Dapp

Share

Dapps are digital applications that run on a P2P network of computers rather than a single server, typically utilizing smart contracts to ensure transparency and uptime. In 2026, Dapps have achieved mass-market appeal through Account Abstraction, allowing for a "Web2-like" user experience with the security of Web3. This tag covers the entire ecosystem of decentralized software—from social media and productivity tools to governance platforms and identity management.

4996 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

2026/02/06 17:24

The $1 Billion Liquidation: Bitcoin’s Brutal Moves

2026/02/06 17:18

PA Daily News | Bitcoin plunges 15.48% in a single day, marking the largest drop since the FTX crash; MSTR reports a net loss of $12.4 billion in Q4 2025.

2026/02/06 17:15

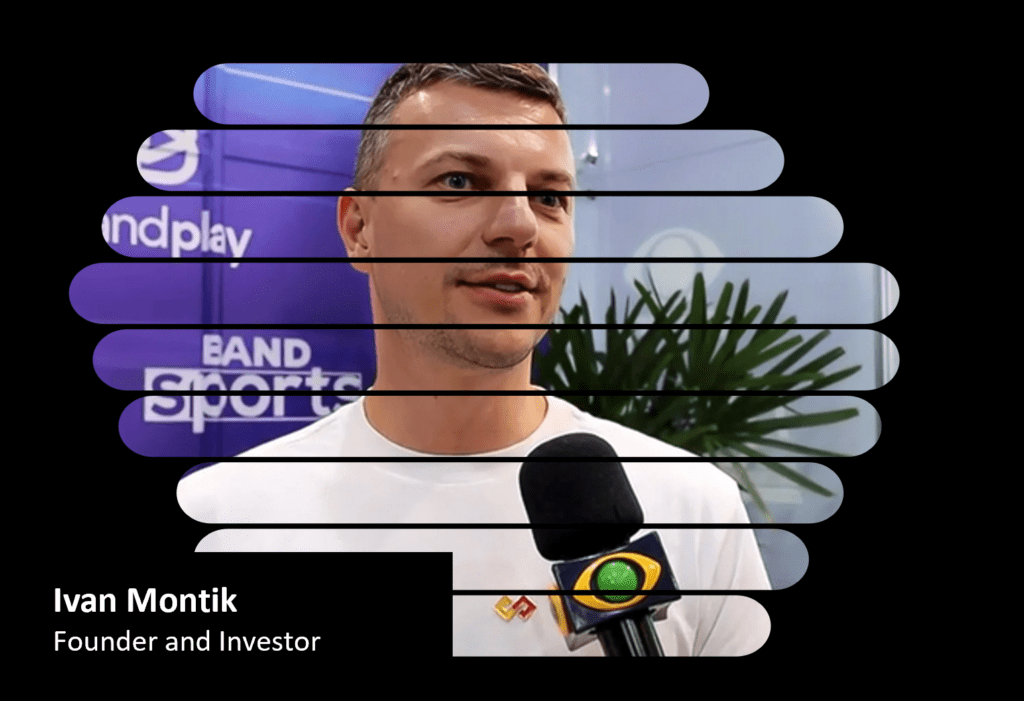

THE WIRECARD SMOKING GUN: SoftSwiss Founder Ivan Montik Unmasked in Munich Court as Judge Flattens PSP Denials

2026/02/06 17:04

What Triggered the Latest Bitcoin and Altcoin Crash?

2026/02/06 16:45