Linea TGE Countdown: A Panoramic Analysis of Technology, Ecosystem, and Token Economics

Linea positions itself as "an Ethereum Layer 2 network built to enhance Ethereum." Its mission is deceptively simple, yet incredibly powerful. With Ethereum's price rebounding significantly over the past two months and nearing new highs, Linea has quickly become one of the most anticipated projects in the crypto space, especially with its upcoming Token Generation Event (TGE).

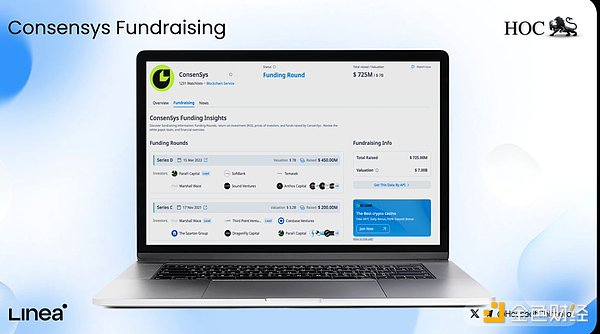

At its core, Linea is more than just another Layer 2 network—it's a zkEVM project designed to push Ethereum further while fully integrating with the Ethereum ecosystem. Founded by ConsenSys, the company behind key Ethereum infrastructure like MetaMask and Infura, Linea has deep institutional backing and years of experience powering core tools used by over 30 million users worldwide. Led by Ethereum co-founder Joseph Lubin, ConsenSys has raised $725 million from investors including Microsoft, SoftBank, and Coinbase Ventures, providing solid support for Linea's long-term growth.

Linea's Technology and Ethereum's Challenges

Ethereum's core challenge has always been scalability. Competing chains like Solana excel at speed and throughput, forcing Ethereum to rely on Rollups for expansion. Rollups bundle large numbers of Layer-2 transactions and submit them to Ethereum for settlement. Rollups use two methods: optimistic fraud proofs (requiring up to seven days for final confirmation) and validity proofs (also known as ZK proofs), which are faster and more secure.

Linea uses the Type 2 zkEVM, which means it's fully equivalent to the EVM, but not to Ethereum. In practice, this allows developers to directly deploy Ethereum dApps on Linea without rewriting their code, while benefiting from faster proof generation and lower costs. Linea aims to gradually transition to the Type 1 zkEVM by 2026, achieving full compatibility with Ethereum.

Reduce costs and improve user experience

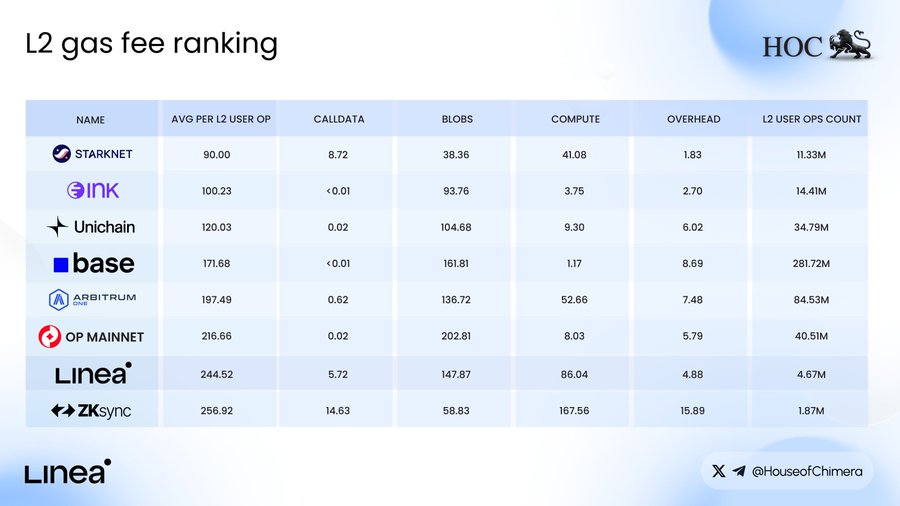

Linea has demonstrated its ability to improve user experience, most notably by significantly reducing gas fees. In its Alpha V2 upgrade, it introduced a mechanism for aggregating multiple batches into a single proof, reducing fixed costs and bringing average gas fees down by 66%. This makes Linea one of the lowest-cost L2 blockchains, giving it an advantage in attracting and retaining users.

Core features driving adoption

Linea's design is built around three pillars:

- Ethereum alignment - using ETH to pay for gas fees to keep consistent with Ethereum's native design;

- Native revenue — introducing token economic incentives at the network level;

- Multi-Rollup network architecture - building an ecosystem by linking different Rollups.

At the same time, Linea uses a double-burn mechanism: ETH fees used in transactions will burn both ETH and LINEA tokens. This mechanism makes Linea's success closely tied to the health of Ethereum.

