Bitcoin Whales Accumulate 47,584 BTC in December After Massive Two-Month Selloff

- Whales and sharks added 47,584 BTC in December after a two-month selloff.

- Strategy Inc. created a $1.44 billion reserve funded by stock sales to cover dividends and debt costs.

Bitcoin’s largest holders have reversed course in December, scooping up tens of thousands of coins after a heavy stretch of selling, according to on-chain analytics firm Santiment.

Data from Santiment shows that wallets holding between 10 and 10,000 BTC — often labeled whales and sharks — have accumulated a net 47,584 BTC so far this month. The move follows a sustained reduction in their balances from Oct. 12 to Nov. 30, when these wallets collectively offloaded about 113,070 BTC.

In a post on X, Santiment said the shift has pushed Bitcoin back into what it calls a “blue zone,” where both large holders and smaller investors add to positions and prices historically move “more up than down.” The firm’s chart tracks supply held by big wallets against holdings of addresses with less than 0.01 BTC, used as a proxy for retail.

Bitcoin Whale and Retail Supply Zones: Source: Santiment

Bitcoin Whale and Retail Supply Zones: Source: Santiment

During September and early October, Bitcoin traded in a similar blue zone while whales added coins and smaller addresses bought as well. Santiment’s visual shows that period lining up with a steady price advance. The subsequent red zone, when large holders sold while retail kept accumulating, coincided with choppier action and downside pressure.

Now, the December rebound in whale and shark balances has arrived alongside modest price gains, Santiment noted. The firm argues that continued accumulation by these larger wallets typically supports further upside over time.

However, Santiment also pointed out that smaller addresses have been buying dips through the latest move. In its framework, that pattern keeps the market away from the “green zone,” where key stakeholders accumulate while retail sells and where the firm sees the most reliable rallies.

Santiment said a scenario in which big wallets keep adding while the smallest holders start to reduce exposure would mirror the setup seen before the September and early-October advance. For now, the data show both groups in accumulation mode, with whales and sharks once again increasing their share of Bitcoin’s outstanding supply after a two-month drawdown.

Bitcoin Slides in November as Strategy Sets 1.44 Billion Dollar Dividend Reserve

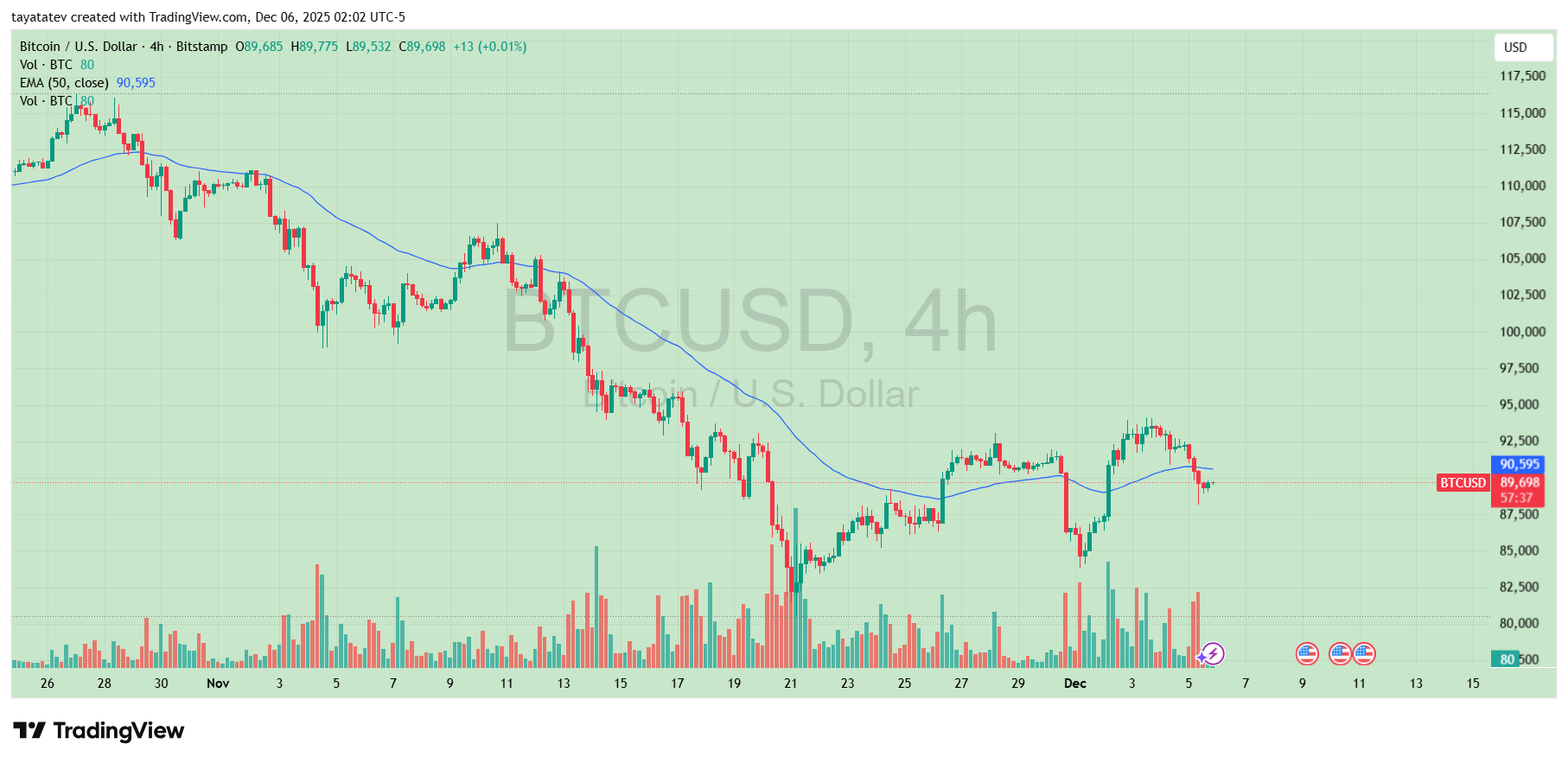

Bitcoin spent most of November falling, according to our recent analysis, staying under the 50 EMA and making lower highs and lows.

Then, around November 21, it bounced back from the lows and pushed up toward $92,000. After that rebound, the price turned lower again and now trades near $89,700, just under the 50 EMA on the 4-hour chart.

Bitcoin BTCUSD 4 Hour Price Chart: Source: TradingView

Bitcoin BTCUSD 4 Hour Price Chart: Source: TradingView

Meanwhile, Strategy Inc. set aside a 1.44 billion dollar reserve to cover dividends on preferred stock and interest on its debt, as highlighted in our previous article. The money came from selling Class A common shares through its at-the-market program. As a result, the reserve now equals about 2.2% of the company’s enterprise value, 2.8% of its equity, and 2.4% of its Bitcoin holdings. Going forward, Strategy Inc. will use this reserve as the main source for dividend payments on its various securities.

]]>You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Major Banks Rush to Get Crypto Charters in 2025