SOL Price Shows Early Stabilization Signs as Technical Exhaustion Signals Emerge

The post SOL Price Shows Early Stabilization Signs as Technical Exhaustion Signals Emerge appeared first on Coinpedia Fintech News

SOL price is attempting to stabilize after a prolonged selloff, trading at $94.16 when writing, as short-term technical indicators begin to suggest seller exhaustion. A TD Sequential “9” buy signal on the 4-hour chart, combined with a bullish RSI divergence, has shifted focus toward whether current support can hold.

TD Sequential Buy Signal Flags Potential Selling Exhaustion

From a technical perspective, the Solana price chart has printed a TD Sequential “9” buy signal on the 4-hour timeframe. This is signaling that downside momentum may be stretched. While it does not guarantee a reversal, historically it often precedes short-term stabilization phases.

Meanwhile, price action has respected the $93–$94 zone during recent sessions, suggesting that sellers may be losing control. Still, confirmation requires sustained holding above this area rather than a brief reaction.

Bullish RSI Divergence Reinforces Short-Term Support

At the same time, momentum indicators are beginning to diverge from price. While SOL price briefly dipped to $93, the Relative Strength Index formed a higher low. This bullish RSI divergence implies weakening downside pressure even as price printed a marginally lower low.

Such divergences often emerge near inflection points, particularly after extended declines. That said, they tend to work best when paired with structural support levels, which currently places added significance on the $94 region for SOL price today.

Key Levels Define Near-Term Risk and Reward

From a structural standpoint, $94.16 now acts as a critical support reference. If this level continues to hold on closing bases, attention shifts toward the monthly open near $105, which represents a potential recovery target of roughly 9.4% based on recent Solana price chart behavior.

Still, the path higher is unlikely to be linear. Any failure to defend current levels would delay this scenario and reintroduce lower liquidity zones. For now, the chart suggests that the immediate risk-reward profile has become more balanced than earlier in the decline.

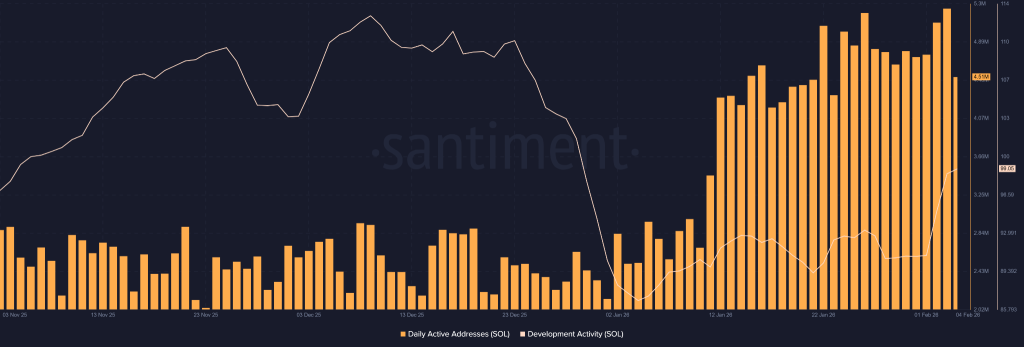

On-Chain Activity Signals Underlying Network Strength

Beyond price, Solana crypto fundamentals present a more constructive backdrop. Development activity has been trending higher, while daily active addresses continue to rise, too. This combination suggests that network usage is expanding even as market sentiment remains cautious.

Historically, divergences between improving on-chain engagement and soft price action often precede trend transitions, although timing remains uncertain. Still, it reduces the likelihood of purely speculative price behavior dominating short-term moves.

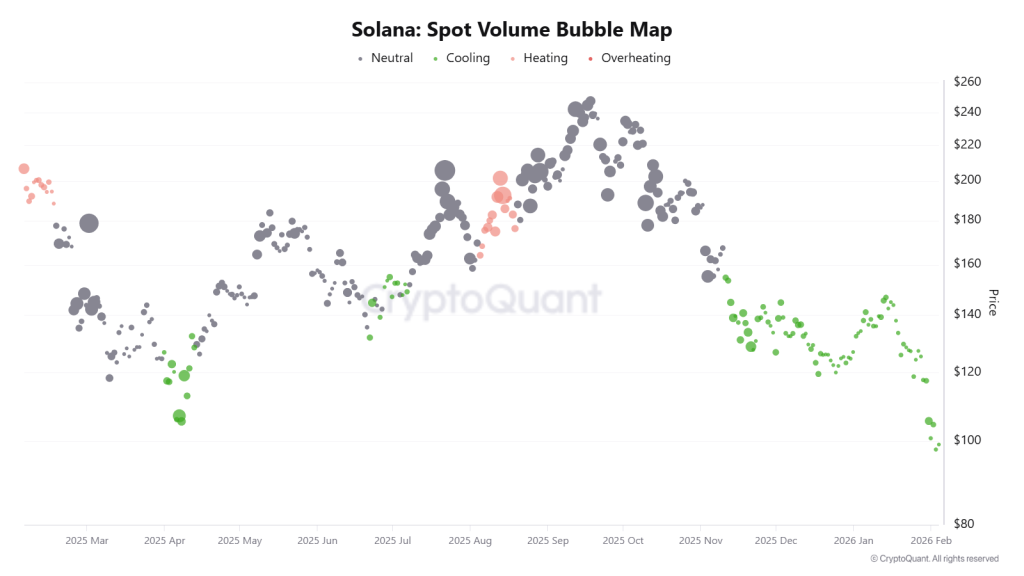

Volume Cooling Adds Context to Momentum Shift

Additionally, CryptoQuant data shows a noticeable cooling in trading volume. Rather than indicating disinterest, declining volume during downtrends often reflects the exhaustion of aggressive sellers. In prior cycles, similar volume compression has aligned with base-building phases.

As a result, SOL price is now balancing between technical exhaustion signals and broader market restraint. Whether this develops into a sustained recovery or extended consolidation will depend on how price reacts around current support over coming sessions.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

XRPL Validator Reveals Why He Just Vetoed New Amendment