- Suncor

- ATS

- Brookfield

- Thomson Reuters

- BCE

- Canada Goose

Stock news: Dividend hikes, earnings results, and what moved Canadian stocks this week

Build your retirement savings with 1.50% interest, tax-deferred contributions and zero fees.

Earn a guaranteed 2.75% in your RRSP when you lock in for 1 year.

See our ranking of the best RRSP accounts and rates available in Canada.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

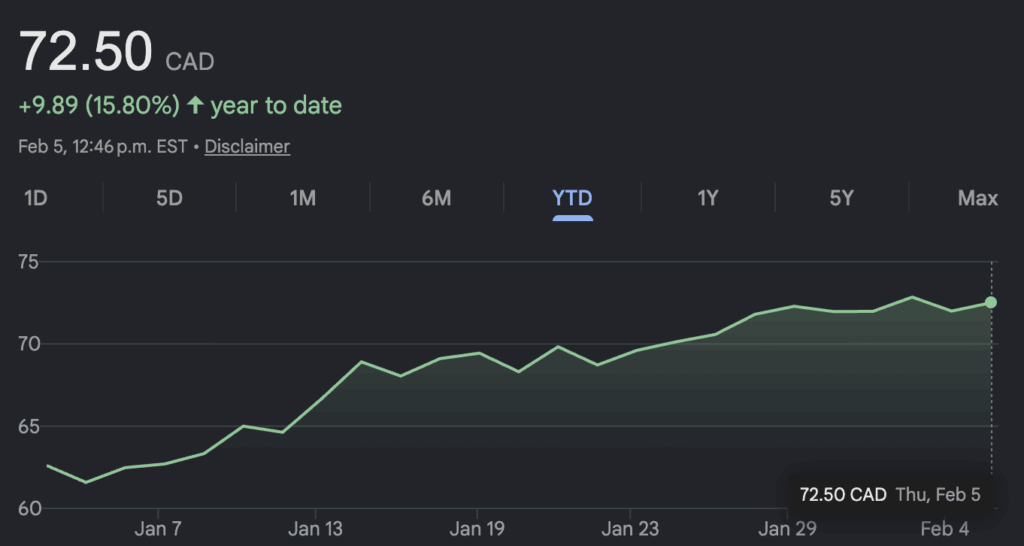

Suncor posts record production in fourth quarter, adjusted profit nudges downward

Oilsands giant Suncor Energy Inc. has reported net earnings of $1.48 billion for the last three months of 2025, up from $818 million a year earlier. That amounted to a profit of $1.23 per share, versus 65 cents a year earlier.

Adjusted operating earnings, which Suncor considers a better gauge of its underlying performance because it filters out the effects of unusual items, were $1.33 billion, or $1.10 per share. That’s a drop from the prior-year quarter, when Suncor had adjusted operating earnings of $1.57 billion, or $1.25 per share.

Operating revenues, net of royalties, were $12.04 billion for the period, down from $12.53 billion. Total upstream production was a record 909,000 barrels per day, up from 875,000 in the same 2024 period.

Source Google

Source Google

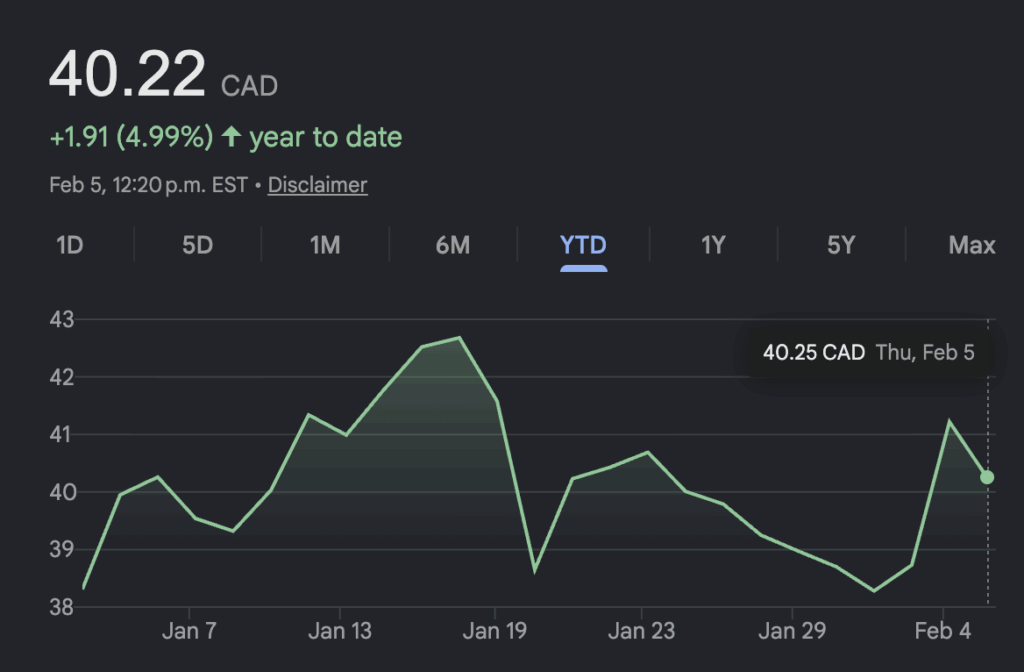

ATS reports third-quarter profit and revenue up from year ago

ATS Corp. reported third-quarter net income of $30.0 million, up from $6.5 million a year ago as its revenue rose nearly 17%. The maker of automation systems says the profit amounted to 30 cents per diluted share for the quarter ended Dec. 28 compared with a profit of seven cents per diluted share a year earlier.

