From the Genesis Block to Breaking $100,000, the Evolution of the Bitcoin Network and Its Economic Foundation

Author: Glassnode

Compiled by: Felix, PANews

Key points:

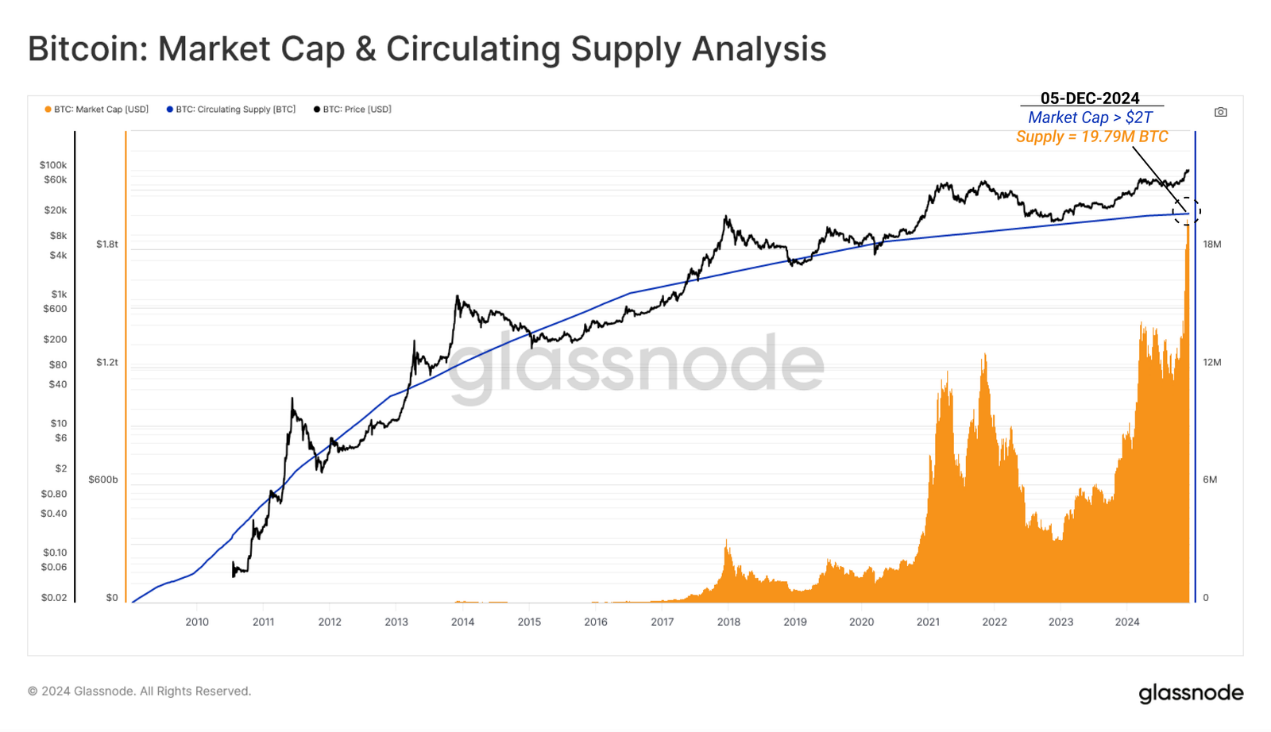

- After 5,256 trading days, Bitcoin broke through the $100,000 mark for the first time on December 5, and its market value once exceeded $2 trillion.

