Metaplanet Sets Up US Subsidiary To Strengthen Bitcoin Income Business

Japanese investment firm Metaplanet today announced that it has set up new subsidiaries in the US and Japan to expand its Bitcoin (BTC) income generation business. In addition, the company also bagged the domain Bitcoin.jp – an indication that it will continue to spearhead BTC adoption in Asia.

Metaplanet Unveils Subsidiaries To Expand Bitcoin Business

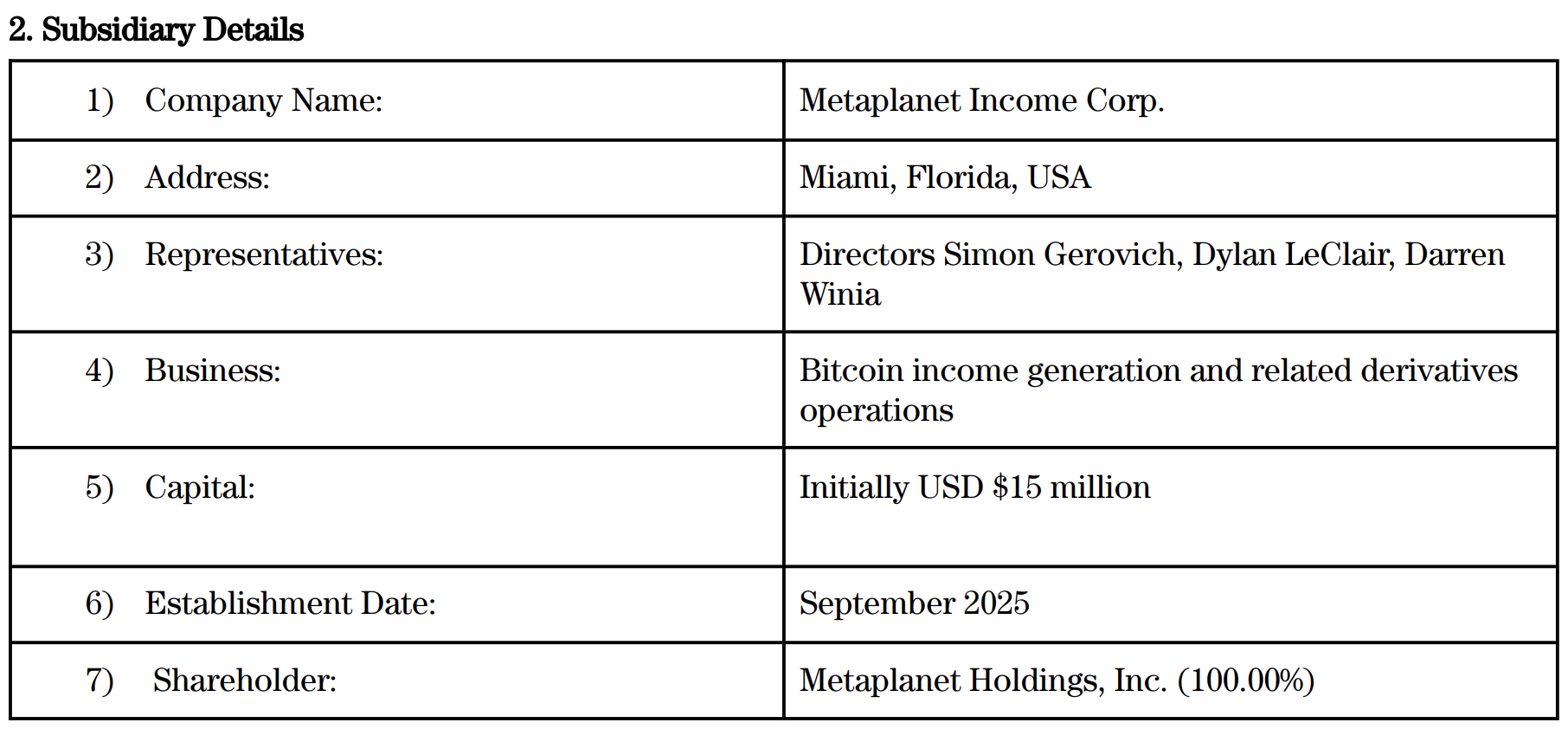

In an announcement made earlier today, Tokyo-listed Metaplanet stated it had established a new wholly-owned subsidiary in the US called Metaplanet Income Corp. to expand its BTC income business.

It should be noted that Metaplanet recently concluded a massive $1.4 billion capital raise. The firm’s US subsidiary will provide Metaplanet the opportunity to pursue derivatives operations and related activities that produce cash flow and revenue.

The establishment of Metaplanet Income Corp. will help the firm have a clear separation between the Bitcoin income generation business, and its core BTC treasury operations. This will help the company enhance transparency, governance, and risk management.

Besides Metaplanet Income Corp, the firm has also established a Japan subsidiary called Bitcoin Japan Inc. Metaplanet CEO, Simon Gerovich, commented on the development, saying:

Bitcoin Japan Inc., will primarily look after an array of BTC-based media such as conferences and online platforms, the Bitcoin.jp domain, and Bitcoin Magazine Japan. Notably, the domain was purchased from a private investor who had held it for over a decade.

Gerovich also commented on Metaplanet’s recent $1.4 billion capital raise, stating that almost 100 investors had joined the roadshow, with more than 70 of them ultimately investing. These investors include sovereign wealth funds, hedge funds, and other similar financial entities.

Metaplanet’s long-term ambition remains to be the second-largest holder of BTC, behind Michael Saylor-led Strategy. According to data from Coingecko, Metaplanet currently holds 20,136 BTC on its balance sheet.

In comparison, Strategy holds 638,935 BTC, and continues to extend its lead. However, to rank second, Metaplanet only needs to overtake MARA Holdings, which currently holds 52,477 BTC in its reserves.

Is BTC About To Fall?

Corporate adoption of Bitcoin continues to reach new heights, with a recent report noting that the total value of BTC treasury holdings recently surpassed $113 billion. Just a week ago, Metaplanet added to its BTC reserves.

That said, BTC whales recently dumped 115,000 – the largest distribution since 2022 – hinting that institutional demand for the digital asset may be temporarily waning. At press time, BTC trades at $115,670, down 0.7% in the past 24 hours.

Ayrıca Şunları da Beğenebilirsiniz

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

XRP Price Prediction March Update: Ripple and Aave Consolidate While DeepSnitch AI Surges 170%+ and Raises $1.8M