FET Price Analysis: Symmetrical Triangle Breakout Could Boost The Rally to $0.60

- FET price drops sharply, signaling short-term bearish pressure.

- Weekly performance decline reflects cautious investor sentiment.

- A symmetrical triangle breakout could trigger rapid upward movement.

- RSI and MACD indicate a potential relief bounce.

Artificial Superintelligence Alliance (FET) is currently on a downward trajectory, with a significant value decline. In the last 24 hours, FET has dropped by nearly 7.56%, while weekly performance also reflects a decrease of 6.62%, signaling short-term bearish pressure in the market.

At the time of writing, FET is trading at $0.2417 with a 24-hour trading volume of $115.99 million, down 1.42%. Its market capitalization stands at $559.19 million, reflecting a 7.3% decline. These metrics highlight a cautious sentiment among investors and ongoing volatility for FET in the crypto market.

Also Read: Fetch.ai Leads the Agent Economy as Digital Intelligence Expands Globally

Symmetrical Triangle Shows Early Bullish Signs

Artificial Superintelligence Alliance (FET) is tightening inside a large symmetrical triangle on the 12-hour chart, with the current price at $0.2418. The candles are pressing against the upper trendline, showing early bullish strength as buyers attempt to break the pattern. If the price closes above the $0.255–$0.260 zone, momentum may shift rapidly and trigger a new upward phase.

A confirmed breakout would open the path toward multiple resistance layers highlighted in the chart. Volume gaps on the VRVP suggest faster movement once the price clears the first barrier. The nearest targets sit at $0.270 and $0.315, followed by stronger upside zones at $0.390 and $0.460. Continued strength could eventually drive the market toward the $0.600 macro level.

A potential rejection around the upper line would cause FET to move back into the triangle, with support seen between $0.225 and $0.230. A further retreat would test support around $0.200-$0.210. At present, there is still a bullish bias, though validation of this is necessary before proceeding towards other targets in $0.270, $0.315, $0.390, $0.460, and $0.600.

RSI and MACD Signal Potential Reversal

The RSI index of Artificial Superintelligence Alliance (FET) for a week now stands at 33.24, edging above the conventional oversold line of 30. The RSI index has been in a declining trend for a couple of weeks now, yet it remains below its moving average of 36.05.

The MACD line stands at –0.13716 with a Signal line of –0.12435. The histogram bars are slightly negative but weakening, pointing to a deterioration in bearish momentum. The converging distance between the MACD and Signal lines suggests a looming bullish cross. Overall, it appears that RSI and MACD are pointing to weakening selling pressures and a relief rally.

Also Read: FET Approaches Reversal Zone After Sharp Decline: Is $13 the Next Stop?

You May Also Like

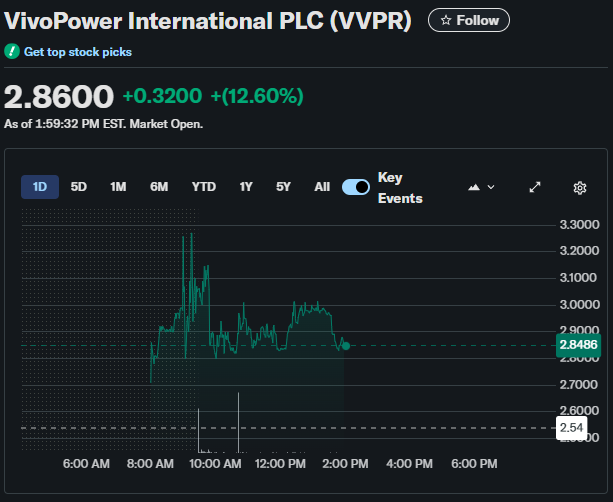

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally

Milk Mocha’s 40-Stage Presale Explained