Stablecoin market changes: USDC market share doubles, newcomer USDe emerges

Original: Artemis, Dune

Compiled by: Yuliya, PANews

Stablecoins are reshaping the global financial system at an unprecedented pace. According to the "2025 State of Stablecoins" report jointly released by Dune and Artemis, the stablecoin market has seen significant growth in the past year, with accelerated institutional adoption, the rise of decentralized stablecoins, and continued growth in on-chain transaction activity.

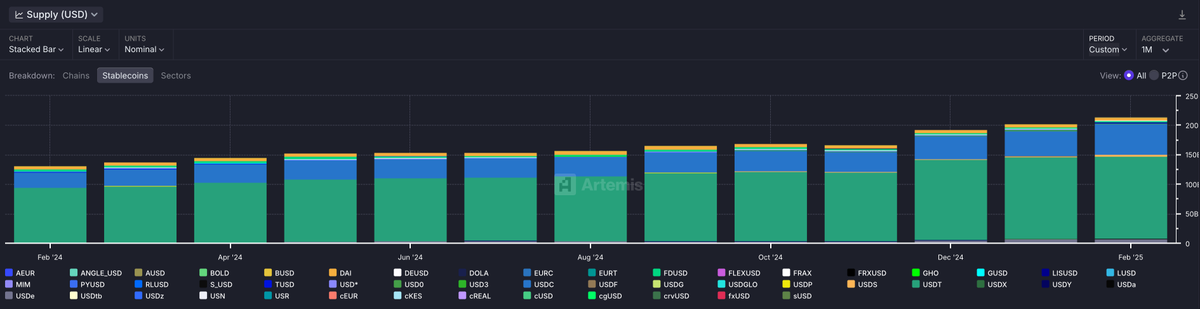

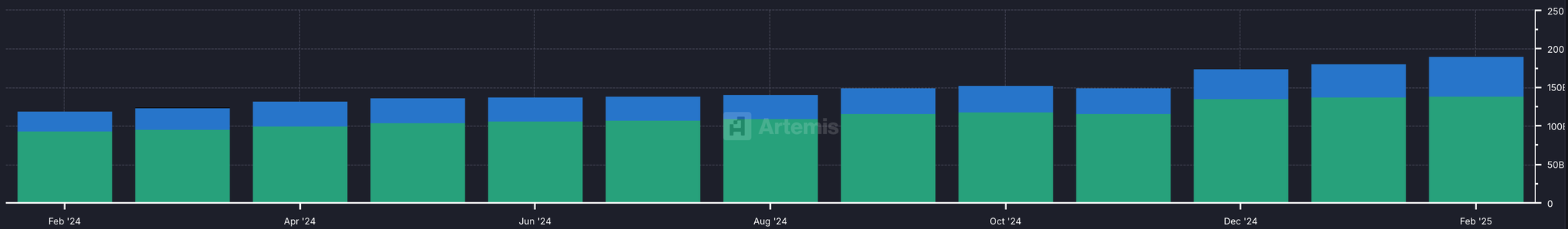

Market size and growth trends

As of February 2025, the supply of stablecoins has reached $214 billion, with an annual transaction volume of $35 trillion, twice the size of Visa's annual transaction volume. Market activity has also increased, with the number of active addresses on the chain increasing by 53% to over 30 million. Institutional funds are flowing in on a large scale, driving the deep integration of traditional finance (TradFi) and the crypto market.

Changes in USDC and USDT dominance

Driven by the compliance process and market strategies, USDC and USDT still dominate, but there are subtle changes in market share.

- USDC's market value doubled to US$56 billion, mainly due to MiCA and DIFC regulatory approvals, the addition of important strategic partners such as Stripe and MoneyGram, and rapid expansion in the global market.

- USDT's total market value has grown to $146 billion, and it is still the largest stablecoin by market value, but its market share has declined, institutional adoption has declined, and its focus has gradually shifted to the P2P remittance market, consolidating its position in the global payment field.

The rise of decentralized stablecoins

In the decentralized finance (DeFi) ecosystem, the influence of decentralized stablecoins has increased significantly, and many emerging projects have achieved breakthrough growth.

