Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

15686 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Which Offers Better 2025 Returns?

Author: BitcoinEthereumNews

2025/11/24

Share

Recommended by active authors

Latest Articles

OpenClaw Creator Peter Steinberger Joins OpenAI in Strategic Move to Revolutionize Personal AI Agents

2026/02/16 06:45

Positive Pay: Strengthening Business Security Against Check Fraud

2026/02/16 06:16

XRP Rally Fails as Traders Take Early Profit: What’s Next?

2026/02/16 06:09

Scott Melker: Bitcoin’s swift reversal could shock investors

2026/02/16 05:45

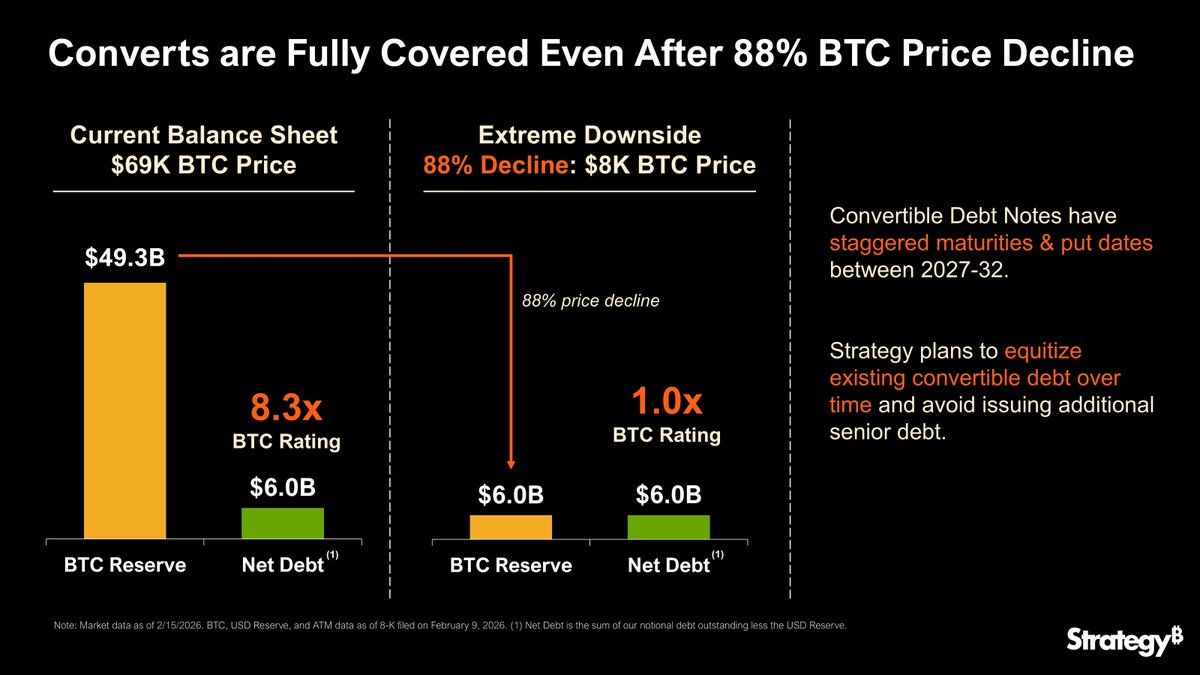

Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

2026/02/16 04:08