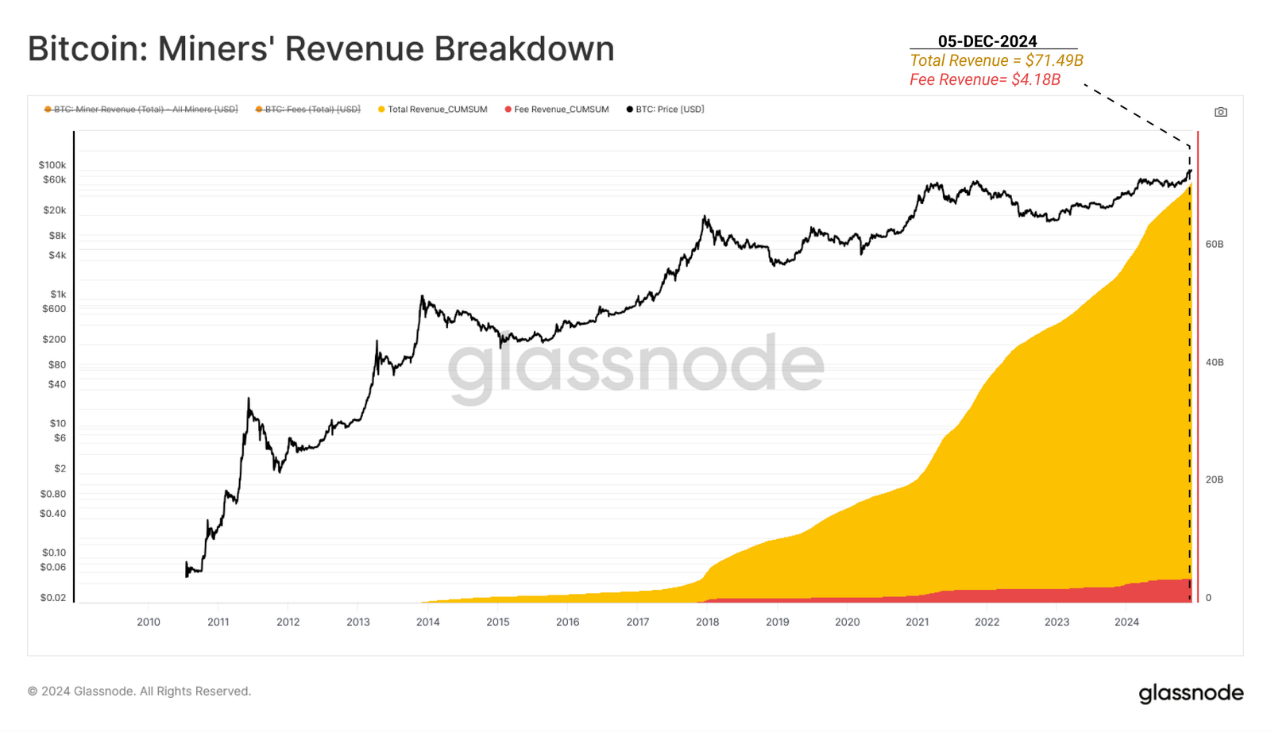

- Miners have earned a cumulative $71.49 billion, reflecting the security and economic incentives of the Bitcoin network.