- USDe (Ethena Labs) : The market value has skyrocketed from US$146 million to US$6.2 billion, becoming the third largest stablecoin in the market. The key to its growth lies in its innovative yield strategy and Delta-neutral hedging mechanism.

- USDS (MakerDAO) : MakerDAO rebranded as Sky and launched the compliance-friendly USDS, with a market value of $2.6 billion in February 2025. This adjustment enhanced its competitiveness in the decentralized stablecoin market.

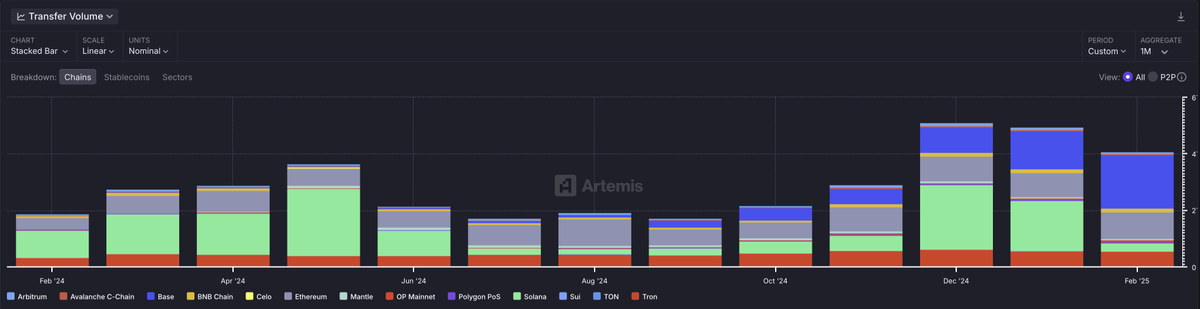

Capital Flow and Industry Distribution

The flow trend of stablecoins reflects the positioning and competitiveness of different public chains in the market:

- Ethereum remains the leading stablecoin issuance platform, accounting for 55% of the supply share.

- Base and Solana have grown rapidly in transaction volume. Driven by the DeFi and Meme coin markets, they have become important on-chain ecosystems for the circulation of stablecoin funds.

- TRON continues to occupy a core position in the global P2P payment and cross-border remittance markets, especially in emerging markets where stablecoins are widely used for payments and savings.

