Bittensor TAO Halving Nears as Grayscale Launches $GTAO for Investors

- Grayscale has made its Bittensor trust publicly tradable, expanding regulated access to TAO for U.S. investors.

- The listing comes just before Bittensor’s first halving, which will reduce token emissions and tighten supply.

Grayscale has now expanded its portfolio of digital assets by making its Bittensor-focused investment product public and offering U.S. investors regulated access to the TAO market, just days before the network’s first halving event.

The Grayscale Bittensor Trust is now trading on OTCQX under the ticker of GTAO, according to a company announcement. OTCQX is a regulated secondary market provided by OTC Markets Group Inc. that hosts securities that meet financial and disclosure standards. Grayscale described GTAO as the first publicly quoted U.S. investment product designed to provide exposure to TAO. Previously, the trust was only available through private placement since its launch in August 2024.

Grayscale Opens Public Access To TAO

Grayscale, a subsidiary of Digital Currency Group, remains one of the largest digital asset managers in the market. Its product range includes everything from single-asset trusts to diversified crypto index products and exchange-traded funds tracking assets like Bitcoin and Ethereum.

In recent years, the firm has gradually moved beyond the flagship cryptocurrencies. It has turned select altcoin trusts into exchange-traded products and recently launched a Chainlink-focused fund. Alongside these, Grayscale also continues to operate private investment vehicles with exposure to assets such as Avalanche and Zcash, as well as publicly traded trusts linked to tokens including Basic Attention Token, NEAR, and SUI.

Bittensor Prepares Supply Cut As Halving Approaches

The public debut of GTAO comes just before an important milestone for the Bittensor network. Bittensor will undergo its first halving on December 14, which will reduce the rate at which new TAO tokens are distributed to network participants.

TAO is the native asset of Bittensor, a decentralized, AI-focused network that is based around application-specific subnets. Participants earn TAO when they contribute computing resources to support and enhance these AI-driven chains. The protocol has a maximum supply of 21 million tokens, which are emitted at a decreasing rate every 4 years, similar to Bitcoin. The next halving is projected to actually tighten new supply while predictably maintaining the overall issuance structure for long-term participants.

With the public quoting, the Grayscale Bittensor Trust will now be filing regular reports and financial statements with the U.S. Securities and Exchange Commission. These disclosures contribute to increased transparency and bring the product into line with regulatory requirements of publicly traded investment vehicles.

TAO Price Action Improves

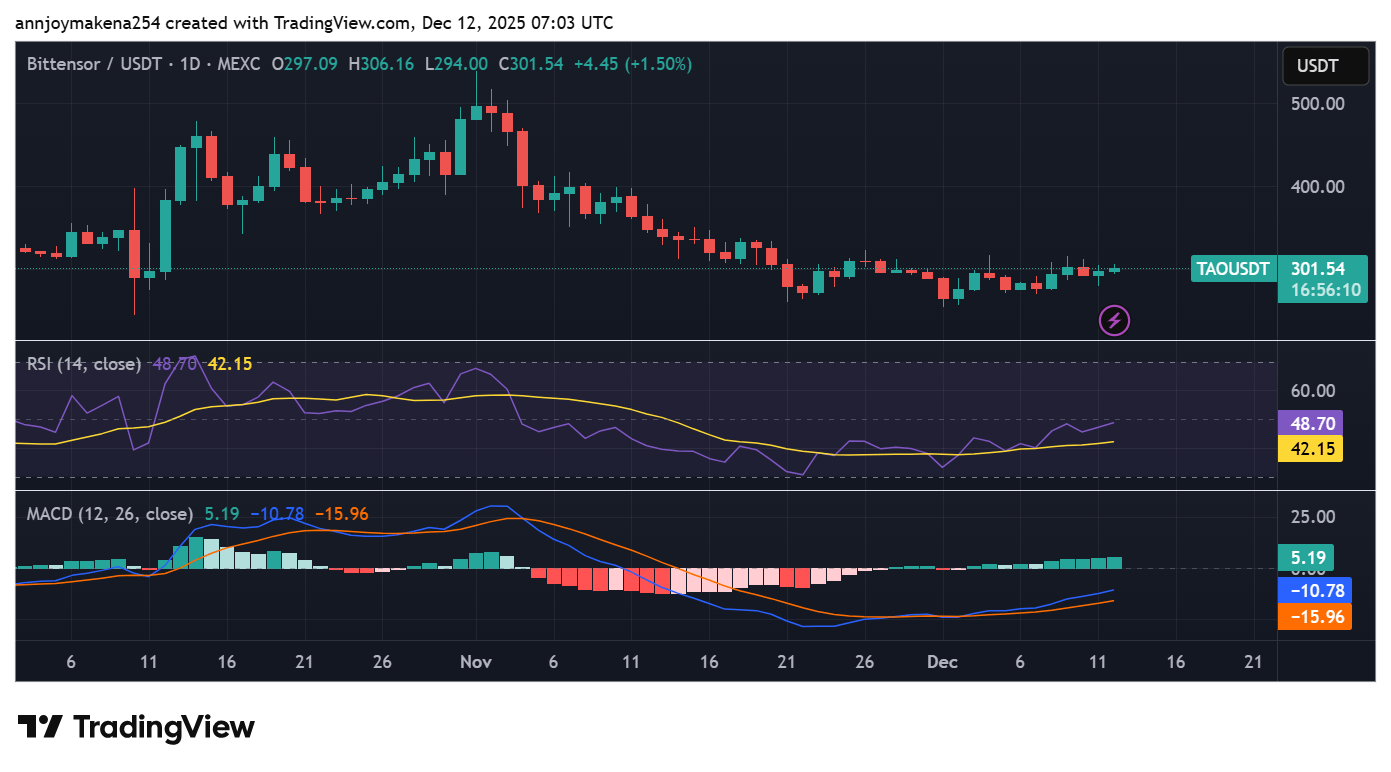

The upcoming halving is expected to cause more scarcity as it slows the supply of new TAO into circulation. There have already been signs of anticipation in market pricing. TAO was trading above $300 on Thursday, continuing a short-term upward trend that had sent the token up more than 5% in the previous 24 hours. Prices fluctuated from lows around $281 to highs around $306, and market capitalization surged to around $3.15 billion.

Technical indicators show improving conditions. TAO has made a base between $270 and $290 before recovering $300. Momentum gauges such as the relative strength index and MACD histogram indicate the easing of bearish pressure.

Source: Trading View

Source: Trading View

Crypto analyst Daniel Ramsey, in a post on X, noted that the structure of TAO is in a weekly channel and has potential for an upward retracement. Additionally, Whales_Crypto_Trading pointed to a breakout on the four-hour timeframe, indicating scope for further gains, provided strength continues.

Source : Whales_Crypto_Trading on X ]]>

Source : Whales_Crypto_Trading on X ]]>You May Also Like

Now You Don’t’ New On Streaming This Week, Report Says

Pakistan’s Bitcoin Pivot Sparks Momentum for DeepSnitch AI, Up 80% In Presale