Native income mechanism and ecological flywheel

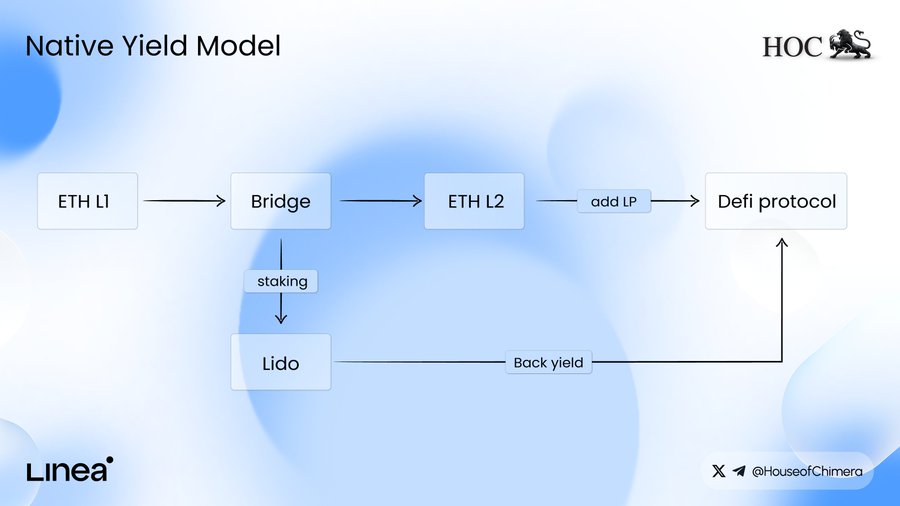

Another key differentiator for Linea is its native yield mechanism. Through integration with Lido, ETH bridged to Linea can be automatically staked, with the generated yield flowing back into the ecosystem to support liquidity and incentivize growth. This design creates a liquidity flywheel effect that is expected to support Linea's long-term development, avoiding the boom-and-bust cycles seen in other projects driven by short-term incentives.

Linea not only positions itself as a Layer 2 network but also provides a comprehensive suite of tools through the Linea Stack to help other projects build their own Rollups. This strategy, similar to Optimism's Superchain approach, aims to create broader network effects, ensure interoperability, and enhance the cohesion of the entire ecosystem.

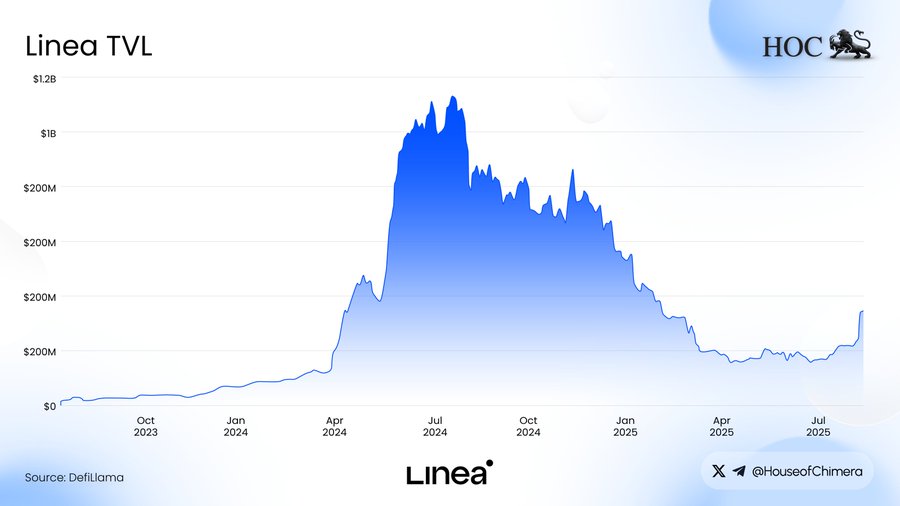

Ecological Potential and Token Economics

Linea's ecosystem is rapidly gaining momentum. It has already established partnerships with over 400 partners across DeFi, NFT, infrastructure, and AI, including major protocols such as Aave, PancakeSwap, SushiSwap, and Stargate. During the 2024 Surge event, its TVL reached $1.2 billion. Despite a decline after the end of the incentive program, funds are flowing back as the TGE approaches. Ethereum, a decentralized exchange that launched just a few weeks ago, has surpassed $120 million in TVL, demonstrating a rebound in ecosystem capital.

Unlike many projects, Linea deliberately avoids distributing tokens to venture capital firms. Instead, 85% of tokens are allocated to the ecosystem, with only 15% reserved for ConsenSys, subject to a five-year lockup period. Regarding governance, Linea deliberately excludes token governance. Instead, token emission, grants, and incentives are managed by the Linea Consortium, a group of trusted Ethereum organizations. This design mitigates regulatory risk while ensuring strong alignment between Linea and Ethereum's long-term vision.

Outlook for the Future

According to its roadmap, Linea will launch a series of key upgrades in the third and fourth quarters of 2025, including a new burn mechanism, an increased gas limit, and the full implementation of its native revenue mechanism. By 2026, Linea plans to implement Type 1 zkEVM and increase network throughput to 5,000 transactions per second (TPS), while also advancing its more ambitious real-time proof-of-stake (RPS) for Ethereum.

Summarize

Linea is a bold experiment: its lack of VC backing, native ETH returns, and Ethereum-first design make it more than just a scaling solution. While questions remain about its token model and long-term value capture, as the TGE approaches, one thing is certain: Linea's goal isn't just to scale Ethereum, but to strengthen it.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon