From "water buffalo" to "value bull", why do retail investors have such a hard time?

Author: Luke, Mars Finance

For crypto investors who have experienced the magnificent bull market in 2020-2021, the current market is undoubtedly confusing and tormenting. It was a carnival era ignited by the "flooding" of central banks around the world. Liquidity was flooding, everything was rising, and it seemed that buying any project with your eyes closed could get amazing returns. However, those days are gone forever. Today, the global financial market is hanging on a delicate balance point: on one side is the unexpectedly strong US economic data, and on the other side is the Fed's unwavering hawkish stance. The historically high interest rate environment is like a mountain, pressing on all risky assets.

This paradigm shift led by the macro environment has made this round of crypto cycle the "toughest era" for retail investors. The past "water-release bull" model that relied on liquidity-driven and purely emotional speculation has become ineffective, and has been replaced by a "value bull" market that focuses more on intrinsic value and is driven by clear narratives and fundamentals.

However, the other side of difficulty is opportunity. When the tide recedes, true value investors will usher in their "golden age". Because it is in such an environment that the compliant entry of institutions, the programmatic deflation of technology, and the real application combined with the real economy can highlight their true, cross-cycle value. This article aims to deeply deconstruct this profound change and explain why this era that makes speculators feel difficult is precisely the golden road paved for prepared investors.

1. The most difficult times: when the tide of “flooding” recedes

The difficulty of this cycle is rooted in the fundamental reversal of macro-monetary policy. Compared with the extremely friendly environment of "zero interest rate + unlimited quantitative easing" in the previous bull market, the current market is facing the most severe macro headwinds in decades. In order to curb the most severe inflation in 40 years, the Federal Reserve has started an unprecedented tightening cycle, which has brought double suppression to the crypto market and completely ended the old model of easy profit.

1. Macro data puzzle: Why is there no interest rate cut in sight?

The key to solving the current market dilemma lies in understanding why the Fed is reluctant to give up on the end of interest rate hikes. The answer lies in the recent macroeconomic data - these seemingly "good" data have become "bad news" for investors who expect easing.

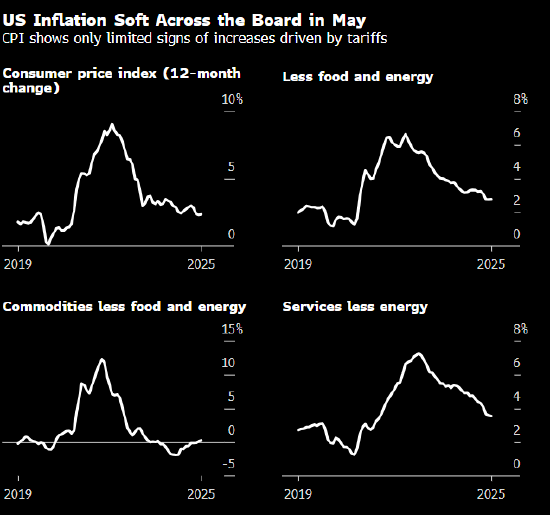

Stubborn inflation and hawkish dot plot: Although inflation has fallen from its peak, its stickiness is far beyond expectations. The latest data shows that although the annual rate of US CPI in May was slightly lower than expected, the core inflation rate still stubbornly remained at a high level of 2.8%.

This is still a significant gap from the Fed's 2% target. This stubbornness is directly reflected in the Fed's latest economic forecast (SEP) and the much-watched "dot plot". After the June interest rate meeting, Fed officials significantly lowered their expectations for rate cuts, reducing the median number of rate cuts this year from three to only one. This hawkish shift has dealt a heavy blow to market optimism. As Powell said in the press conference after the meeting: "We need to see more good data to increase our confidence that inflation is continuing to move toward 2%." In other words, the Fed's threshold for rate cuts has become very high.

