Toncoin (TON) Explained 2025: The Telegram-Backed Crypto Powering Web3

Table of Contents

Table of Contents

- What Makes Toncoin Unique?

- The Origins and Background of TON

- How Toncoin’s Technology Works

- The TON Ecosystem & Key Partnerships

- Real-World Use Cases of Toncoin

- TON Tokenomics Explained

- Latest Toncoin News & Developments

- Final Thoughts on Toncoin

- FAQ: 10 Unanswered Questions About Toncoin

What Makes Toncoin Unique?

What Makes Toncoin Unique?

Toncoin is the native cryptocurrency of The Open Network (TON), a next-generation blockchain with deep integration into the Telegram ecosystem. With its extraordinary reach, TON focuses on ultra-fast payments, performance-driven DeFi, advanced NFT applications, and versatile Web3 integrations. Its seamless connection with Telegram positions Toncoin as a cryptocurrency designed for mass adoption.

The Origins and Background of TON

The Origins and Background of TON

TON traces its roots back to 2018, when Telegram launched the ambitious Telegram Open Network project. The vision was to integrate crypto payments directly into the messaging app, enabling mass adoption on a global scale. However, due to regulatory challenges with the U.S. SEC, Telegram withdrew from the project in 2020. Development was then transferred to the open-source community, leading to the formation of the TON Foundation, which now governs and develops the ecosystem. The idea of merging blockchain with messaging technology continues to shape TON’s strategy today.

How Toncoin’s Technology Works

How Toncoin’s Technology Works

TON is built on an advanced Proof-of-Stake blockchain with a sharding architecture, splitting the network into workchains and shardchains. This structure allows for near-infinite scalability, with thousands of transactions per second at minimal fees. The integration of a native Telegram wallet makes onboarding and payments accessible for millions of users. TON is optimized for fast payments, flexible smart contracts, NFT data architecture, and Web3 app deployment, with a unique emphasis on embedding blockchain utility directly into messaging and payment flows.

| Feature | Toncoin (TON) | Ethereum | Solana |

|---|---|---|---|

| Transactions per Second | 100,000+ | 30 | 65,000 |

| Native Integration | Telegram Wallet | External Wallets | Phantom, Solflare |

| Architecture | Sharded Proof-of-Stake | Proof-of-Stake (L2 scaling) | Proof-of-History + PoS |

The TON Ecosystem & Key Partnerships

The TON Ecosystem & Key Partnerships

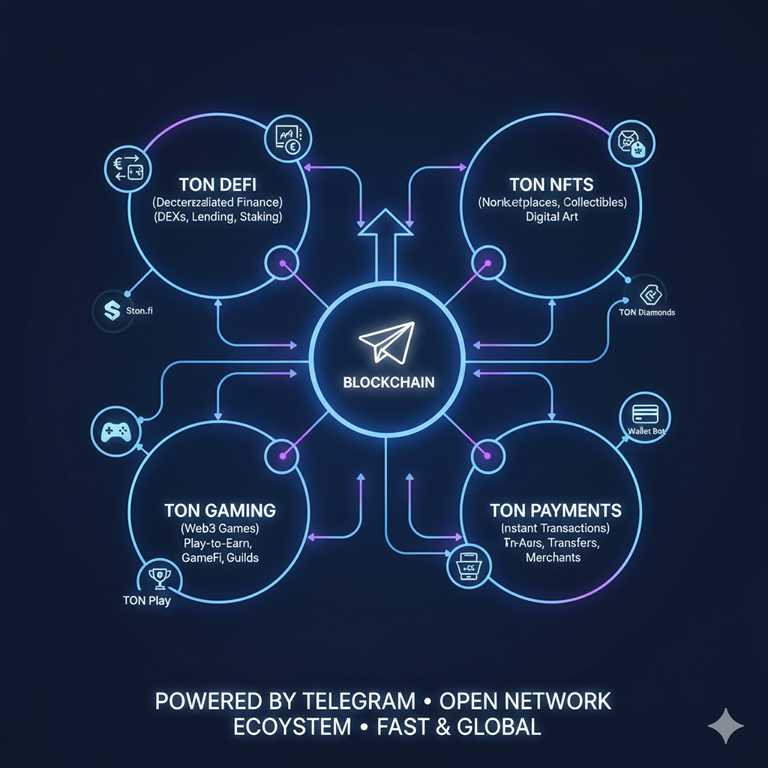

The TON ecosystem spans payments, DeFi, NFTs, and gaming. Users can send and receive Toncoin directly within Telegram, while DeFi projects such as TonSwap and lending platforms expand financial opportunities. TON Domains and digital collectibles highlight the NFT sector, while Animoca Brands partnerships strengthen Web3 gaming. Official wallet bots inside Telegram make adoption effortless, exposing TON to hundreds of millions of users worldwide.

Real-World Use Cases of Toncoin

Real-World Use Cases of Toncoin

Toncoin has practical applications across different sectors:

- Payments: Direct peer-to-peer and merchant transactions via Telegram Wallet.

- DeFi: Swaps, lending, and liquidity pools accessible through the Telegram interface.

- NFTs: TON-based domains, digital art, and collectibles.

- Gaming: Web3 and play-to-earn gaming powered by TON integrations.

- Mini-Apps: Telegram mini-apps providing Web3 experiences directly inside the messenger.

TON Tokenomics Explained

TON Tokenomics Explained

The TON ecosystem is powered by Toncoin, with a maximum supply of around 5 billion tokens. Toncoin covers transaction fees, staking, and governance voting. Validators secure the network and earn rewards, while users participate in staking for yield. The Proof-of-Stake consensus ensures efficiency, security, and equitable distribution, making Toncoin’s tokenomics sustainable and designed for long-term adoption.

Latest Toncoin News & Developments

Latest Toncoin News & Developments

In 2025, TON expanded its ecosystem with a surge of Mini-Apps inside Telegram, boosting adoption to hundreds of millions of active users. DeFi and NFT integrations grew rapidly, supported by new gaming and payment partnerships. The TON Foundation accelerated governance upgrades and protocol improvements, aiming to establish Toncoin as a cornerstone currency of the Web3 ecosystem. By combining blockchain with messaging, TON distinguishes itself as a pioneer in merging financial tools with social platforms.

FAQ: 10 Unanswered Questions About Toncoin

FAQ: 10 Unanswered Questions About Toncoin

]]>You May Also Like

WIF price reclaims 200-day moving average

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise