JPMorgan: Stablecoins to boost US dollar demand by $1.4T

Analysts at JPMorgan say that stablecoins have the potential to generate at least $1.4 trillion in demand for U.S. dollars by 2027, considering most of the market is backed by the currency.

- JPMorgan has predicted that the U.S dollar will receive a $1.4 trillion boost in demand following the rising wave of stablecoin adoption.

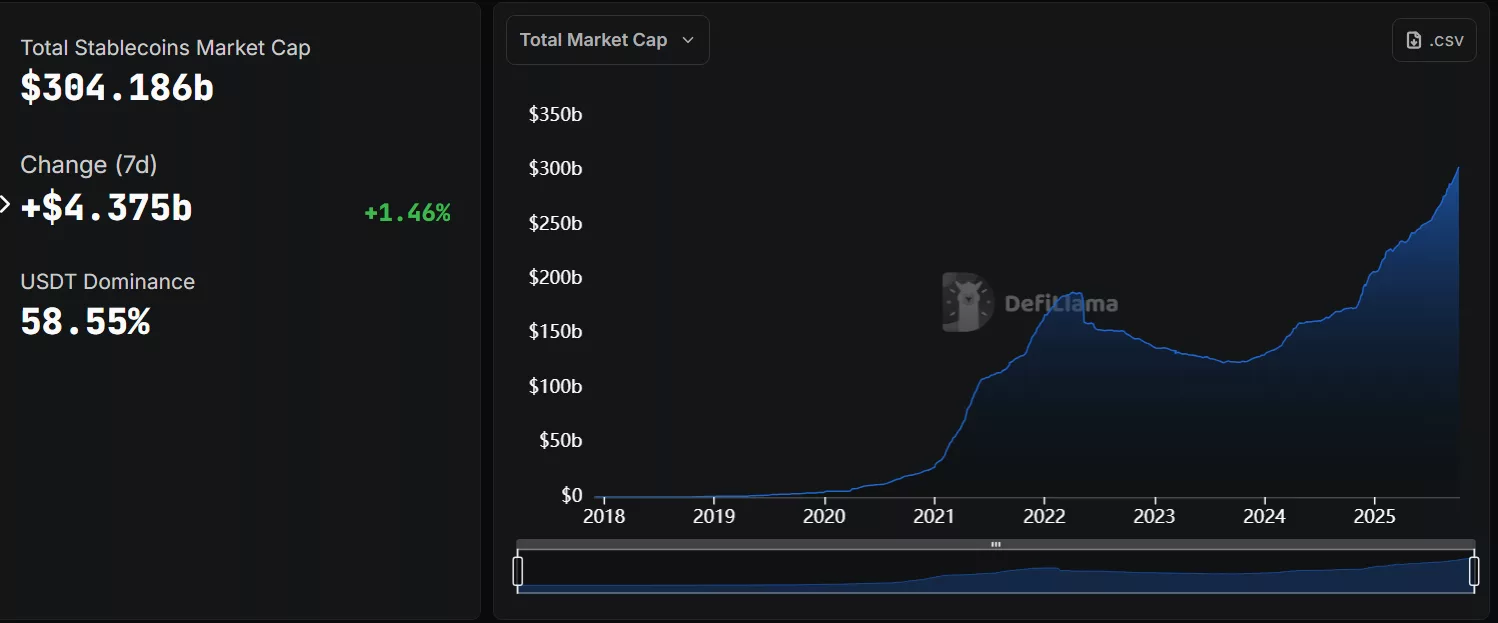

- At press time, the stablecoin market is dominated by USD-pegged tokens, contributing to more than 90% of the total market cap. Tether’s USDT alone dominates the market by nearly 60%.

According to a note from the bank, the rapid growth of the stablecoin market could potentially lift the U.S. dollar along with it. Instead of dethroning the fiat-currency and taking over as the dominant payment instrument, analysts from JPMorgan predict the adoption of dollar-pegged tokens could generate about $1.4 trillion in demand for U.S dollars by 2027.

This massive increase can be attributed to overseas investors adopting the token for transactions and investments, which would require them to convert local currencies into tokens that are backed by the U.S-dollar or equivalents of it. Some are backed by U.S. treasuries, bonds and other dollar-based assets.

“Whether such a high-end scenario growth trajectory will actually play out remains to be seen, but if it does, stablecoin-related dollar inflows could become cumulatively significant,” said JPMorgan in its official statement.

Although there has been an increase in the number tokens backed by other fiat-currencies, such as the ruble-backed A7A5 and Circle’s euro-pegged EURC (EURC), none have managed to surpass the domination of USD-backed tokens.

According to data from CoinGecko, USD tokens make up more than $300 billion of the $304 billion-valued market cap. This means that more than 90% of these assets are backed by the U.S dollar in some shape or form. In fact, Tether’s own dollar-backed USDT (USDT) alone currently contributes to nearly 60% of the total market cap.

“Given that [about] 99% of the total stablecoin supply is pegged 1:1 to the dollar, stablecoin market growth necessarily implies some demand for the dollar,” said the bank.

What is fueling the stablecoin market?

According to JPMorgan, the stablecoin market could grow to reach $2 trillion in the next few years. This marks a $1.7 trillion jump from its current value at $304 billion. While such a massive leap may seem difficult to imagine, the past year has shown promising growth in financial adoption worldwide.

Just a week prior, the market surpassed $300 billion for the first time in history. In just five years, the industry has grown from a meager $4 billion to more than $300 billion in market cap. In 2025 alone, the market has received a $100 billion boost from investors eager to take part in the fairly new financial technology.

The emergence of global regulations that facilitate stablecoin usage has also played a major role in accelerating mainstream adoption. The United States government passing the GENIUS Act became a stepping stone that accelerated the growth of dollar-backed tokens.

Outside of the U.S, Hong Kong’s Stablecoin Ordinance became the catalyst that set off a frenzy of firms eager to acquire a license in order to issue their own tokens pegged to local currencies. In the EU, banks have grown increasingly eager to launch their own euro-backed tokens, with the goal of challenging the U.S dollar’s dominance over the market.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

US Senate Releases Draft Crypto Bill Establishing Clear Regulatory Framework for Digital Assets