Why am I firmly optimistic about Ordinals? The gaming field of miners, KOLs, and gamblers, and my personal declaration at the bottom

Author: Nikola

Compiled by: Tim, PANews

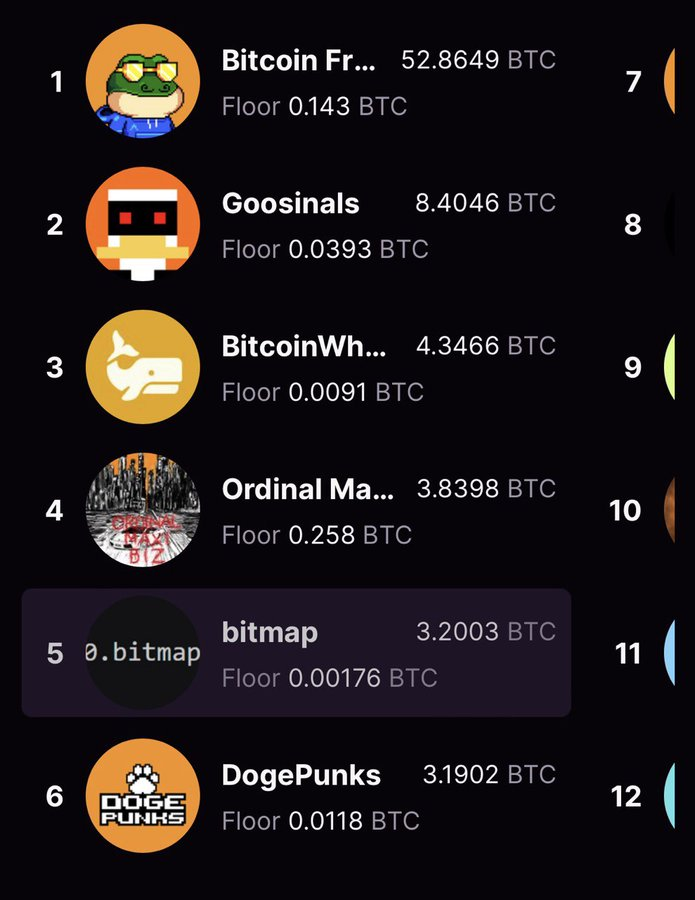

The value of most blue chip Ordinals has shrunk significantly! The golden age of Magic Eden, full of green candlesticks and frenzied speculation, is gone forever... (The carnival was short, but it is still unforgettable 🫡)

What wonderful days were before...

Most of the so-called "founders" and "builders" have abandoned the community and run away. People are attacking each other endlessly on the timeline, and everyone is declaring the Ordinals "dead" once again...

However, we are still holding our ground and remain bullish on Ordinals... At this point you may be asking: why?

When the Ordinals seem to be spiraling back to zero, why should they persist?

If this is your question and position, it means you still have a lot to learn in this market. Let me help you solve your doubts one by one, young man...

I will break down my views and ideas into three parts:

1. Ordinals: The gaming field of mining groups

2. Ordinals: Bitcoin’s Immortal Symbiont

3. Ordinals: My personal legend and battlefield

1. Ordinals: The gaming field of mining groups

Sub-100k, sub-10k, rare sats, early heritage, Ordinals artwork: it all sounds familiar, right?

These buzzwords have all briefly dominated the ecosystem.

People hold these concepts as if they are the foundation of value. But the truth is - they are not!

If you think scarcity, provenance, or some imaginary intelligence gives Ordinals value, you are dreaming.

The only rule in this field is money!

It’s that simple. Bitcoin is the real hard currency: it is fuel, it is loot, and it is the ultimate goal.

Who controls the circulation of Bitcoin? Miners.

Miners are the behind-the-scenes operators of the entire ecosystem.

They control the memory pool, transaction fees, and market narrative.

Have you noticed that before every popular project goes online, the memory pool is always "coincidentally" flooded with various junk coin minting transactions?

Most KOLs, project owners, and even the bull market flag bearers you admire are controlled by the mining group or are pawns in its game. (This is what people often call a "conspiracy group")

That's why you see everyone suddenly jumping on the bandwagon to promote a "project"

Some people directly colluded with the bigwigs behind the scenes, while others just took money to do the work - cooperating to promote a specific narrative, but the results were the same:

Miners always make a profit!

Miners shape the space, set the rules, and reap the benefits. They profit from hype cycles, pumps and dumps, and FOMO-driven minting frenzies.

Whether it’s Ordinals, Rune Protocol, or anything new that emerges in the future - they are just new tools for miners to make money.

As long as Bitcoin exists, this playground will continue to operate. It’s cruel, but it’s the truth.

This market has nothing to do with art, community, culture, or any Meme coin.

It's just a value game.

Apart from the cold, hard Bitcoin, everything else is just a mirage.

I'm tired of serial runners running rampant in this industry! (It's so ironic, isn't it?)

2. Ordinals: Bitcoin’s Immortal Symbiont

Even in the face of such a harsh reality, I am still bullish. Why? Because Ordinals is deeply tied to Bitcoin, the king of cryptocurrencies👑

Throughout the market cycle, Bitcoin has been able to crush the competition every time and firmly sit on the top spot of value storage and ultimate investment. When the US government starts to buy Bitcoin as a national reserve? That will be the final confirmation. Large-scale popularization is no longer a distant prospect, but a historical necessity.

When Bitcoin breaks through the million-dollar mark (and that day will eventually come), everyone will inevitably look for new places to play for money.

Maybe some people choose to take profits, but what about real gamblers?

They never leave.

This group of fanatical speculators will continue to look for the next playground: an ultimate gaming paradise with extremely low transaction friction and almost zero entry threshold.

This is the significance of Ordinals and Rune Protocol: they are directly rooted in the Bitcoin protocol layer, without the need for cross-chain bridges or token exchange, and are purely based on Bitcoin's native innovation laboratory.

As the price of Bitcoin rises, the demand for projects like Ordinals and Rune Protocol will surge. Whether the carrier is art, altcoins or a new paradigm - the infrastructure for the new paradise is already in place.

Yes, I am still bullish. Because Ordinals is Bitcoin’s eternal companion: As long as Bitcoin stands, the legend of Ordinals will not end.

3. Ordinals: My personal legend and battlefield

What is the last part?

My personal manifesto.

I was involved in the blockchain industry long before the so-called "experts" understood what it was (most of them still don't understand it 🤣). Now, these half-baked people have become opinion leaders, selling narratives that they don't even understand.

Is it absurd?

Is it outrageous?

Bullshit?

This is my personal battlefield – carving out a place of clarity amidst the noise.

When people talk about "application scenarios" and "actual utility" (which is actually old wine in new bottles), most of them are just fame-seeking scammers who have neither insight nor faith in what they create.

And me?

I see Ordinals as a battlefield: a place to reconstruct narratives, challenge conventions, and forge true values; to create things that go beyond empty concepts and give them real meaning and mission.

This is a declaration of war to the speculators, gamblers and behind-the-scenes manipulators in the industry: I will be tougher, wiser and more creative than you.

When the dust settles, I will be the one standing.

Final Thoughts

Back to the original question: Why am I firmly optimistic about Ordinals?

Because I have seen through the essence of this game, I am well aware of the hands behind the scenes, and I am familiar with the rhythm of market cycles. I also foresee that when Bitcoin reaches a new peak, the casinos built around it will rise simultaneously.

Ordinals is not just a simple protocol, it is a mirror image of the nature of the crypto market—a place where greed, manipulation, and power intertwine, but it is also a battlefield of opportunity.

If you want to survive, remember:

Stop chasing bubbles and instead deconstruct the rules of the game; gain insight into the bankers behind the scenes and track the flow of funds.

When the next cycle comes, choose to be a player, or become a chip to be harvested.

Welcome to the never-ending gaming arena.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun