SEC Approves New Generic Listing Rules For Crypto ETPs That Will Streamline Entire Process

The US Securities and Exchange Commission (SEC) has approved new listing standards for exchange-traded products (ETPs) holding spot commodities, including cryptos, which will streamline the process and remove the need for the agency to review applications on a one-by-on-basis.

The decision will enable exchanges such as Nasdaq, NYSE Arca, and Cboe BZX, to proceed with listings of proposed ETFs (exchange-traded funds) by sidestepping the 19(b) rule filing process, which is often lengthy, can take up to 240 days, and requires the SEC to approve or disapprove applications.

The decision will essentially make the process more streamlined, because ETF issuers can now approach exchanges with a product idea that they would like to list. If the issuers meet the generic listing standards, then the exchange can go ahead with listing the ETF.

SEC Chair Says New Listing Standards Will Ensure US Capital Markets Dominance

SEC Chair Paul Atkins said the decision was made to ensure that the US remains a dominant player in the global capital markets, while also reducing the barrier to accessing crypto products in regulated US marketplaces.

“By approving these generic listing standards, we are ensuring that our capital markets remain the best place in the world to engage in the cutting-edge innovation of digital assets,” he said in a statement.

“This approval helps to maximize investor choice and foster innovation by streamlining the listing process and reducing barriers to access digital asset products within America’s trusted capital markets,” Atkins added.

This move by the SEC is the latest in the agency’s shift in stance since Atkins took over from former Chair Gary Gensler and since pro-crypto Donald Trump entered the White House for a second term at the start of the year.

The Trump Administration has opted to embrace digital assets. In addition to signing an executive order to establish a US Strategic Bitcoin Reserve, Trump also signed the GENIUS Act into law.

The President has formed a digital asset working group as well, which made several recommendations to agencies such as the SEC and the Commodity Futures Trading Commission (CFTC) on crypto policy and regulatory frameworks that will help make the US a leader in the crypto space.

Both the SEC and CFTC have since acted on the recommendations from that report. The CFTC recently unveiled its “Crypto Sprint” initiative, while the SEC launched its “Project Crypto” initiative.

Multiple Crypto ETF Filings Waiting For SEC Approval, Analyst Predicts “North Of 100” Will Launch In Coming Months

The decision by the SEC to streamline crypto ETF listings comes as over 90 applications for funds that track cryptos like Dogecoin (DOGE), Solana (SOL), Litecoin (LTC), and others wait for the SEC’s approval.

On Aug. 28, Bloomberg Intelligence ETF analyst James Seyffart said that there were around 92 pending applications sitting on the SEC’s desk.

With the new generic listing rules, he believes that a “wave of spot crypto ETP launches” will happen in the next few weeks and months.

A similar prediction was made by his colleague Eric Balchunas.

“Good chance we see north of 100 crypto ETFs launched in the next 12mo,” Blachunas said on X.

In his prediction, Balchunas also shared an earlier post by Bitwise’s Matt Hougan, wherein he speculated what impact the generic listings will have on the crypto ETP space.

Hougan referred to the “ETF Rule” that was passed by the SEC in late 2019, which created generic listing standards for traditional ETFs. This, he noted, saw the number of these applications rise from approximately 117 per year to around 370 per year.

“Expect the same kind of expansion if Generic Listing Standards come to crypto this fall,” Hougan wrote.

First US DOGE And XRP ETFs Expected To Launch Today

With the number of crypto ETF applications expected to surge, REX Shares and Osprey Funds are preparing to launch their Dogecoin and XRP ETFs in the US market today. These would be the first ETFs to track DOGE and XRP.

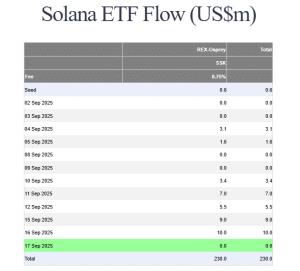

The two companies were able to fast-track listings by filing for the funds under the Investment Company Act of 1940, which comes with a much quicker process than the Securities Act of 1933 that is commonly used by crypto ETF issuers. The same process was used for the REX-Osprey Solana Staking ETF (SSK), however, there has not been demand for the product, according to data from Farside Investors.

SSK flows (Source: Farside Investors)

You May Also Like

Yarm Explained: Turning Trust and Tweets into Yield

Crossmint Partners with MoneyGram for USDC Remittances in Colombia