Bitcoin Structure Is Changing: What Rising CDD Says About This Cycle

Bitcoin is struggling to hold the $100K level, with bulls unable to reclaim momentum as fear and uncertainty dominate the market. The price continues to trade near critical support, and despite strong on-chain fundamentals, sentiment remains fragile. According to top analyst Darkfost, the market is undergoing a profound transformation — one that’s making many traditional on-chain indicators less reliable.

“With time, we can clearly see that the structure and dynamics of the market are evolving,” he notes. While retail behavior and exchange flows once defined market cycles, the growing influence of institutions, ETFs, and long-term investors has changed the rhythm of Bitcoin’s price action.

Still, some metrics remain vital, and one of the most insightful, according to Darkfost, is Coin Days Destroyed (CDD) — a measure of long-term holder activity. “It’s one of the indicators I follow the most because long-term holders are still driving this market,” he says.

Currently, between 75% and 80% of all Bitcoin supply is held by long-term holders, signaling that the majority of investors remain strong-handed despite volatility. This consolidation among patient holders may ultimately set the stage for the next major trend once short-term fear fades.

Long-Term Holders Drive Market Dynamics Through Rising CDD

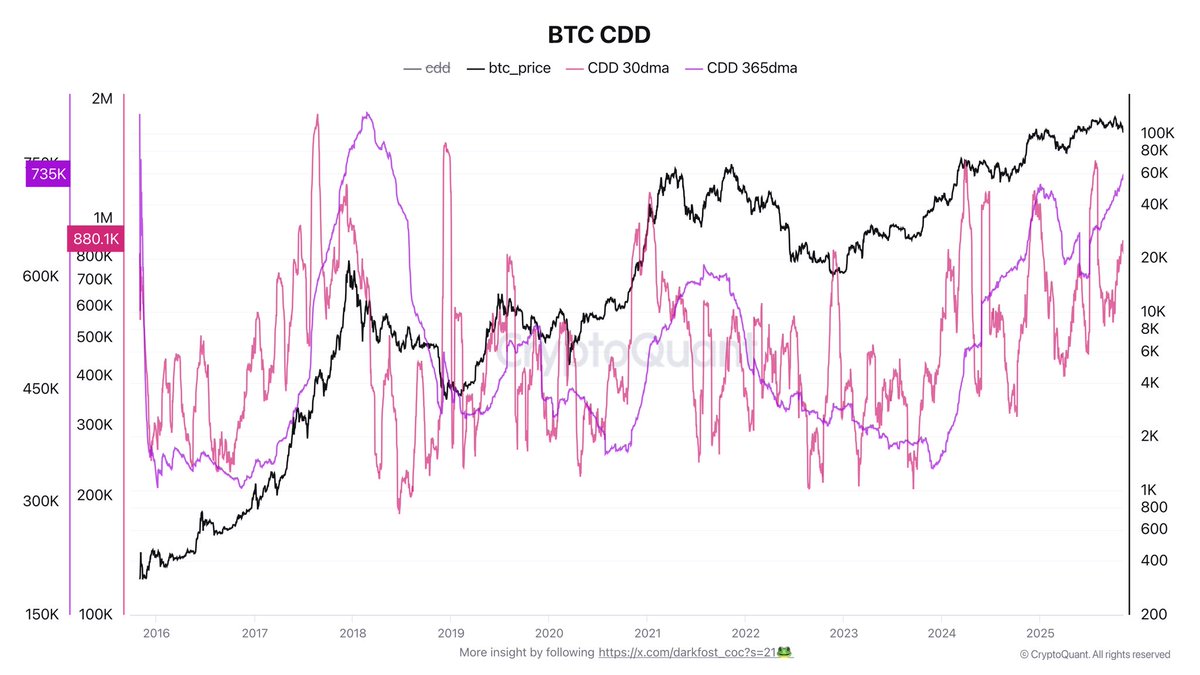

According to Darkfost, the Coin Days Destroyed (CDD) metric remains one of the most valuable tools for understanding Bitcoin’s market structure. It provides a clear visualization of long-term holder (LTH) activity and the potential selling pressure they exert. Essentially, CDD measures how long coins have been held before being moved — and when older coins start circulating again, it’s often a sign that distribution is underway.

Currently, the 30-day moving average of CDD is steadily rising, having doubled since early summer. Interestingly, this metric declined before Bitcoin’s last all-time high, helping fuel that rally, but it has continued to climb since — reflecting growing LTH activity.

On an annual scale, CDD levels have already surpassed the 2021 cycle and are approaching those from 2017, marking one of the most active long-term holder phases in Bitcoin’s history.

This trend signals a massive transfer of supply between market participants. Despite this, Bitcoin remains above $100,000, showing that today’s market is more liquid, resilient, and institutionally driven than in previous cycles. LTHs now have the ability to distribute significant volumes without crashing prices, demonstrating how far Bitcoin’s maturity and market depth have evolved over time.

Bitcoin Battles to Hold $100K Support

Bitcoin is currently trading near $100,767, struggling to maintain stability after a volatile week marked by aggressive selling pressure. The daily chart reveals that BTC has once again tested the $100K psychological support, a key level that bulls must defend to prevent further downside momentum.

From a technical perspective, Bitcoin remains below its 50-day (blue) and 100-day (green) moving averages, signaling that short- and mid-term momentum continues to favor the bears. The 200-day moving average (red) — now positioned slightly above $106K — is acting as dynamic resistance, reinforcing the broader correction phase that began in late October.

If Bitcoin manages to close above $103K–$104K, it could signal a short-term recovery toward $108K–$110K. Conversely, a decisive break below $100K could trigger a sharper correction toward $95K, potentially testing the market’s resilience as sentiment continues to waver between fear and cautious optimism.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

Aave CEO Breaks Silence on Game-changing Upgrade in Q4: Details

Press Release Distribution Services: Build Your Brand, Reputation, and Search Engine Rankings