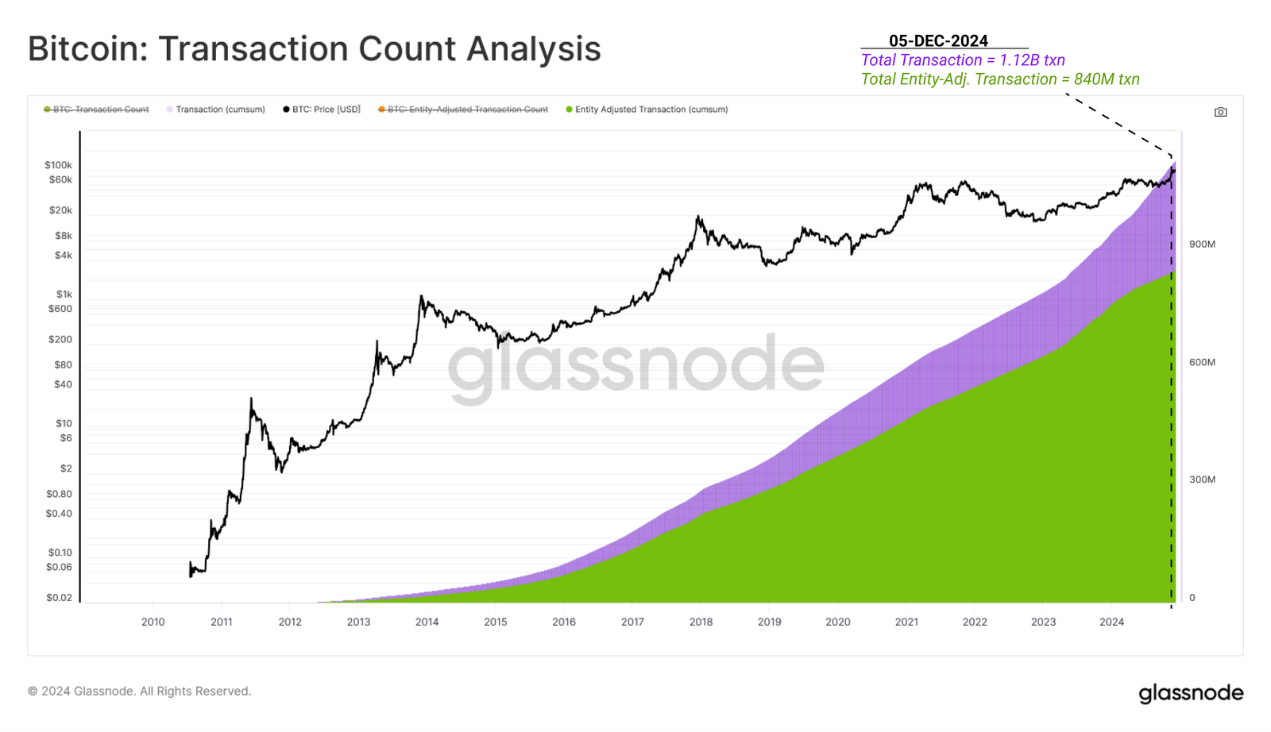

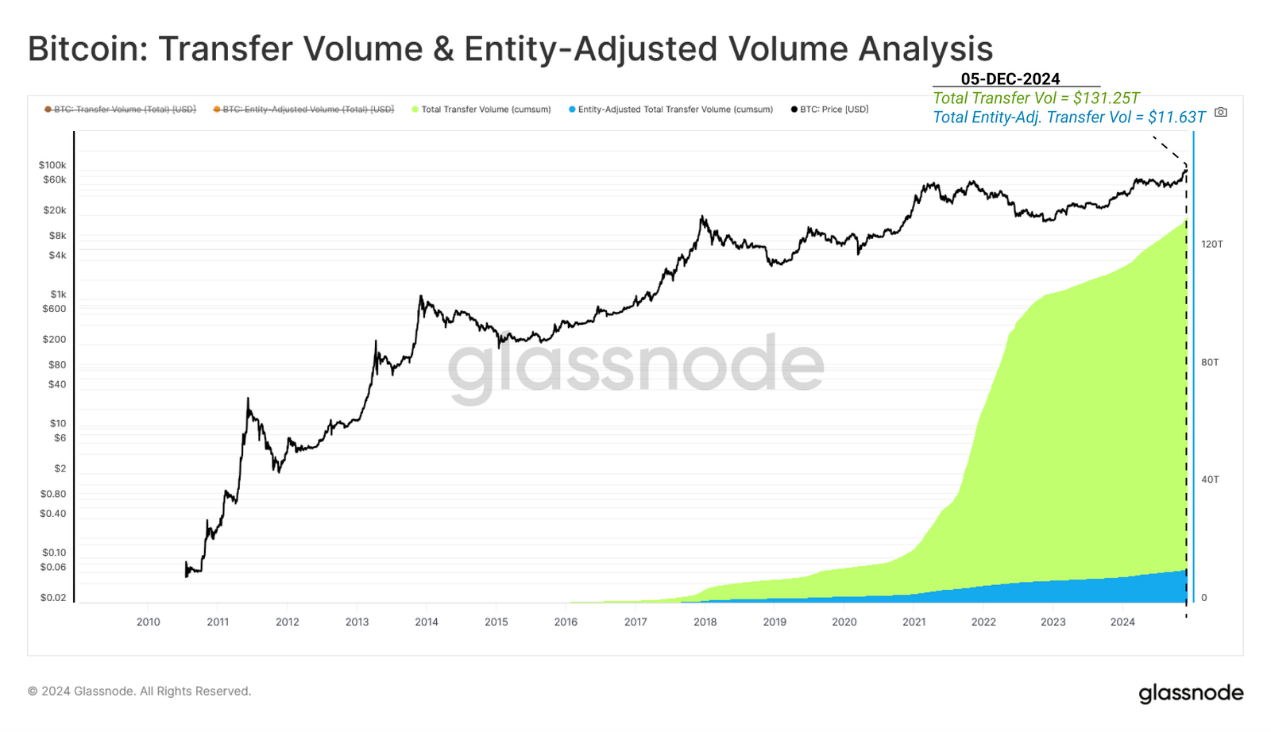

- The Bitcoin network processed a total of 1.12 billion transactions and settled $131.25 trillion in transfers. The entity-adjusted data can more clearly reflect real economic activities.

- The details of holdings of different groups show that Bitcoin holders are widely distributed, covering both retail investors and institutional holders.

This article explores the evolution of the Bitcoin network and its economic foundations, reviewing Bitcoin’s journey from the genesis block to breaking the $100,000 mark.

