Memecoin faces rejection at $0.1409 resistance while institutional flows surge to 480M tokens, creating divergence between technical weakness and fundamental strength.

News Background

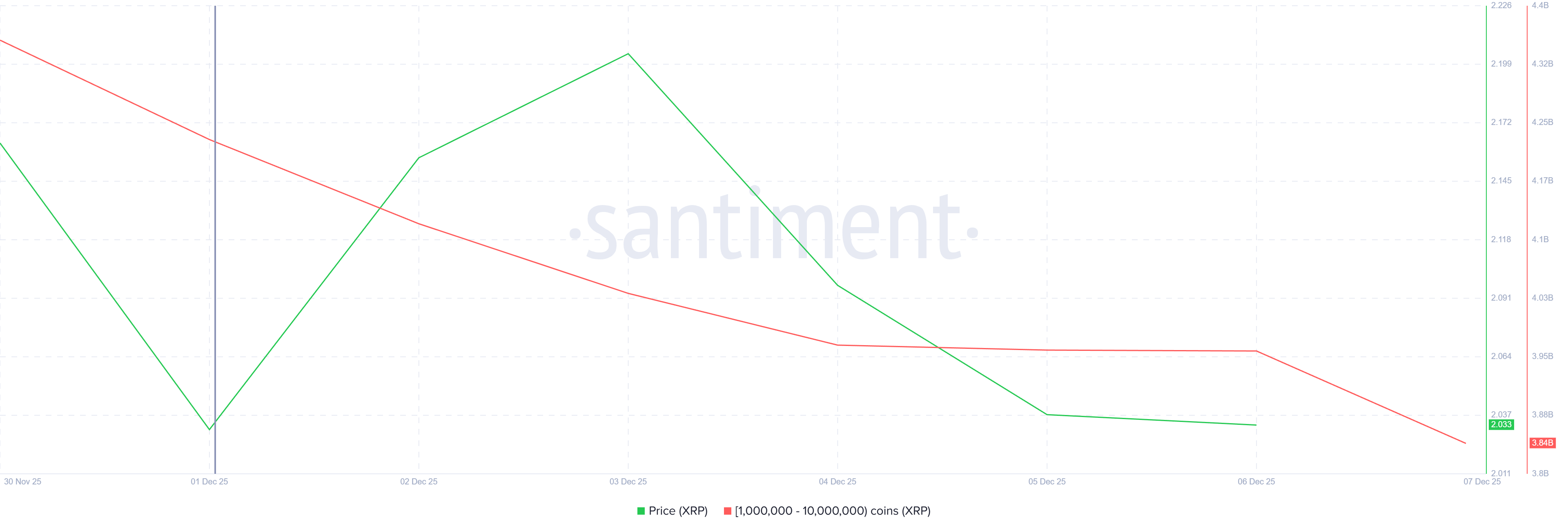

- Dogecoin continues to struggle beneath the $0.14 threshold despite strong accumulation trends and a spike in network activity. On-chain data shows whales purchased 480 million DOGE between December 2–4, lifting total large-holder balances from 28.0B to 28.48B.

- At the same time, DOGE network engagement surged to 71,589 active addresses — its highest reading since September — signaling improving chain activity despite muted price performance.

- Whale buying and rising activity contrast sharply with price behavior, which remains pinned beneath a dense resistance zone as breakeven sellers and technical overhead cap momentum.

Technical Analysis

- DOGE’s attempt to reclaim the $0.1409 resistance failed decisively when a 333M volume spike — 79% above average — triggered immediate rejection from the level. This confirms strong distribution pressure at the psychological barrier.

- The structure remains range-bound with tight consolidation between $0.1393 and $0.1400. Volume contraction following the breakout failure underscores market indecision and a lack of conviction among buyers.

- Intraday charts reveal a minor breakdown below $0.140 support, pushing DOGE to $0.1392 on heightened activity above 15M — a move that widens the consolidation range and establishes fresh resistance at $0.1400.

- Despite accumulation from whales, the technical picture remains weak: the market sits beneath resistance, momentum wanes, and lower timeframes show no confirmed trend reversal.

Price Action Summary

- DOGE fell 1.2% from $0.1522 highs to $0.1395, with multiple failed pushes toward $0.1409.

- The most significant action occurred at 07:00 UTC when volume exploded to 333M, coinciding with a sharp rejection from resistance.

- Subsequent weakness carried DOGE to $0.1392, forming a new intraday support at $0.1393 while consolidating around the $0.1395 midpoint.

What Traders Should Know

- DOGE faces a critical standoff between strong underlying accumulation and weak near-term technicals.

- Whale buying is rising, but overhead supply remains heavy at $0.1400–$0.1409, where repeated sell pressure signals active distribution.

- A break above $0.1409 could open a path toward $0.142, but failure to hold $0.1393 risks a retest of $0.1380.

- The divergence between bullish fundamentals and range-bound technicals suggests consolidation is likely until volume re-expands or a catalyst emerges.

Source: https://www.coindesk.com/markets/2025/12/07/dogecoin-activity-hits-3-month-high-but-doge-price-action-remains-range-bound