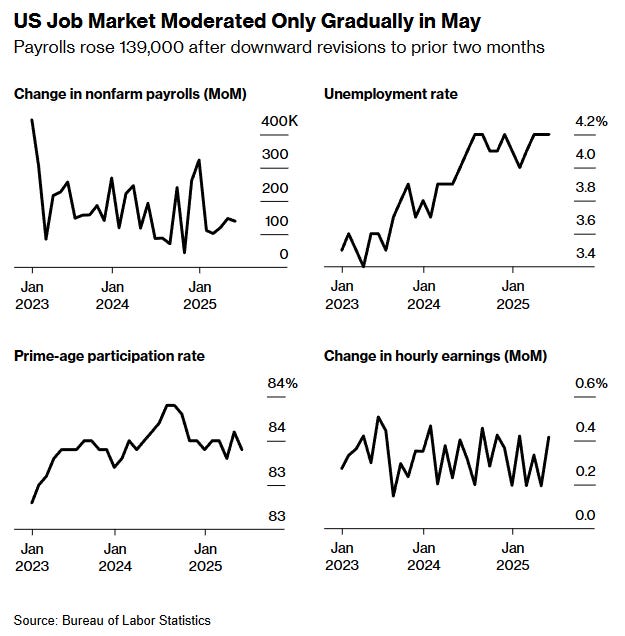

Strong job market: Meanwhile, the U.S. labor market continues to show surprising resilience. The May non-farm payrolls report showed that 139,000 new jobs were added, better than market expectations, while the unemployment rate remained low at 4.2%. A strong job market means that consumer spending is supported, which in turn will put upward pressure on inflation, making the Fed more hesitant to cut interest rates.

Powell's "historical script": As Nicholas Colas, co-founder of DataTrek Research, pointed out, current Chairman Powell is following the script of his predecessors, taking a hawkish tone in the final stage of his term to consolidate his historical legacy of successfully curbing inflation. This consideration of personal and institutional reputation means that unless economic data falls off a cliff, the policy shift will be extremely cautious and slow.

2. The “gravity” of high interest rates: the “bleeding” effect of crypto assets

This macro backdrop directly leads to the difficult situation in the crypto market:

Liquidity exhaustion: High interest rates mean less "hot money" in the market. For the crypto market, especially Altcoins, which is highly dependent on the entry of new funds to drive price increases, the tightening of liquidity is the most fatal blow. The grand occasion of "everything rises together" has been replaced by the structural market of "sector rotation" or even "only a few hot spots" in this cycle.

Opportunity costs have increased dramatically: When investors can easily obtain more than 5% risk-free returns from U.S. Treasury bonds, the opportunity cost of holding assets like Bitcoin that do not generate cash flow and have volatile prices has increased dramatically. This has caused a large amount of funds seeking stable returns to flow out of the crypto market, further exacerbating the market's "bleeding" effect.

For retail investors who are used to chasing hot spots amid the flood of liquidity, this change in environment is cruel. Strategies that lack in-depth research and simply follow the hype are very likely to suffer heavy losses in this cycle, which is the core of the "difficulty" of this cycle.

2. The Golden Age: From Hype to Value, the Emergence of New Opportunities

However, the other side of the crisis is an opportunity. The macro headwind is like a stress test, squeezing out the market's bubbles and screening out the core assets and narratives that truly have long-term value, thus opening up an unprecedented golden age for prepared investors. The resilience of this cycle is driven by several powerful endogenous forces that are independent of macro monetary policy.

1. Golden Bridge: Spot ETFs usher in the first year of institutionalization

In early 2024, the U.S. Securities and Exchange Commission (SEC) historically approved the listing of a spot Bitcoin ETF. This is not just a product launch, but a revolution in the crypto world. It opens a "golden door" for trillions of dollars of funds in the traditional financial sector to invest in Bitcoin in a compliant and convenient manner.

A steady stream of fresh capital: As of the second quarter of 2025, the total assets under management of the two ETFs, BlackRock's IBIT and Fidelity's FBTC, have exceeded tens of billions of dollars, and the continuous daily net inflows have provided strong purchasing power for the market. This "new fresh capital" from Wall Street has largely offset the liquidity crunch caused by high interest rates.

The pillar of confidence: Larry Fink, CEO of BlackRock, called the success of the Bitcoin ETF "a revolution in the capital market" and said it was just "the first step in asset tokenization." This endorsement from the world's largest asset management company has greatly boosted market confidence and provided retail investors with a clear signal to follow the pace of institutions and make long-term value investments.

