In this article:

1. Guide to completing the activities

2. Conclusion

Kuru is a high-performance decentralized exchange on Monad that provides users with a platform for spot asset trading.

The project raised $11.6 million in funding from Paradigm, Electric Capital, and other funds, making it a Tier-1 project in the Monad ecosystem.

In this guide, we’ll look at what activities you should do in the testnet with an eye on drops.

- Request test MON tokens on the faucet page:

Faucet page. Details: Monad.

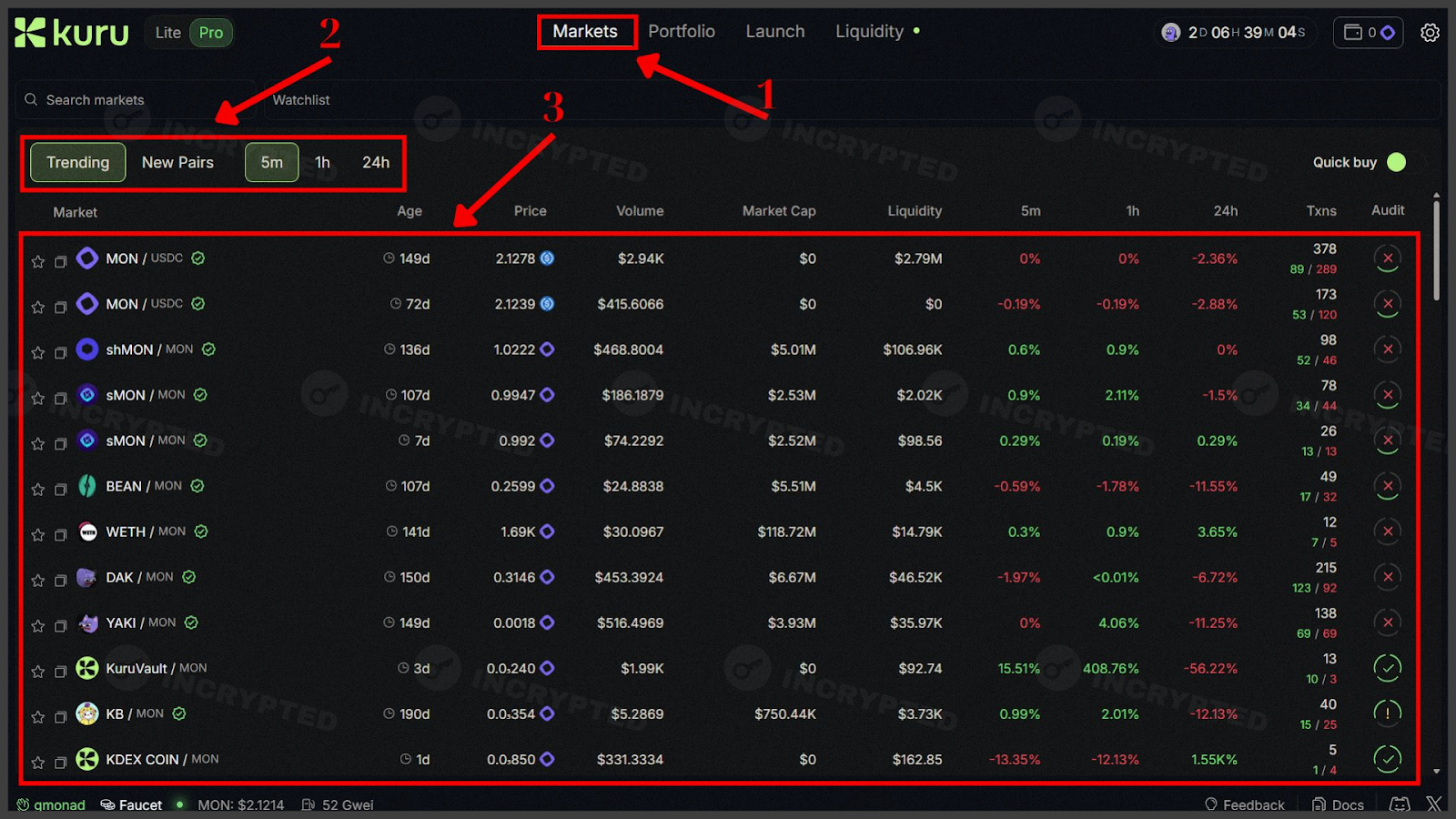

- Go to the website and trade test tokens in the Markets section:

Markets section. Details: Kuru.

