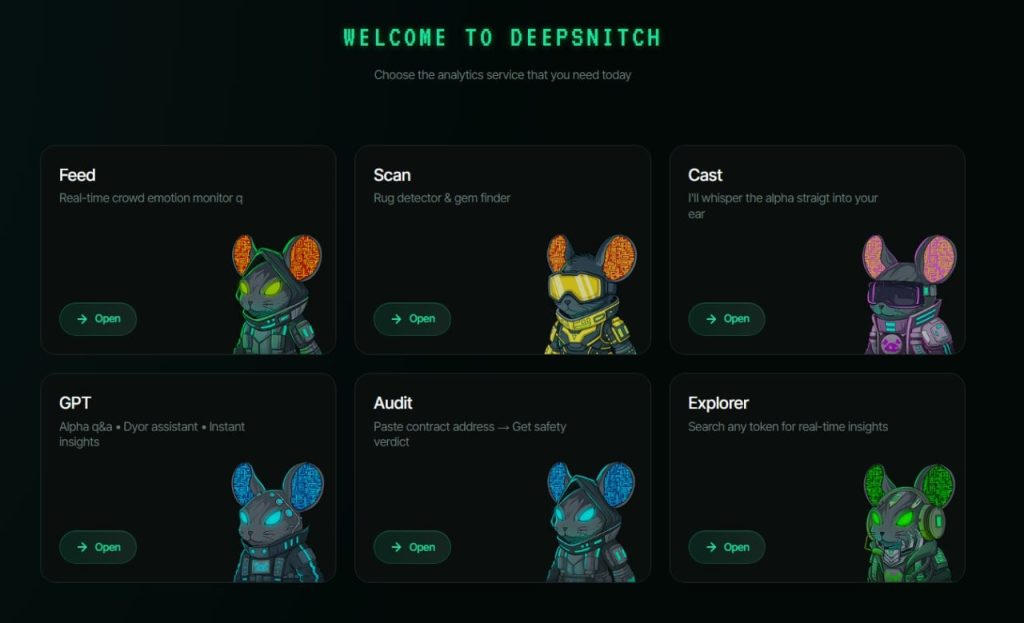

XRP Price Prediction March Update: Ripple and Aave Consolidate While DeepSnitch AI Surges 170%+ and Raises $1.8M

Polkadot Soars 2.3% to $1.555 — What’s Driving This Surge?