Federal Reserve Cuts Rates: What Does This Mean for Crypto?

TLDR:

- The Federal Reserve lowered rates by 25 bps, starting its first easing cycle of 2025.

- Lower rates tend to weaken the dollar, often driving capital into risk assets like crypto.

- Analysts say cheaper liquidity can fuel Bitcoin and altcoin demand as yields fall.

- Investors are watching price reactions closely as markets price in more Fed moves.

The Federal Reserve has hit the markets with its first rate cut of 2025, and investors are watching closely. This 25 bps trim marks the start of what could be a longer easing cycle.

Lower borrowing costs often bring new capital into risk assets. Crypto traders now weigh what this shift means for Bitcoin and other tokens. The move could set the tone for the months ahead.

Federal Reserve Move Signals Liquidity Wave

In its statement, the Fed said growth slowed in the first half of the year and job gains cooled. Inflation remains above target, but policymakers judged risks to employment had risen. They decided to bring the federal funds rate down to a 4.00%–4.25% range.

Stoxkart, a market analyst account on X, noted that a weaker dollar usually follows rate cuts. This often helps emerging markets and makes global commodities priced in dollars more attractive.

Lower yields in U.S. bonds can redirect capital flows into equities and other assets with higher potential returns. Historically, crypto benefits when liquidity improves and investors seek growth plays.

Traders now watch if Bitcoin price reacts to this new macro setup. More capital moving away from bonds could mean higher demand for BTC and altcoins in coming weeks.

Crypto Market Reaction and Price Watch

So far, markets appear cautious but ready. Bitcoin held near key support levels, waiting for confirmation of the trend. Ethereum and other large-cap coins traded in a tight range as investors processed the policy shift.

Some analysts expect the rate cut to boost crypto liquidity if the Fed continues on this path. As yields drop, future cash flows of growth assets get priced higher. That often benefits tech and crypto sectors together.

Market participants now track upcoming economic data closely to see if more cuts are likely. Another round of easing could intensify the shift into digital assets.

For crypto investors, this is a moment to watch price action and funding rates carefully. The coming weeks will show if this policy change sparks a sustained rally or just a short-term bounce.

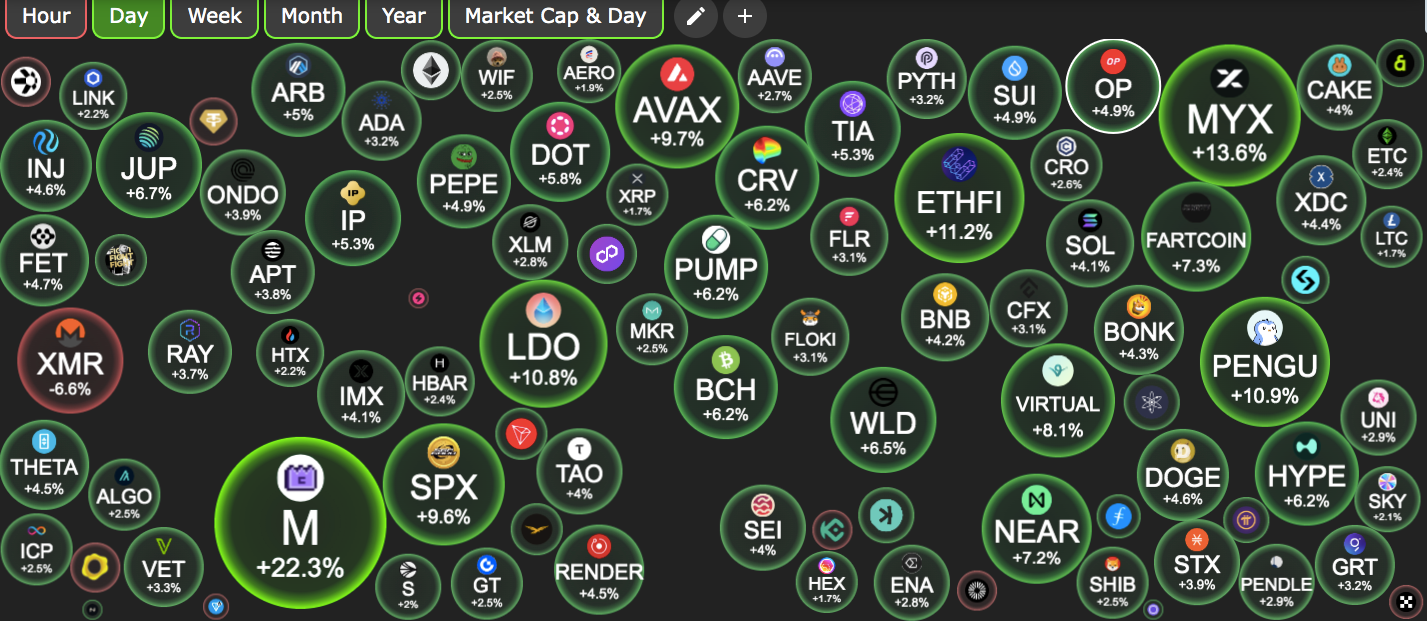

According to the latest market snapshot from CryptoBubbles, most tokens are in the green, picking steam. This could signal the start of a market-wide rally

Crypto Market Snapshot: Source, CryptoBubbles

Crypto Market Snapshot: Source, CryptoBubbles

The post Federal Reserve Cuts Rates: What Does This Mean for Crypto? appeared first on Blockonomi.

You May Also Like

Missouri Considers Bitcoin Reserve Fund using Donations

China Launches Cross-Border QR Code Payment Trial