Options Data API and Option Chain API: How to Use EODHD for Smarter Trading

If you’re a trader, analyst, or developer, you’ve probably felt the pain: you have a brilliant idea for an options strategy, but you can’t find reliable, structured data to backtest it. Free websites are incomplete, premium providers are too expensive, and manual downloads are just not scalable.

That’s where an Options Data API comes in. And if you want to go deeper, an Option Chain API gives you the full picture of all available contracts for a ticker. In this article, we’ll break down what they are, why they matter, and how you can use the EODHD API to power your strategies.

What is an Options Data API?

An Options Data API is a web service that allows you to pull structured data about options contracts — calls, puts, strikes, expiration dates, open interest, Greeks (Delta, Gamma, Vega, Theta), and implied volatility.

An Option Chain API goes one step further: instead of a single contract, it returns the entire chain of options for a given underlying asset. Think of it as the complete menu of contracts traders are dealing with for Apple, Tesla, or any ticker you’re analyzing.

Why Does It Matter?

- Speed & automation: Query option chains in seconds and feed them into your models.

- Historical data: Test strategies like covered calls, iron condors, or volatility spreads.

- Advanced metrics: Work with Greeks and implied volatility, not just closing prices.

- Scalability: From a personal project to a professional quant model, APIs scale with you.

👉 Want to test this right away? Check out the EODHD Options API. It offers more than 40 fields per contract (from bid/ask to open interest and Greeks), with powerful filters and sorting.

5+ Practical Examples with EODHD’s Options Data API

Here’s where the power of EODHD shines. Let’s walk through different use cases with real API examples.

1. Get all call options for AAPL with strike above 300

https://eodhd.com/api/mp/unicornbay/options/eod?

filter[underlying_symbol]=AAPL&

filter[type]=call&

filter[strike_from]=300&

sort=exp_date&

api_token=demo

✅ Returns all call options for Apple with strike ≥ 300, sorted by expiration date.

Fields include: strike, exp_date, bid, ask, open_interest, volatility, delta.

2. Fetch AAPL options expiring in a specific date range

https://eodhd.com/api/mp/unicornbay/options/eod?

filter[underlying_symbol]=AAPL&

filter[exp_date_from]=2024-01-21&

filter[exp_date_to]=2024-01-28&

sort=-exp_date&

api_token=demo

✅ Useful if you’re analyzing contracts within one earnings cycle or planning an earnings strategy.

3. Filter contracts by trading activity window

https://eodhd.com/api/mp/unicornbay/options/eod?

filter[underlying_symbol]=AAPL&

filter[tradetime_from]=2025-02-01&

filter[tradetime_to]=2025-04-03&

sort=strike&

api_token=demo

✅ Returns only options active within a date range. Perfect for volume and liquidity analysis.

4. Retrieve the full Option Chain (calls + puts)

https://eodhd.com/api/mp/unicornbay/options/contracts?

filter[underlying_symbol]=AAPL&

filter[strike_from]=150&

filter[strike_to]=200&

sort=strike&

api_token=demo

✅ Returns all calls and puts between strike 150 and 200. Ideal for strategies like iron condors or butterflies.

5. Focus on near-the-money options

https://eodhd.com/api/mp/unicornbay/options/eod?

filter[underlying_symbol]=TSLA&

filter[strike_from]=240&

filter[strike_to]=260&

filter[type]=put&

sort=exp_date&

api_token=demo

✅ Example for Tesla: pulls only puts near the current price (useful for hedging).

6. Combine filters: calls expiring in Q1 2025, strike > 200

https://eodhd.com/api/mp/unicornbay/options/eod?

filter[underlying_symbol]=MSFT&

filter[type]=call&

filter[strike_from]=200&

filter[exp_date_from]=2025-01-01&

filter[exp_date_to]=2025-03-31&

sort=exp_date&

api_token=demo

✅ Perfect for seasonal strategies or quarterly backtests.

Example in Python

import requests

API_TOKEN = "your_api_key_here"

BASE = "https://eodhd.com/api/mp/unicornbay"

def get_options(symbol, params):

params["filter[underlying_symbol]"] = symbol

params["api_token"] = API_TOKEN

url = f"{BASE}/options/eod"

resp = requests.get(url, params=params)

return resp.json().get("data", [])

# Example: AAPL calls expiring in 2025 Q1

options = get_options("AAPL", {

"filter[type]": "call",

"filter[strike_from]": 200,

"filter[exp_date_from]": "2025-01-01",

"filter[exp_date_to]": "2025-03-31",

"sort": "exp_date"

})

for o in options[:5]:

print(o["contract"], o["strike"], o["exp_date"], o["delta"])

👉 You can replicate any of the above endpoints in Python with minor tweaks.

Competitors vs. EODHD

Real Use Cases

- Covered call backtest: filter by strike > market price, short calls, and analyze premiums.

- Iron condor: fetch option chains for multiple strikes in the same expiration.

- Volatility trading: pull implied volatility vs. realized volatility.

- Risk management: near-the-money puts for portfolio hedging.

- Liquidity scan: filter by high open interest and volume.

👉 With EODHD’s flexibility, you can go from basic analysis to quant-level modeling in a few lines of code. Start with the EODHD Options API and explore what’s possible.

Conclusion

An Options Data API is not just a convenience — it’s the foundation of serious options analysis. An Option Chain API takes it further, giving you the full market picture. With EODHD, you get affordable access, robust coverage, and developer-friendly filters.

Sharpen your trading axe with reliable data. Start using EODHD’s Options API today and take your strategies from guesswork to data-driven execution.

Options Data API and Option Chain API: How to Use EODHD for Smarter Trading was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

You May Also Like

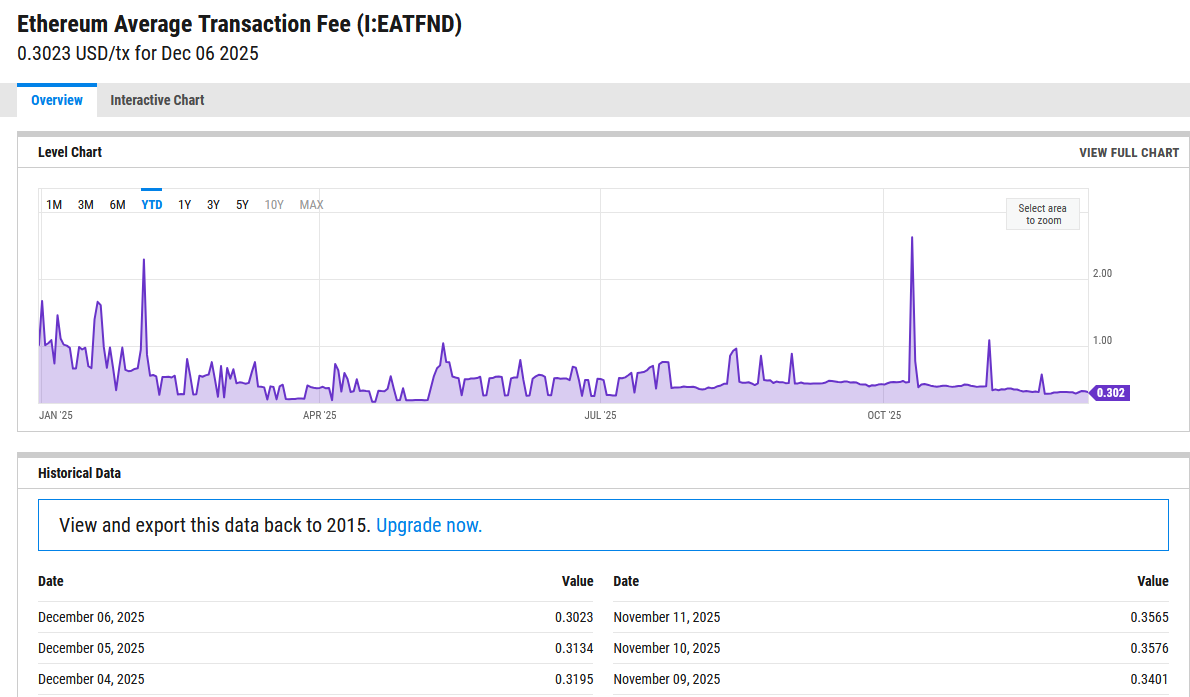

Vitalik Buterin Proposes Onchain Gas Futures to Stabilize Ethereum Fees

Trading Moment: Markets Enter a Key Week Ending the Year, Bitcoin Holds Key Level at $86,000