2. Belief in code: hard-core support under the halving narrative

The fourth Bitcoin "halving" in April 2024 will reduce its daily supply from 900 to 450. This predictable supply deflation written in code is the unique charm of Bitcoin that distinguishes it from all traditional financial assets. Against the backdrop of stable or even growing demand (especially from ETFs), the halving of supply provides a solid, mathematical underlying support for the price of Bitcoin. Historical data shows that within 12-18 months after the first three halvings, the price of Bitcoin hit an all-time high. For value investors, this is not a short-term hype gimmick, but a reliable, long-term logic that transcends cycles.

3. The Narrative Revolution: When Web3 Begins to Solve Real Problems

Macro headwinds force market participants to shift from pure speculation to exploring the intrinsic value of projects. The core hot spots of this cycle are no longer the rootless "Dogecoins", but the innovative narratives that try to solve real-world problems:

- Artificial Intelligence (AI) + Crypto: Combining the computing power of AI with the incentive mechanism and data ownership of blockchain to create new decentralized intelligent applications.

- Tokenization of real-world assets (RWA): Put real-world assets such as real estate, bonds, and artworks on the chain to release their liquidity and break down the barriers between traditional finance and digital finance.

- Decentralized Physical Infrastructure Network (DePIN): Using token incentives, global users can jointly build and operate infrastructure networks in the physical world, such as 5G base stations, sensor networks, etc.

The rise of these narratives marks a fundamental shift in the crypto industry from "speculating on air" to "investing in value." In its annual report, crypto venture capital giant a16z Crypto highlighted the potential of "AI+Crypto" as the core engine of the next round of innovation. For retail investors, this means that the opportunities to discover value through in-depth research have greatly increased, and knowledge and cognition have become more important than pure courage and luck in this market for the first time.

3. Survival rules in the new cycle: Patiently plan between the finale and the prelude

We are at the intersection of an era. The Fed's "hawkish finale" is unfolding, and the prelude to easing has not yet sounded. For retail investors, understanding and adapting to the new rules of the game is the key to crossing the cycle and seizing golden opportunities.

1. A fundamental shift in investment paradigm

- From chasing hot spots to value investing: give up the fantasy of finding the "next 100x coin" and turn to research on the fundamentals of the project, understand its technology, team, economic model and the track pattern it is in.

- From short-term speculation to long-term holding: In the "value bull" market, the real returns belong to those investors who can identify core assets and hold them for a long time and through fluctuations, rather than short-term traders who trade frequently.

- Build a differentiated investment portfolio: In the new cycle, the roles of different assets will become clearer. ** Bitcoin (BTC) ** As the "digital gold" recognized by institutions, it is the "ballast stone" of the investment portfolio; Ethereum (ETH) is a core asset with both value storage and means of production attributes due to its strong ecology and ETF expectations; and high-growth altcoins should be "rocket boosters" based on in-depth research and small position layout, focusing on cutting-edge tracks with real potential such as AI and DePIN.

2. Be patient and plan ahead

DataTrek's research reveals an interesting phenomenon: in the last 12 months of the past three Fed chairmen, the S&P 500 rose an average of 16% even when interest rates remained high. This suggests that once the market is convinced that the tightening cycle is over, risk appetite may pick up in advance even if interest rate cuts have not yet occurred.

This kind of "preemptive" market may also appear in the crypto market. While the market's attention is generally focused on the short-term game of "when to cut interest rates", the real wise men have begun to think about which assets and tracks will occupy the most advantageous position in this future feast driven by the resonance of macro tailwinds and industrial cycles when the prelude to easing finally sounds.

Conclusion

This round of crypto cycle is undoubtedly an extreme test of retail investors’ cognition and mentality. The era of “water buffalo” that can easily make profits by courage and luck has ended, and the era of “value bull” that requires in-depth research, independent thinking and long-term patience has arrived. This is exactly its “difficulty”.

However, it was also during this era that institutional funds poured in at an unprecedented scale, providing a solid bottom for the market; the value logic of core assets became clearer; and applications that could truly create value began to take root. For retail investors who are willing to learn, embrace change, and view investment as a journey of cognitive realization, this is undoubtedly a "golden age" where they can compete with the top minds and share the long-term growth dividends of the industry. History will not simply repeat itself, but it is always surprisingly similar. Between the finale and the prelude, patience and foresight will be the only path to success.

You May Also Like

Where Is Marcela Borges Now? The Horrific True Story Behind ‘Terror Comes Knocking’

Bitcoin Investment: ZOOZ Power Unveils Bold $180M Strategy