Market expansion

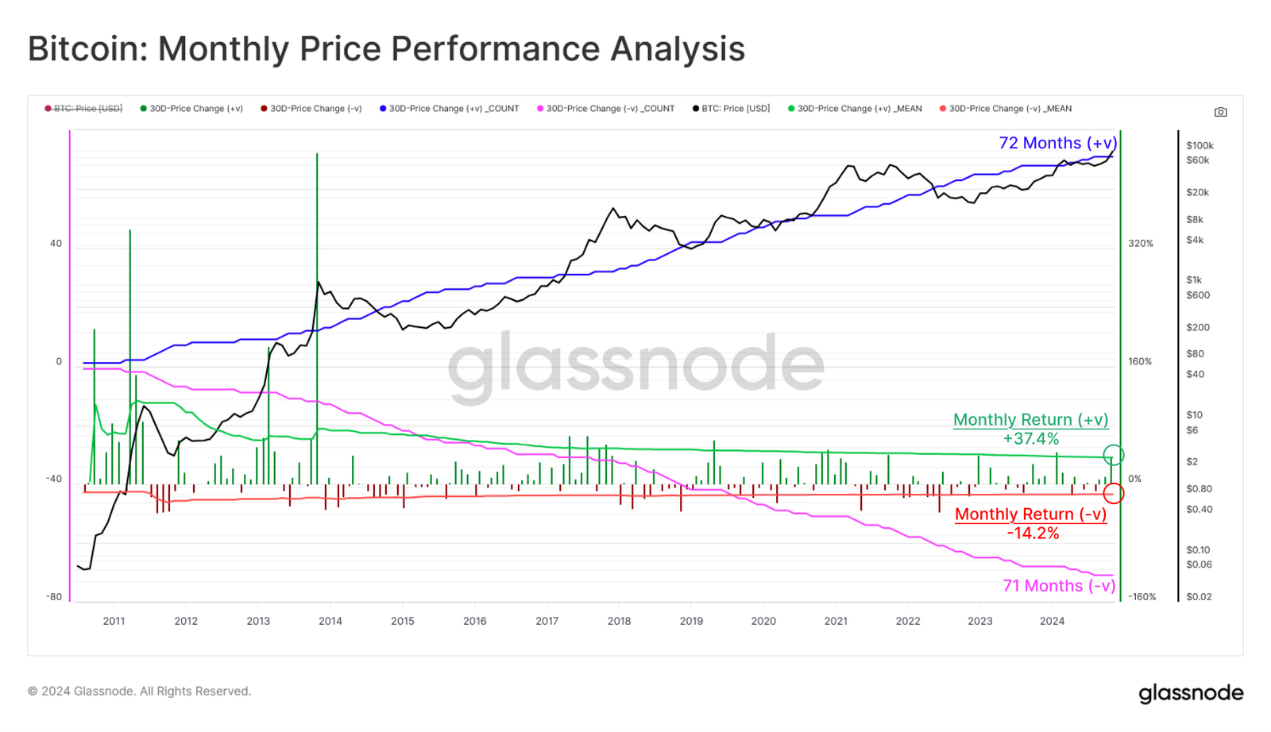

Bitcoin has been trading actively for 5,256 days, rising from a few cents to $100,000. This journey includes 72 positive monthly candlesticks (including December 2024), with an average increase of 37.4%, and 71 negative monthly candlesticks, with an average decrease of -14.2%.

This reflects a fantastic balance between bull and bear markets, and a positive tilt during the most important periods of price appreciation.

As of December 5, a total of 19,791,952 BTC have been mined, accounting for 94.2% of the total 21 million BTC. The market value of Bitcoin also briefly exceeded $2 trillion, surpassing the market value of silver (about $1.84 trillion).