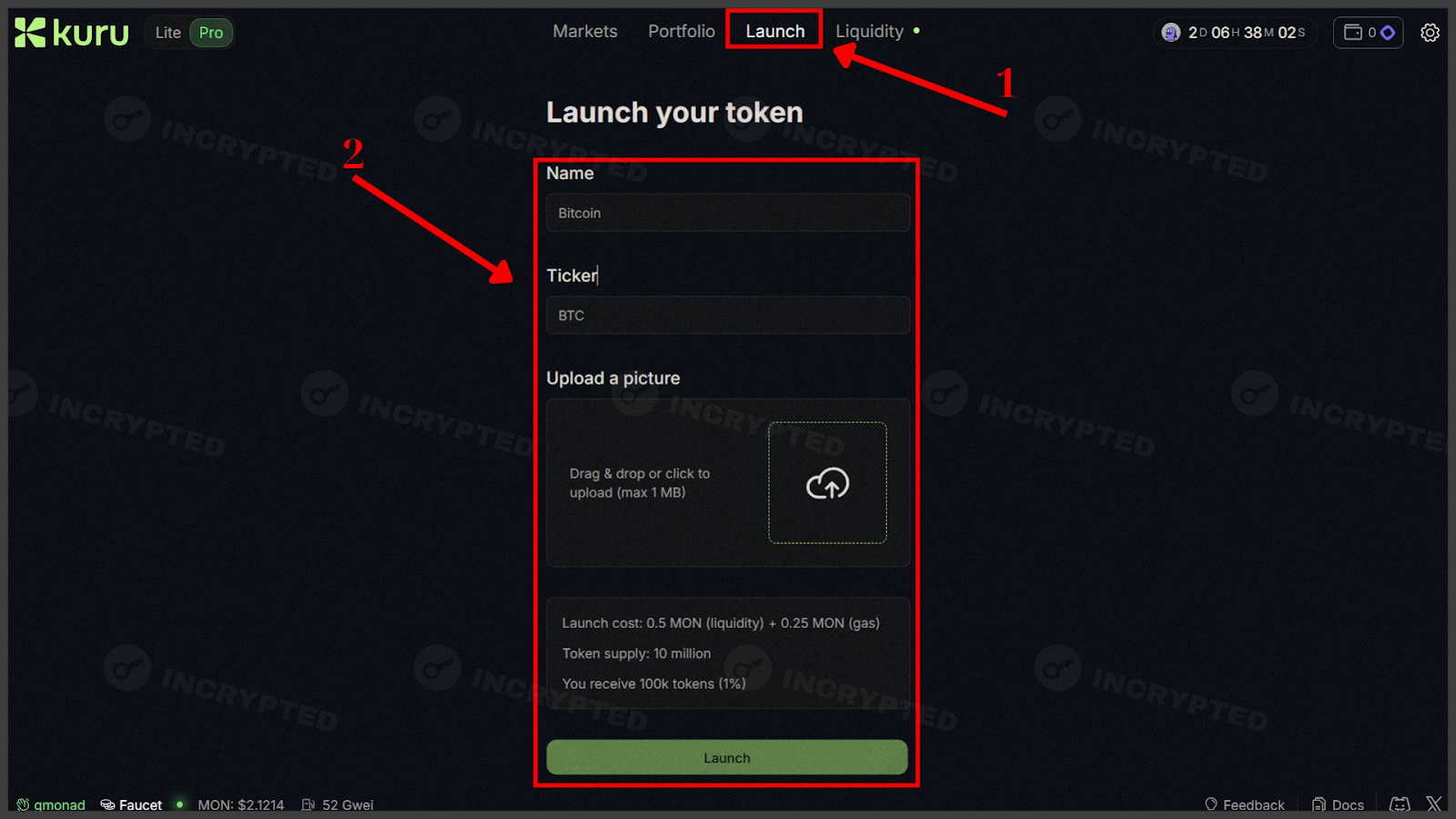

- In the Launch section, create your own token:

Launch section. Details: Kuru.

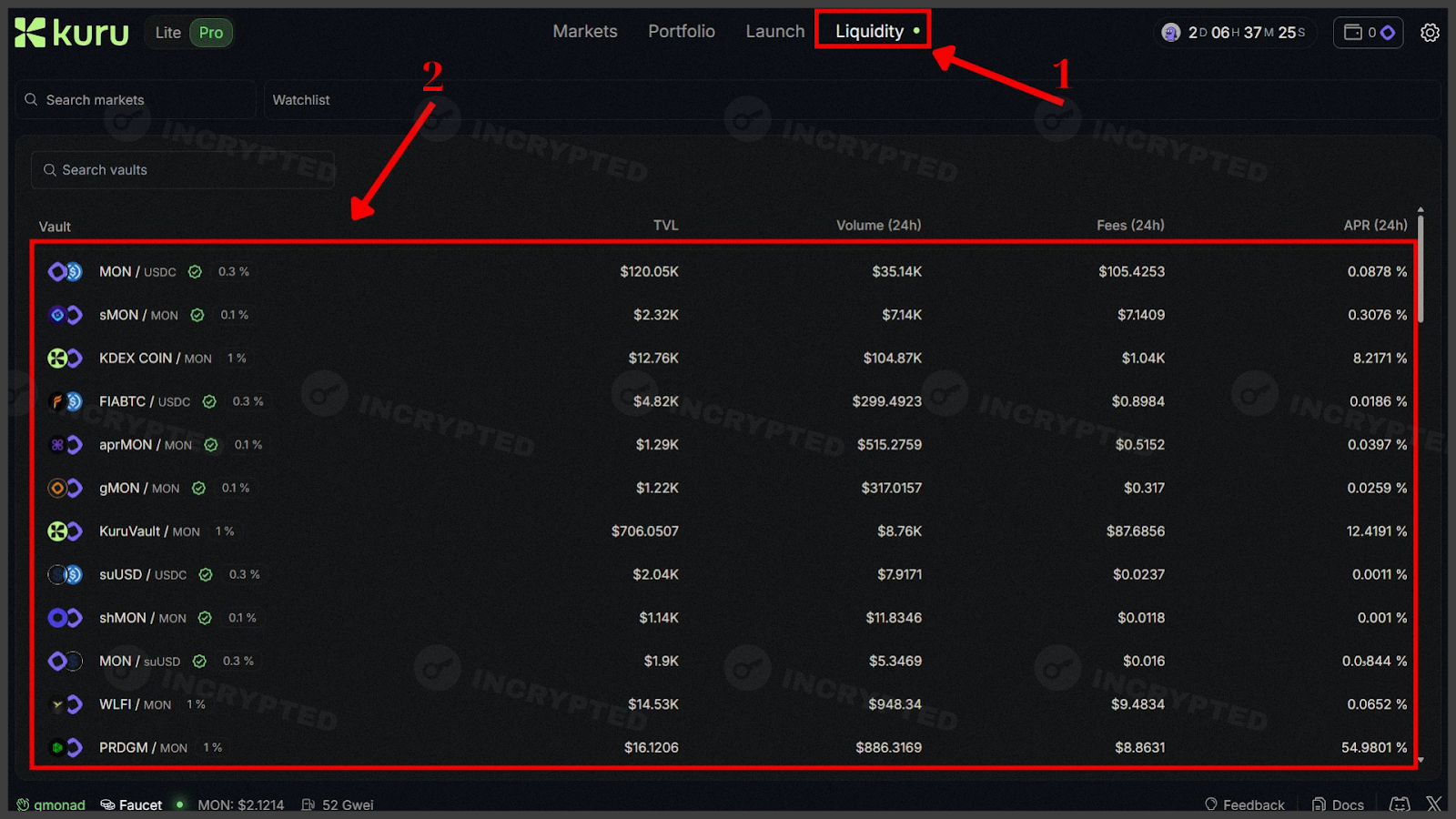

- Add liquidity in the Liquidity tab:

Liquidity section. Details: Kuru.

- Open boxes on the page to get a character. Also, join the Discord and claim roles.

The project is a Tier-1 in the Monad ecosystem and has raised solid investments. By participating in the testnet, we can potentially qualify for two airdrops at once. Also, don’t forget to stay active in the Monad testnet itself.

Follow the project’s social media to stay updated on important announcements.

Highlights:

- engage in the testnet;

- no costs required.

If you have any questions when completing activities, you can ask them in our Telegram chat.

Useful links: Website | X | Discord

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact

[email protected] for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.