Decoding Market Sentiment: The Critical BTC Perpetual Futures Long/Short Ratios You Need to Know

BitcoinWorld

Decoding Market Sentiment: The Critical BTC Perpetual Futures Long/Short Ratios You Need to Know

For any serious crypto trader, understanding market sentiment is a powerful edge. Right now, all eyes are on the BTC perpetual futures market, where the battle between bulls and bulls plays out in real-time. The long/short ratio—a simple percentage—reveals whether traders are leaning optimistic or pessimistic about Bitcoin’s next move. Let’s dive into the latest data from the world’s largest exchanges and uncover what it truly means for your strategy.

What Do Today’s BTC Perpetual Futures Ratios Tell Us?

The aggregate data paints a fascinating picture of a market in near-perfect equilibrium. Over the last 24 hours, the combined BTC perpetual futures data from the top three exchanges shows a razor-thin margin: 49.45% of positions are long, betting on a price increase, while 50.55% are short, anticipating a drop. This delicate balance suggests a moment of collective indecision. Traders are cautiously waiting for a clear signal before committing to a strong directional bet. Therefore, this data point becomes a crucial baseline for gauging any sudden shifts in sentiment.

A Closer Look at Exchange-Specific BTC Futures Data

While the aggregate view is essential, savvy traders know that each exchange has its own unique user base and trading culture. Breaking down the numbers by platform provides deeper, actionable insights. Here is the 24-hour breakdown for the leaders in futures open interest:

- Binance: 48.87% long / 51.13% short

- OKX: 48.98% long / 51.02% short

- Bybit: 49.63% long / 50.37% short

Notice a pattern? All three major platforms show a slight majority of short positions. However, Bybit’s ratio is notably less bearish, with nearly half of its traders positioned long. This subtle divergence can hint at where the most aggressive buying or selling pressure might originate if the market breaks out of its current range.

How to Use This Data in Your Trading Strategy

So, you have the numbers—now what? Raw data is useless without interpretation. A market heavily skewed towards longs can sometimes be a contrarian indicator, suggesting everyone who wants to buy already has, leaving few new buyers to push the price higher. Conversely, extreme short positioning can set the stage for a dramatic ‘short squeeze’ rally. Currently, with ratios so balanced, the signal is one of caution. It tells us the market lacks a strong consensus, making it vulnerable to news or a large order that could tip the scales. Monitoring these BTC perpetual futures ratios daily helps you sense these shifts before they become obvious on the price chart.

The Bigger Picture: Sentiment Beyond the Ratios

Remember, the long/short ratio is just one piece of the puzzle. It’s most powerful when combined with other metrics like funding rates (which show if longs or shorts are paying fees to hold their positions) and open interest (the total number of outstanding contracts). For instance, if the ratio is balanced but funding rates are highly positive, it means longs are aggressively paying shorts, which can be unsustainable. Always cross-reference this BTC perpetual futures sentiment data with on-chain analytics and broader market trends for a holistic view.

In conclusion, the current BTC perpetual futures long/short ratios reveal a market holding its breath. The slight aggregate bias towards shorts, especially on Binance and OKX, indicates a cautious or mildly bearish lean among leveraged traders. However, the closeness of the numbers warns against expecting a major move without a catalyst. For now, this data serves as a vital warning to avoid over-leveraging in either direction. The true opportunity will come when this balance breaks, signaling the next major sentiment shift in the Bitcoin market.

Frequently Asked Questions (FAQs)

What is a BTC perpetual futures contract?

A BTC perpetual futures contract is a derivative that allows you to speculate on Bitcoin’s price without an expiry date. You can go long (bet on price increase) or short (bet on price decrease) using leverage.

Why is the long/short ratio important?

It acts as a sentiment gauge. A very high long ratio can signal over-optimism (a potential top), while a very high short ratio can signal extreme fear (a potential bottom), though it should not be used in isolation.

How often do these ratios change?

They update in real-time as traders open and close positions. The 24-hour snapshot provides a stable overview of the day’s prevailing sentiment.

Can this data predict Bitcoin’s price?

No single metric can reliably predict price. However, extreme readings in the long/short ratio can highlight periods of potential market exhaustion and warn of possible reversals.

What’s the difference between this and spot market sentiment?

Futures traders often use leverage and have shorter timeframes, making this data more indicative of speculative, short-term sentiment compared to spot holding patterns.

Where can I check these ratios myself?

Many crypto analytics websites and the exchanges themselves provide real-time data on long/short ratios and other derivatives metrics.

