Bitcoin Is Showing Signs Of Exhaustion, Glassnode Says

Bitcoin (BTC) price has dropped to a four-week low as long-term holders sell and institutional demand weakens.

Bitcoin’s recent price action has caught the attention of traders around the world.

The cryptocurrency has now dropped to a four-week low, after slipping to around $108,700 according to Glassnode.

Analysts say the market is showing signs of exhaustion after weeks of strong inflows and profit-taking by long-term holders.

Long-Term Holders Take Profits as Bitcoin Stumbles

Long-term holders have started cashing out their Bitcoin holdings and have realised around 3.4 million BTC in profits. This surge in selling activity coincided with the US Federal Open Market Committee’s recent rate cut, which initially pushed prices to $117,000 before the decline started.

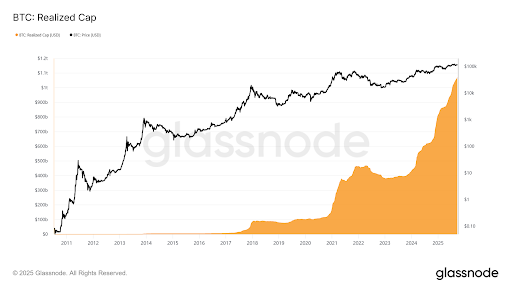

Bitcoin’s current realised cap | source-Glassnode

Bitcoin’s current realised cap | source-Glassnode

Glassnode reported that these holders have been distributing about 122,000 BTC per month.

This wave of selling has come just as institutional demand slowed. Exchange-traded fund (ETF) inflows fell from 2,600 BTC per day to nearly zero on a seven-day average. This alone has left the market vulnerable.

The profit-taking trend has made it difficult for short-term holders to maintain Bitcoin above its cost basis near $110,000. Breaking below this level could also trigger further stop-loss selling and deepen the correction.

Market Exhaustion Rises

Glassnode’s latest data shows that Bitcoin is entering a cooling phase. The firm described the recent move as a classic case of “buy the rumour, sell the news” after the Fed’s rate cut.

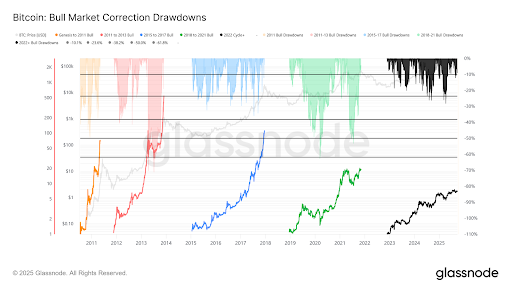

This cycle has been different from previous ones.

Instead of a single prolonged wave of inflows, there have been three distinct multi-month surges since November 2022. Each surge has come alongside heavy profit-taking. Over 90% of coins moved during these periods were sold at a profit, which is one of the biggest signs of a cyclical peak.

Analysts are warning that this pattern tends to point towards the end of a strong rally. Now with ETF inflows drying up and long-term holders taking profits, the market is facing a lack of fresh capital to support higher prices.

Stop-Loss Selling and Weak Support Levels Add Pressure

Markus Thielen from 10x Research pointed out that Bitcoin’s recent rebound after the early September drop “quickly lost momentum.” As the price once again hovers near those levels, traders are worried that more stop-loss orders could be triggered.

Spot and futures markets have also shown stress. Volumes spiked during the sell-off, while open interest in futures contracts dropped by billions of dollars. Options markets also moved defensively as demand for protective puts increased.

Glassnode pointed out that the short-term holder cost basis at $111,800 is important because losing this level increases the chances of a deeper cooling period.

Historical Trends Offer Hope for ‘Uptober’

Despite the current outlook, many traders are hopeful about October, which is often called “Uptober.” This month has historically been favourable for Bitcoin. Data from Coinglass shows the cryptocurrency has averaged a 21.89% return in October since its inception.

Analyst Darkfost noted that Bitcoin has closed October in profit in 12 out of the past 16 years. Since 2020, an investment on October 1st has typically delivered gains of 7.5 to 30.5% within the month.

This seasonal trend indicates that if market sentiment stabilises, Bitcoin might find support in the next few weeks. However, any rally will likely face resistance from ongoing profit-taking and weak institutional participation.

Glassnode’s Data Signals a Fragile Market

The on-chain metrics indicate that Bitcoin’s realised cap now stands at $1.06 trillion. This figure represents the total value of all Bitcoins at the price they were last moved.

In previous cycles, realised cap growth was recorded at $4.2 billion between 2011 and 2015, $85 billion between 2015 and 2018, and $383 billion between 2018 and 2022.

The market’s historical drawdowns | source-Glassnode

The market’s historical drawdowns | source-Glassnode

The current cycle has seen $678 billion in net inflows, which is nearly double the previous one.

Despite the impressive inflows, the recent distribution by long-term holders shows that much of this capital is being locked in as profits rather than reinvested.

The post Bitcoin Is Showing Signs Of Exhaustion, Glassnode Says appeared first on Live Bitcoin News.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Why Are Disaster Recovery Services Essential for SMBs?