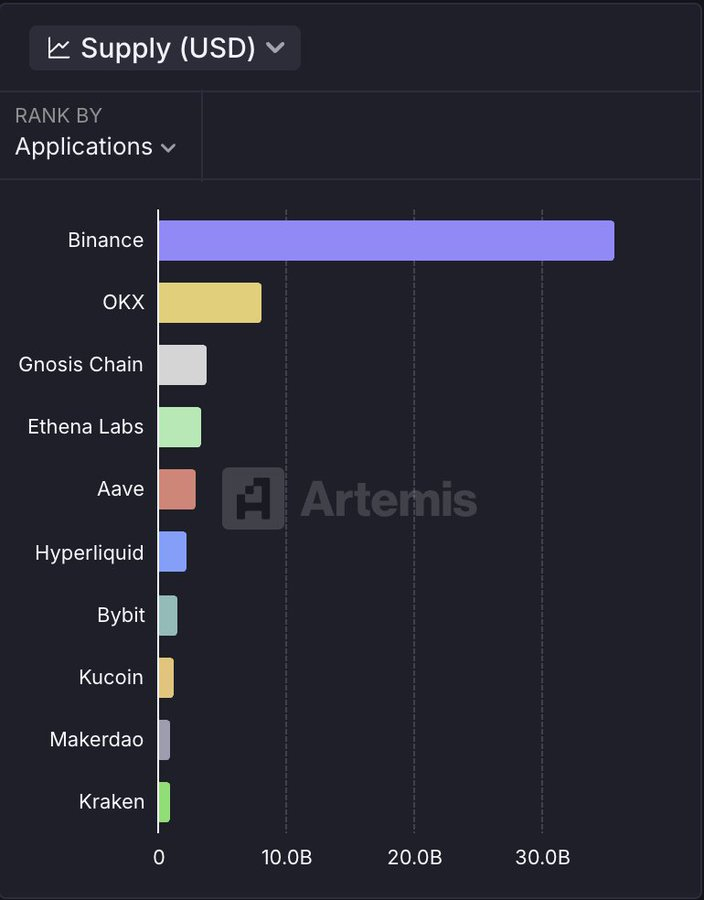

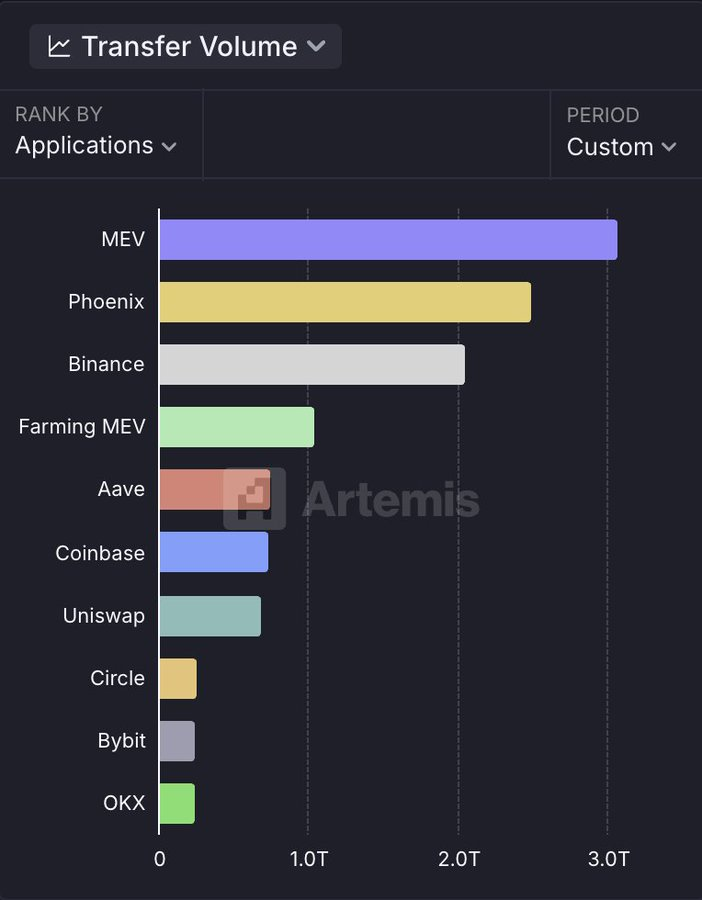

Most stablecoin liquidity is concentrated in centralized exchanges (CEX), and trading volume is mainly driven by DeFi (DEX, lending, and yield mining), reflecting the efficient circulation and innovation of funds.

Core role and future development

Stablecoins have become a key infrastructure in the crypto market, while also driving innovation in the traditional financial sector. Industry experts are optimistic about the future development of stablecoins:

“Stablecoins are the lifeblood of the crypto market and a super conductor for the financial system. They open up new markets and financial opportunities, driving innovation that would otherwise be out of reach.”

— Rob Hadick, General Partner, Dragonfly

“Stablecoins have significant advantages in cross-border payments. We hope that Base will support more local currency stablecoins, so that global users can use familiar currencies to trade on the chain and increase the popularity of blockchain technology.”

—— Neodaoist, Product Manager of Base

“The new generation of stablecoins must have market resilience. At its core, USDe is a yield-backed stability mechanism that ensures users have access to a reliable alternative to the U.S. dollar.”

— Conor Ryder, Head of Research at Ethena Labs

“The flow of stablecoins depends on the quality of infrastructure - low cost, fast transactions, and market demand. On Solana, Meme coin transactions have extremely high demand for liquidity and instant settlement, making stablecoins an indispensable part.”

—— Andrew Hong, Herd founder and data analysis expert

“TRON has become the blockchain of choice for stablecoin transactions, with billions of dollars in daily transactions. USDT drives real economic activity on TRON, especially in emerging markets, where it has become a key tool for payments and savings.”

——Sam Elfarra, TRON DAO community spokesperson

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon