Bitcoin Maximalism Is Fading As Top Altcoins Like PEPENODE Rise

What to Know:

- Bitcoin’s ETF-driven evolution into digital gold is softening strict maximalism and encouraging more diversified crypto portfolios.

- Capital is rotating into top altcoins with real narratives, especially in infrastructure, AI and DePIN rather than pure speculation.

- PEPENODE mixes meme culture with gamified virtual mining and multi token rewards to keep holders engaged.

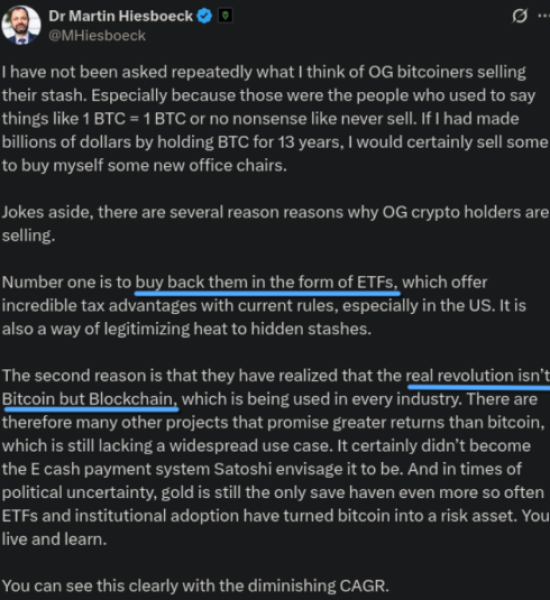

For most of crypto’s history the script was simple: own Bitcoin, ignore everything else. That mindset is fading. Bitcoin now behaves more like digital gold, while the real experimentation (and much of the upside) is shifting to newer chains and app layers.

Spot Bitcoin ETFs accelerated that shift. Many veteran holders in the US are moving coins from self custody into ETF wrappers to gain tax advantages and easier reporting without giving up long term $BTC exposure.

Yes, OG whales definitely aren’t selling their Bitcoin for nothing – they’re going the ETF way.

On chain, that unlocks fresh capital that no longer needs to sit idle. Instead of chasing random memes, that capital is rotating into infrastructure and narrative rich plays.

High throughput networks like Avalanche, DePIN platforms such as Peaq and experimental designs like Kaspa’s blockDAG are drawing serious research time from investors who once swore they would never touch an altcoin.

In this more mature market, Bitcoin can remain the macro anchor, while the upside shifts toward the top altcoins that pair clear stories with working products and lean tokenomics. Meme coins still matter, but they now need actual hooks.PEPENODE ($PEPENODE) tries to be one of those hooks. It blends Pepe style culture with a mine to earn model that turns virtual mining into a browser based strategy game.

With more than $2.1M already raised at a presale price of $0.0011454 and 605% staking rewards, it gives rotated Bitcoin profits a defined, higher risk lane.

PEPENODE’s Mine-To-Earn Model And Presale In One Snapshot

PEPENODE ($PEPENODE) starts from a basic problem – most crypto presales and staking pools are passive: you buy, you lock, you wait, and attention fades long before launch.

The project’s whitepaper instead describes a virtual mining simulator. After TGE, holders will build a server room inside a web app by buying Miner Nodes and upgrading Facilities with $PEPENODE.

A dashboard tracks simulated hashrate, energy use and rewards so it feels like running a mining farm without hardware, noise or power bills.

PEPENODE also plugs into existing meme liquidity instead of ignoring it. Leaderboards and bonus pools aim to pay rewards not only in $PEPENODE but also in some of the best meme coins such as $PEPE and $FARTCOIN.

One active position can become exposure to several assets, which appeals to traders who prefer to keep their stack working instead of parked in a single token.

On the funding side, the presale runs as a community first public sale with no private rounds or insider allocations. Pricing began around $0.001 and sits at $0.0011454 in the current stage, with $ETH, $BNB, $USDT and card payments accepted.

Here’s how to buy PEPENODE now.Early staking yields at 605% are live alongside the raise and are designed to step down as more tokens are locked, encouraging commitment rather than quick flips.

Our $PEPENODE price prediction sees a potential high near $0.0031 in 2025, with a 2026 range between roughly $0.0022 and $0.0077 if the game ships on time and user numbers grow.

From a presale level around $0.0011454, that translates into indicative moves of about 2.7x at the first target and up to roughly 6.7x at the top of the 2026 band.

For investors who now hold Bitcoin exposure through ETFs and want a defined risk sleeve for growth, PEPENODE offers a narrative that lines up with the wider rotation into utility driven altcoins and interactive on chain products.

Consider PepeNode when shaping your next altcoin sleeve.

This article is informational only, not financial advice; cryptocurrencies are highly volatile and can lead to full loss of invested capital.

Authored by Elena Bistreanu, NewsBTC – https://www.newsbtc.com/news/bitcoin-maximalism-fading-top-altcoins-pepenode-rise

You May Also Like

ZEC Technical Analysis Feb 5

MYX Finance price surges again as funding rate points to a crash