Michael Saylor Claims Short Sellers Using Bot Army to Attack Strategy Stock

TLDR

- Michael Saylor claims short sellers are using paid bot networks to spread criticism about MicroStrategy online

- MicroStrategy stock hit a five-month low of $323 despite Bitcoin only dropping 8% from recent highs

- Short seller Jim Chanos dismissed Saylor’s bot claims and called them serious allegations without evidence

- MicroStrategy added 7,714 BTC in August, bringing total holdings to 636,505 Bitcoin worth about $46.95 billion

- Chanos compares MicroStrategy’s Bitcoin treasury model to the speculative 2021 SPAC boom

MicroStrategy Executive Chairman Michael Saylor has accused short sellers of orchestrating bot attacks against his company’s stock. He claims coordinated networks of fake accounts are spreading negative sentiment about the Bitcoin treasury company.

Speaking on a podcast with Natalie Brunell, Saylor alleged that artificial criticism is targeting MicroStrategy online. He said a short seller paid a digital marketing firm to create bot accounts that post negative content about the company.

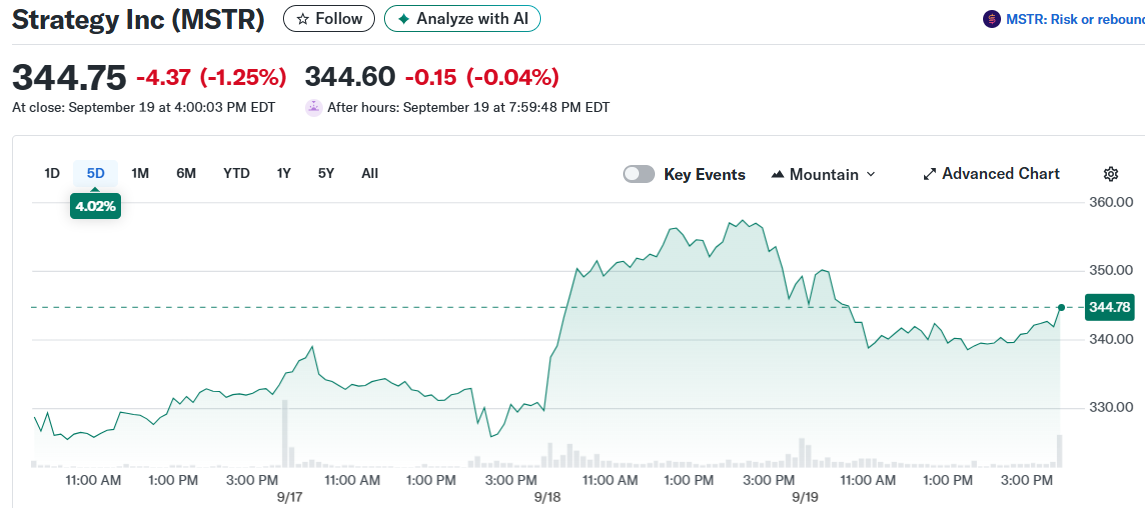

The allegations come as MicroStrategy stock trades near five-month lows. The shares fell to $323 last week despite Bitcoin only declining 8% from its recent peak.

Strategy Inc (MSTR)

Strategy Inc (MSTR)

MicroStrategy has become the largest corporate Bitcoin holder under Saylor’s leadership. The company now owns 636,505 Bitcoin purchased for approximately $46.95 billion at an average price of $73,765 per coin.

Short Seller Pushes Back on Bot Claims

Veteran short seller Jim Chanos rejected Saylor’s accusations and demanded evidence. Chanos called the bot allegations “pretty serious” statements presented as facts without proof.

Chanos previously exposed the Enron accounting scandal in 2001. He has compared MicroStrategy’s business model to the speculative excesses of the 2021 SPAC market boom.

The short seller has repeatedly criticized MicroStrategy’s strategy of issuing Bitcoin-backed securities to buy more cryptocurrency. He calls this approach “complete financial gibberish” and warns investors about the company’s valuation methods.

Company Continues Bitcoin Buying Strategy

MicroStrategy added 7,714 Bitcoin during August through multiple smaller purchases. This was down from 31,466 Bitcoin acquired in July as the company maintained its accumulation strategy.

The latest purchase involved 4,048 Bitcoin for $449.3 million between August 25 and this week. The company paid an average price of $110,981 per coin for these holdings.

Bitcoin briefly reached $113,000 before sliding below $108,000 during the recent buying period. MicroStrategy’s total Bitcoin position is now valued at around $69 billion at current prices.

Saylor’s personal wealth has reached $7.37 billion according to Bloomberg’s Billionaire Index. Most of his fortune comes from his MicroStrategy equity stake worth approximately $6.72 billion.

The company trades at a premium to its Bitcoin holdings as investors bet on future cryptocurrency appreciation.

The post Michael Saylor Claims Short Sellers Using Bot Army to Attack Strategy Stock appeared first on CoinCentral.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon