Digital Asset Treasury Firm Helius Plans to Acquire 5% of Solana Worth Over $6 Billion: Report

Solana Digital Asset Treasury (DAT) company Helius is considering buying at least 5% of Solana (SOL), equivalent to more than $6 billion.

The company will acquire Solana once it meets market capitalization and regulatory requirements, said Joseph Chee, who leads the SOL treasury strategy. In an interview with Hong Kong Economic Times, Chee noted that Hong Kong will be its second listing location.

“We will come here as soon as possible, perhaps within six months,” he said.

Joseph Chee acquired Helius, a healthcare tech company, transforming it into a DAT. Last month, the firm secured $500 million to build a Solana treasury focused on acquiring SOL. Chee founded Summer Capital and served as the head of investment banking, Asia at UBS.

Success of a DAT Relies on Technically Sound Currency: Zhu Junwei

Zhu Junwei, former head of UBS Investment Banking Asia, who currently serves as the executive chairman of Helius Solana Company (HSDT), proposed the goal of acquiring 5% Solana.

He said that the DAT companies can continuously increase the value of each token. “DAT is a bridge, an infrastructure that guides the flow of funds,” Junwei added.

He referred to the continuous issuance and market entry of DATs as a “flywheel,” noting that DAT’s stock prices generally trade at a premium to their net asset value (NAV).

Crypto treasury firms generally purchase digital assets, raising capital through common stock, convertible bonds, preferred stock, and even call options.

Further, Junwei believes that the success of a DAT relies on a “technically sound currency” and a “strong management team.”

“However, not all DAT companies can perfectly replicate or outperform cryptocurrencies,” he stated. “For example, Metaplanet, a Bitcoin DAT listed in Japan, saw its share price rise fourfold from May to June this year, but has since halved in recent months, with its performance clearly deviating from Bitcoin.”

Market Awareness of Solana is Currently ‘Low’

Relatively, a very few DAT firms are accumulating Solana. Recently, Brera Holdings PLC announced a $300 million private placement to establish Solmate, a Solana-based DAT and crypto infrastructure company.

Despite ‘low’ market awareness for Solana, the crypto’s processing power has surpassed Ethereum, with over 1,500 transactions per second, says Junwei.

Besides, Helius Solana Company has partnered with the Solana Foundation to develop in-depth ecosystem-level collaboration in Asia.

“DATs need to confront Wall Street, be able to clearly explain and analyze data in their language, and earn their trust,” Junwei added.

Ayrıca Şunları da Beğenebilirsiniz

Metaplanet CEO Denies Hiding Details

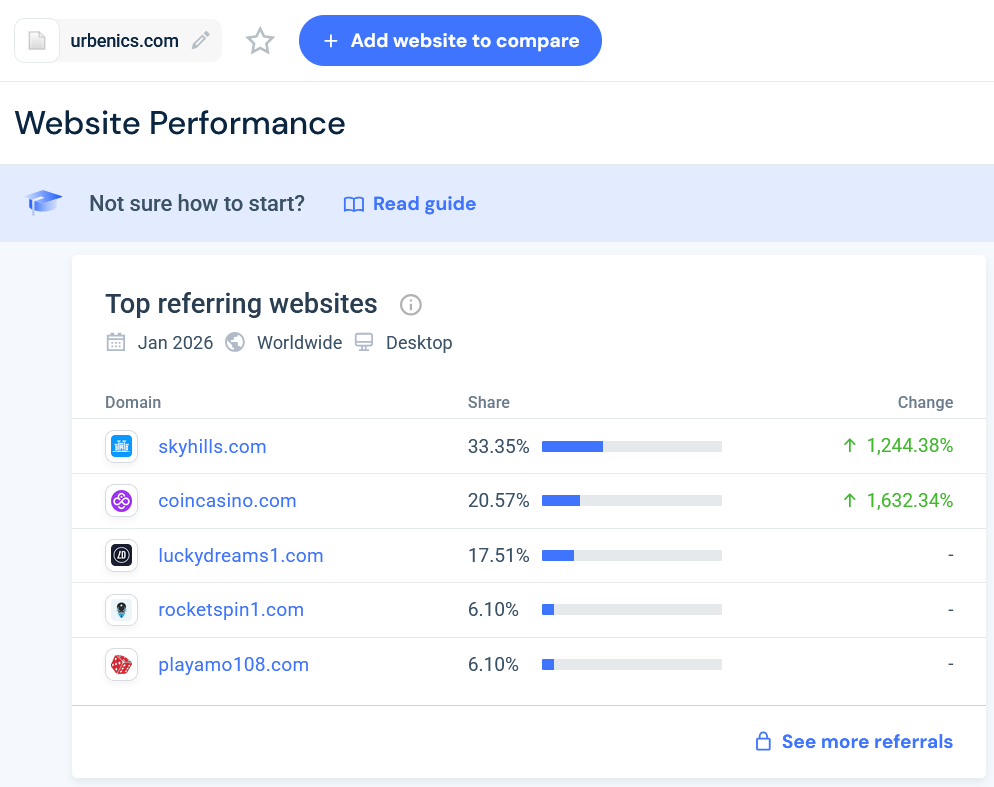

Shadows in the Payment Rail: The Urbenics.com Mystery