Found this breakdown of BTC perpetual futures sentiment helpful? Share this article with your trading community on Twitter or Telegram to spark a discussion about the current market balance. Understanding collective sentiment is key to navigating the volatile crypto markets.

To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin price action and institutional adoption.

This post Decoding Market Sentiment: The Critical BTC Perpetual Futures Long/Short Ratios You Need to Know first appeared on BitcoinWorld.

You May Also Like

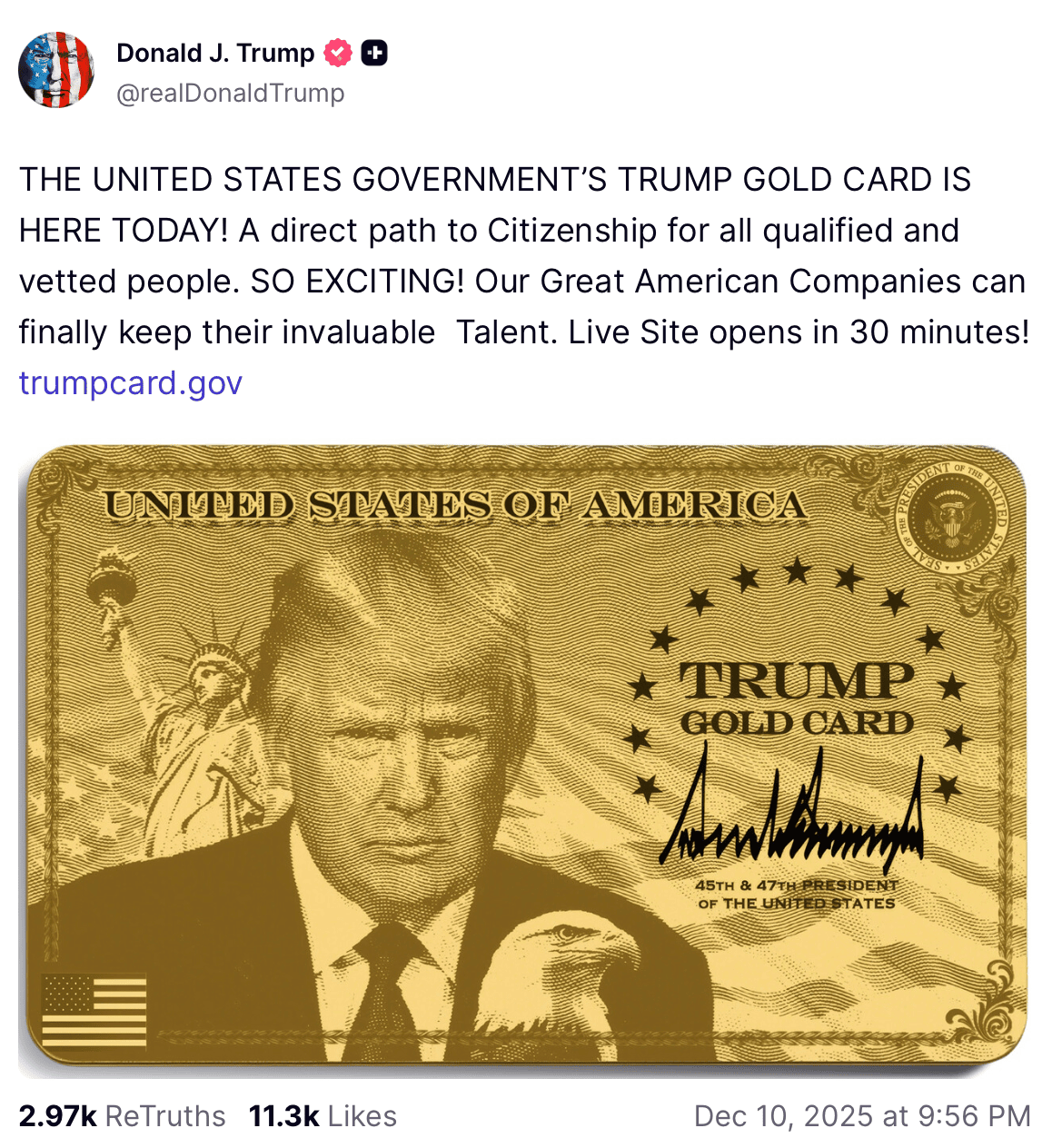

Trump Announced the Launch of the Trump Gold Card

How High Can Avantis (AVNT) Spike This Bull Run?