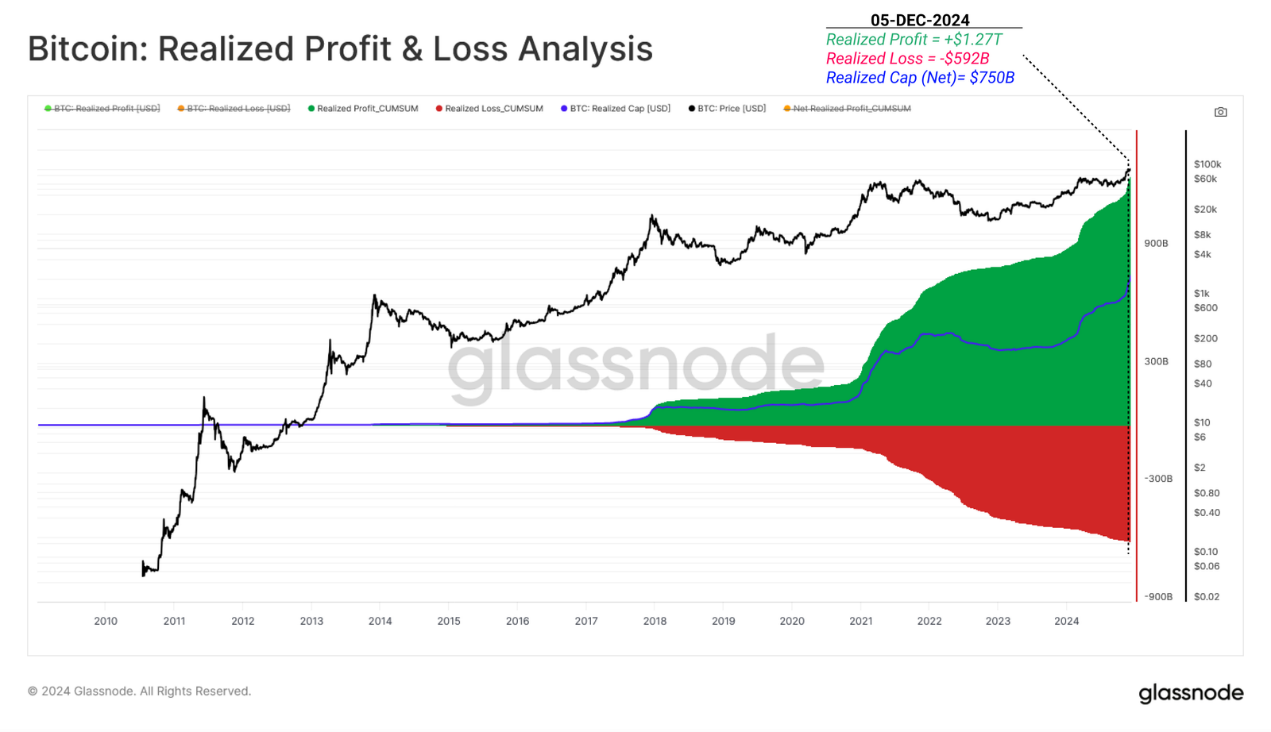

During this period of market expansion, investors realized $1.27 trillion in profits and $592 billion in on-chain losses (based on the difference between buy and sell prices). This resulted in a cumulative net capital inflow (realized market capitalization) of $750 billion and highlights the enormous value that has flowed into the Bitcoin network over its lifetime.

Supply Distribution

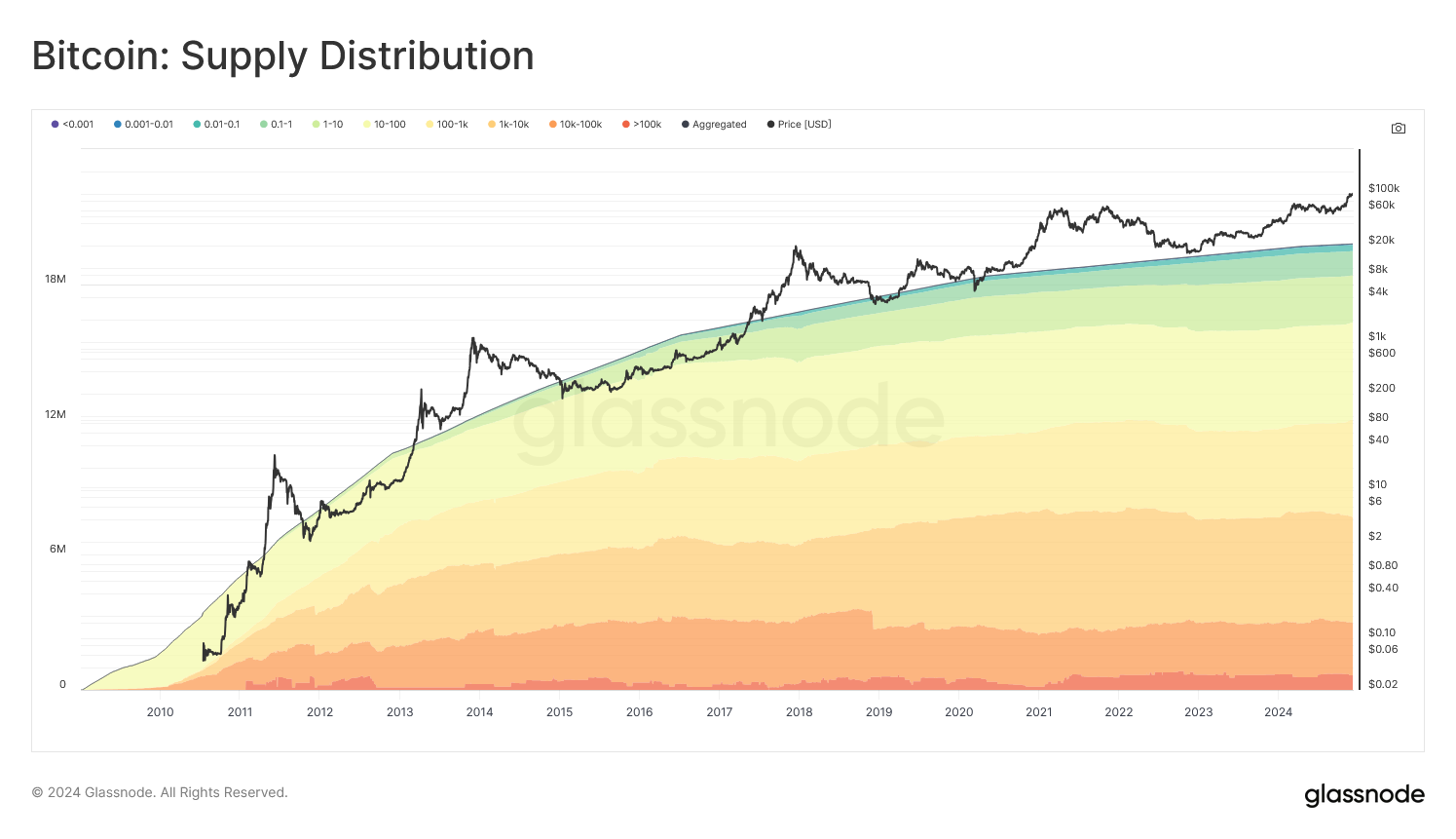

Among the mined Bitcoins, the distribution of groups with different wallet sizes is as follows:

- <0.001 BTC: 5,491 BTC (0.027%)

- 0.001–0.01 BTC: 42,683 BTC (0.216%)

- 0.01–0.1 BTC: 271,641 BTC (1.373%)

- 0.1–1 BTC: 1,077,839 BTC (5.446%)

- 1–10 BTC: 2,093,845 BTC (10.581%)

- 10–100 BTC: 4,306,780 BTC (21.761%)

- 100–1,000 BTC: 4,342,868 BTC (21.935%)

- 1,000–10,000 BTC: 4,693,216 BTC (23.716%)

- 10,000–100,000 BTC: 2,309,654 BTC (11.671%)

- >100,000 BTC: 647,934 BTC (3.274%)

It is worth noting that most of the whale wallets (holding 1,000+ BTC) are associated with exchanges, ETFs, and large institutions such as MicroStrategy. Each of these large entities represents the collective ownership of thousands to millions of customers and shareholders.

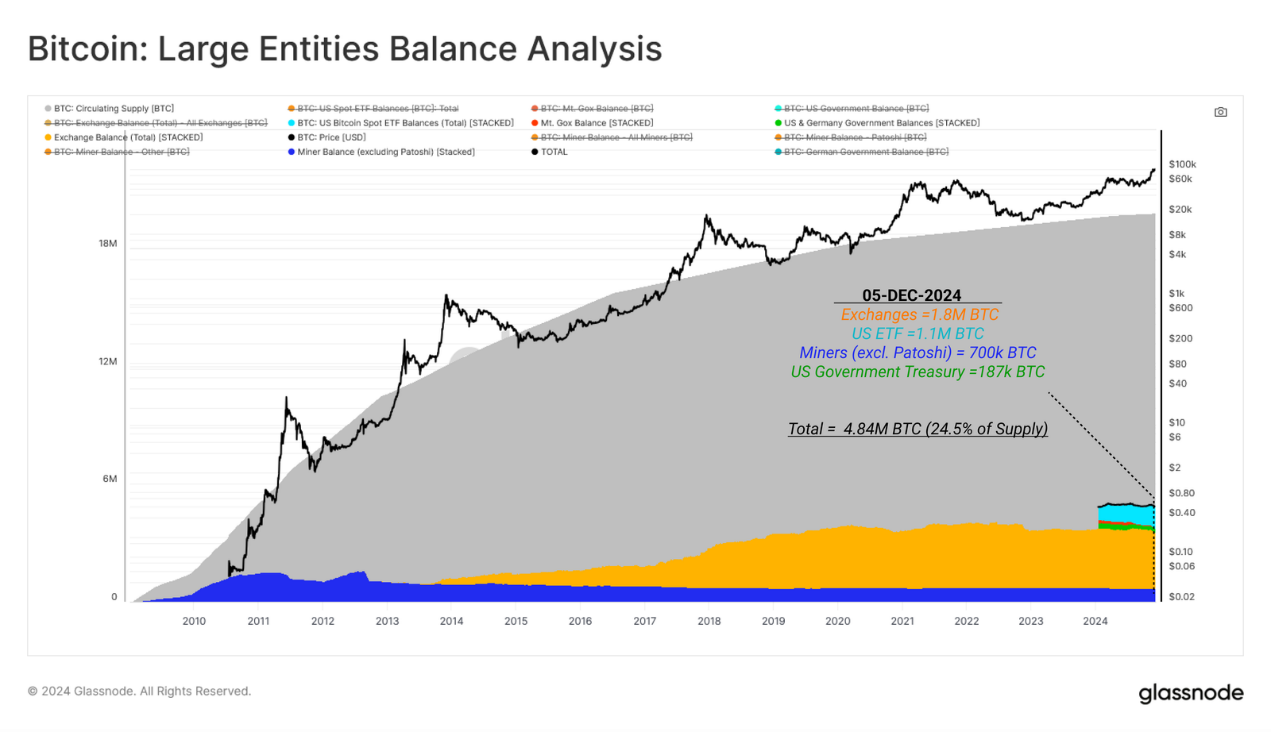

Notable holdings include 1.8 million bitcoins held on exchanges (9.1% of the supply) and 1.1 million bitcoins managed by U.S. ETFs (5.6% of the supply). In addition, miners (excluding Patoshi) retain 700,000 bitcoins (3.5% of the supply), while the U.S. government Treasury holds 187,000 bitcoins (0.9% of the supply), reflecting the wide distribution of bitcoins among various entities and highlighting the increasing institutionalization and centralization of bitcoin custody. (Note: An independent miner first mined a large number of bitcoins. The community believes that this miner is Satoshi Nakamoto and calls this mining model Patoshi)

Network Evolution

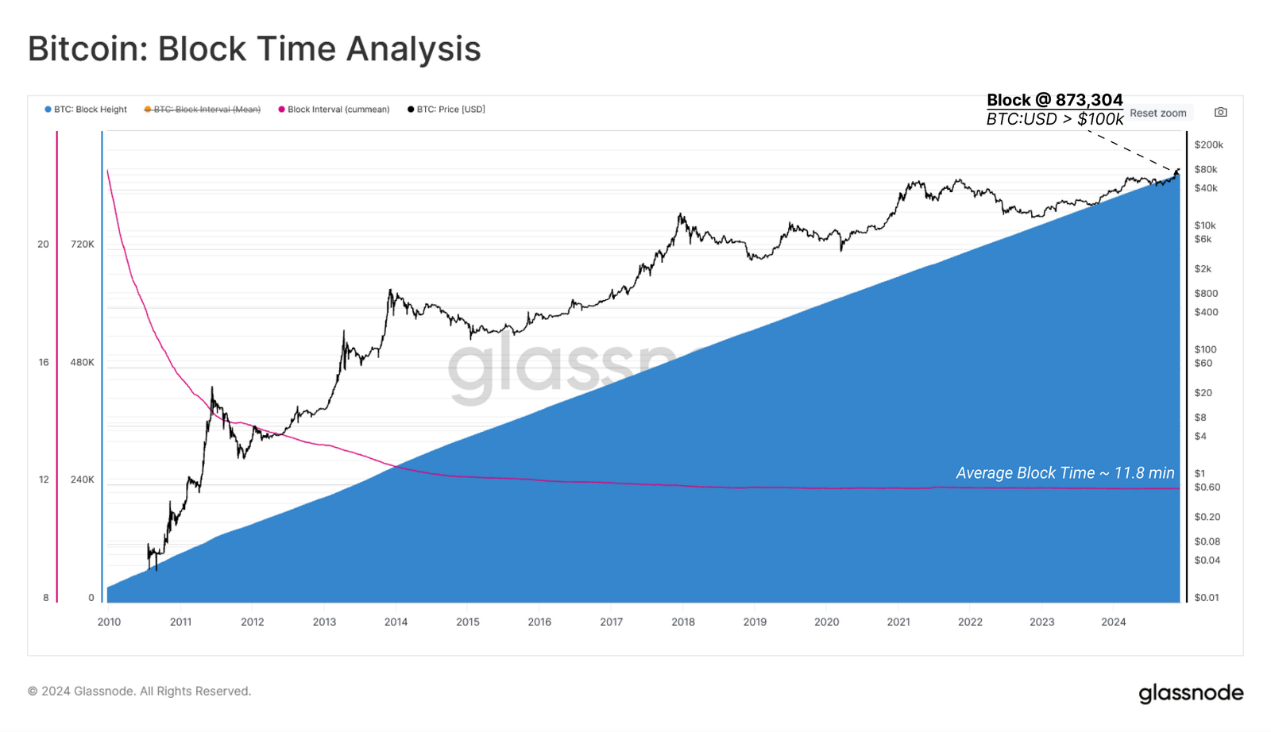

Since the genesis block, a total of 873,304 blocks have been mined, with an average Bitcoin block generation time of 11.8 minutes. While the current average block interval is about 9.6 minutes due to an increase in hash rate, the early years saw a slow start because Satoshi Nakamoto overestimated the performance of laptop CPUs relative to the initial difficulty setting.

During the same period, the network difficulty increased dramatically. As the security and computing power behind Bitcoin continued to grow, after 418 difficulty adjustments (excluding periods without adjustments), the network difficulty increased to 446,331,432,498,125,300,000,000.

The difficulty adjustment target of the Bitcoin Proof of Work (PoW) consensus is to mine a block approximately every 10 minutes, regardless of changes in the network hash rate. The mining difficulty is dynamically adjusted every 2016 blocks (about 2 weeks) to align with the target block time of 600 seconds.

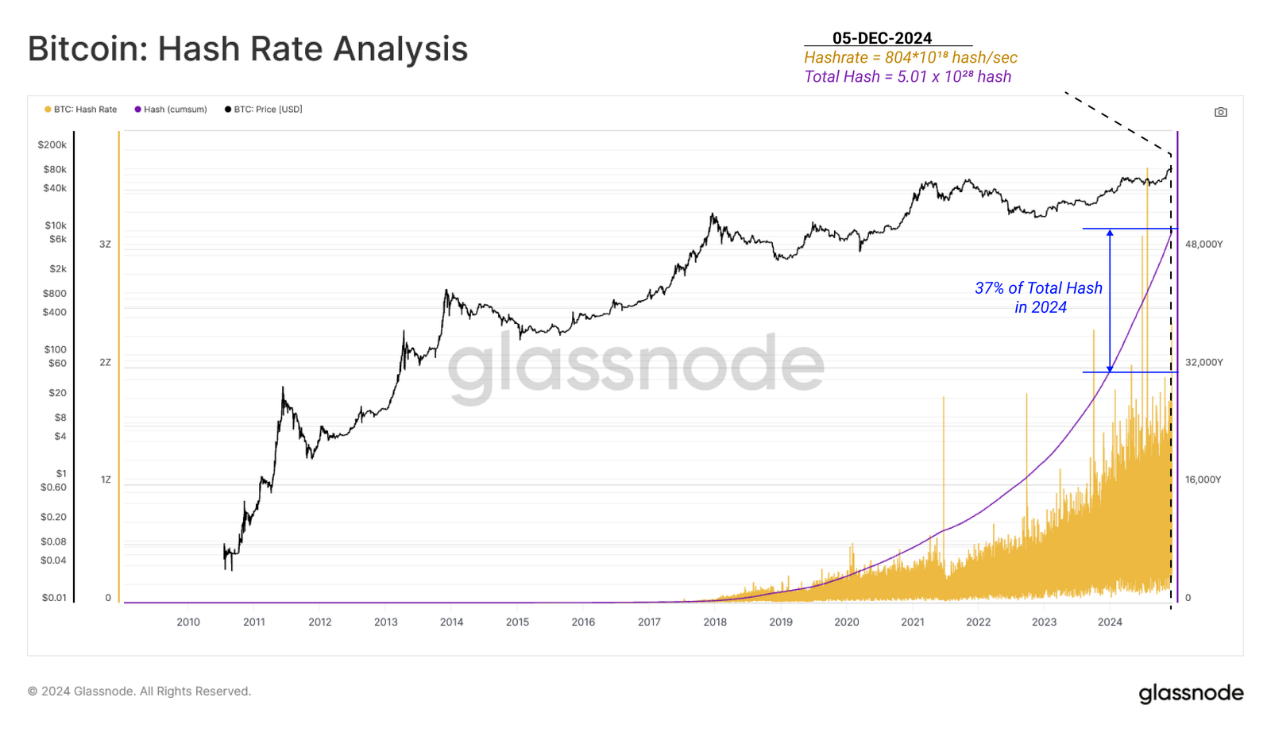

When Bitcoin reached $100,000, the network hash rate soared from 128,185 hashes/second to 804,407,834,059,443,100,000 hashes/second. So far, miners have cumulatively calculated about 5.01 x 10^28 hashes. It is worth noting that the hashes calculated in 2024 account for 37% of the total hashes.

As of December 5, miners have earned a cumulative $71.49 billion, the value of the block reward based on the day the block is mined. This revenue includes $67.31 billion in block subsidies earned through minting new coins and $4.18 billion in transaction fees paid by users. This is only 3.57% of Bitcoin's peak market value of $2 trillion, reflecting a huge return on the security budget invested.

Bitcoin transaction volume has also seen a staggering increase. To date, the Bitcoin network has successfully processed 1.12 billion transactions (unfiltered), filtering out internal transfers, and the total number of actual economic transactions is 840 million.

The Bitcoin network has processed a total of $131.25 trillion in transactions, based on the dollar value of transactions at the time of confirmation. After adjustment, the filtered transfer volume was $11.63 trillion, accounting for only 8.86% of the total.

This reflects that most transactions are economic in nature. However, the vast majority of volume transferred on-chain is likely associated with large exchanges and custodial wallet management.

in conclusion

The rise of Bitcoin to $100,000 not only represents a price milestone, but also demonstrates its extraordinary journey from a small corner of the Internet to an important global financial infrastructure. Since the genesis block, the Bitcoin network has grown by leaps and bounds, reaching a market value of $2 trillion, surpassing silver, and settling $131 trillion in trading volume through 1.12 billion transactions.

The network has cumulatively paid miners $71.49 billion in value, just over 3% of its market valuation, to support its own input costs, reflecting an incredible return on input costs. With its hash rate near all-time highs and a highly dispersed holder base, Bitcoin is playing an increasingly important role on the world stage.

Related reading: Data explains how Bitcoin holders behave after reaching new highs?

You May Also Like

Santander’s Openbank Sparks Crypto Frenzy in Germany

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future