Ethereum Will Impose Gas Limit In Fusaka Upgrade

The Ethereum Foundation has confirmed that the upcoming Fusaka hard fork will introduce a protocol-level ceiling on how much gas a single transaction may consume, formally codified as EIP-7825. The cap is set at 2²⁴ gas—16,777,216 units—marking the first time Ethereum enforces a per-transaction limit distinct from the block gas limit. The change is already active on Holesky and Sepolia and will go live on mainnet when Fusaka activates.

In a post published October 21, Toni Wahrstätter framed the rationale in direct terms: “Starting with the upcoming Fusaka hard fork, EIP-7825 introduces a per-transaction gas limit cap of 2²⁴ (≈ 16.78 million gas).” The Foundation’s note emphasizes that while the cap bounds individual transactions, it does not alter the block gas limit; instead, it is designed to mitigate denial-of-service vectors where a single oversized call monopolizes an entire block and to improve block packing predictability as the network prepares for parallel execution.

EIP-7825 draws a clean line between transaction-level complexity and system-level throughput. Previously, exceptionally large calls could approach the full block gas target (around 45 million at times), creating timing and scheduling pathologies for builders and validators.

The new ceiling obliges workloads that would exceed 16.78 million gas to be broken into smaller, sequenced calls. The Foundation’s guidance is careful to note that “for most users, nothing changes,” since the statistical distribution of real-world transactions already sits well below the threshold; the risk surface primarily concerns batch-heavy contracts, deployment scripts, and specialized routers.

What This Means For Ethereum And Users

From a roadmap perspective, the cap is explicitly positioned as groundwork for parallel execution. The blog post connects the change to anticipated efforts such as EIP-7928 in the “Glamsterdam” era, where predictable, bounded transactions are a prerequisite for meaningful concurrency in the execution layer. By ensuring that at least several independent transactions can be packed per block—even under pathological mempool conditions—the cap reduces worst-case contention and simplifies scheduler design for builders experimenting with parallelizable execution paths.

The specification itself is spare and mechanical. EIP-7825’s abstract states the intent “to 16,777,216 (2^24) gas” per transaction, improving resilience against certain DoS vectors and making transaction processing more predictable as block limits rise. That simplicity has been part of its appeal in core-dev channels: a small, well-scoped constraint that preserves forward compatibility with more ambitious scaling work.

Debate on how to encode and communicate the ceiling has been active for months, including discussions over naming and parameterization on Ethereum Magicians and during AllCoreDevs calls. One thread summarized the core guarantee being targeted by several contributors: aligning block targets to multiples of 2²⁴ so builders can always include at least n transactions if the mempool has n eligible ones—an argument for predictability rather than raw throughput.

Operationally, the Foundation says all major clients—Geth, Erigon, Reth, Nethermind, and Besu—have implemented the change in Fusaka-ready releases, reducing cross-client divergence risk at activation. The post also stresses that eth_call semantics are unaffected and that pre-signed transactions whose gas limits exceed 2²⁴ will need to be re-signed below the cap. The upgrade path for developers is straightforward: test against Holesky or Sepolia, re-tool batch operations that flirt with the limit, and adjust gas-estimation logic and alerts so they fail fast when constructions exceed the new ceiling.

The policy context is worth parsing. Ethereum’s history has favored minimal, general-purpose constraints, deferring complexity to higher layers. EIP-7825 fits that pattern: it does not opine on what contracts should do, only that they respect an upper bound that protects liveness and prepares the execution layer for a multi-threaded future.

It also sidesteps fee-market alterations and leaves blob-space economics and block targets to other EIPs and forks. As the Foundation put it, the cap “establishes a safer and more predictable foundation for higher throughput in future forks,” a line that sums up the trade-off succinctly.

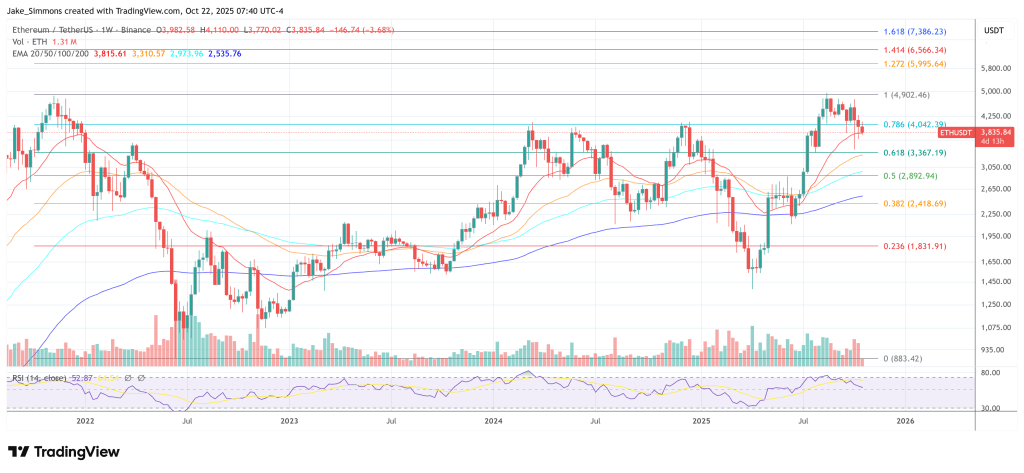

At press time, ETH traded at $3,835.

You May Also Like

Crypto Casino Luck.io Pays Influencers Up to $500K Monthly – But Why?

What Changes Is Blockchain Bringing to Digital Payments in 2026?