On an adjusted basis, ATS says it earned 48 cents per share in its latest quarter, up from an adjusted profit of 32 cents per share a year earlier.

Revenue for the quarter totalled $760.7 million, up from $652.0 million.

ATS chief executive Doug Wright says the results reflected solid organic revenue growth across its portfolio, including continued momentum in services.

The company’s order backlog stood at $2.05 billion at the end of its most recent quarter, compared with $2.06 billion a year earlier.

Source Google

Source Google

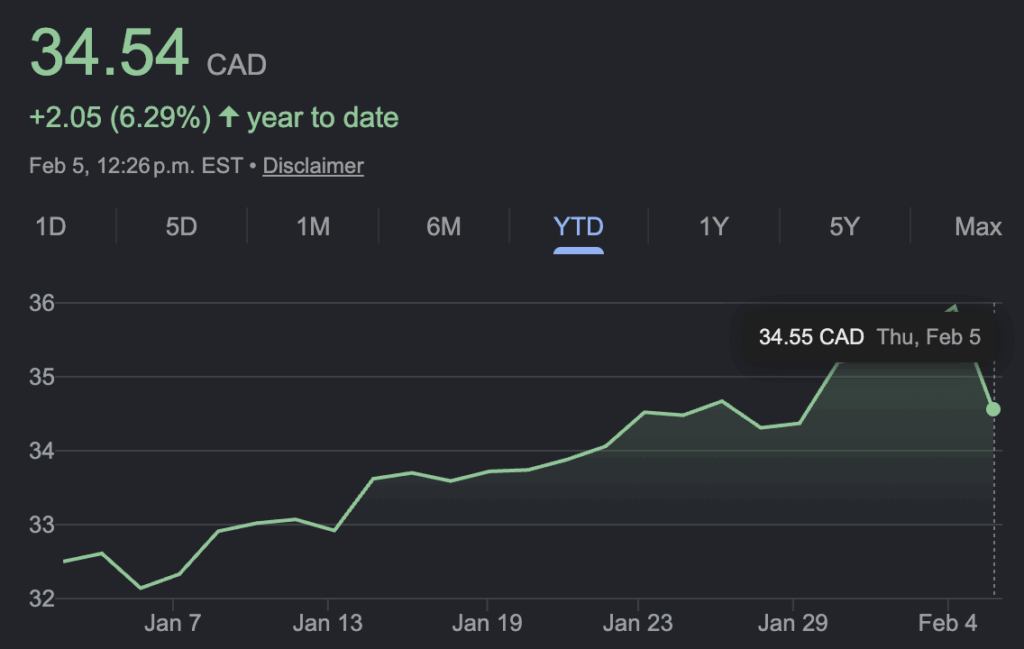

Brookfield Asset Management reports US$615M Q4 profit, raises dividend

CGI Inc. reported a first-quarter profit of $442.0 million, up from $438.6 million a year earlier, as its revenue rose nearly 8%. The business and technology consulting firm says the profit amounted to $2.03 per diluted share for the quarter ended Dec. 31, up from $1.92 per diluted share a year earlier.

Revenue for the three-month period totalled $4.08 billion, up from $3.79 billion. On an adjusted basis, CGI says it earned $2.12 per diluted share in its most recent quarter, up from $1.97 per diluted share a year earlier.

Earlier this week, CGI announced a collaboration deal with OpenAI that will see it expand the use of artificial intelligence across its business and help clients adopt it in their operations.

CGI has 94,000 consultants and professionals across the globe that provide business and technology consulting services.

Source Google

Source Google

Thomson Reuters reports US$332M Q4 profit, raises quarterly dividend 10%

Thomson Reuters raised its dividend by 10% as it reported a fourth-quarter profit of US$332 million, down from US$587 million a year earlier.

The company says it will pay a quarterly dividend of 65.5 US cents per share, up from 59.5 cents US per share. The increased payment came as Thomson Reuters says its fourth-quarter profit amounted to 74 cents US per diluted share for the quarter ended Dec. 31, down from US$1.30 per diluted share a year earlier.

Revenue totalled US$2.01 billion, up from US$1.91 billion in the fourth quarter of 2024. On an adjusted basis, Thomson Reuters says it earned US$1.07 per share in its latest quarter, up from an adjusted profit of US$1.01 per share a year earlier.

The average analyst estimate had been for an adjusted profit of US$1.06 per share, according to data compiled by LSEG Data & Analytics.

Source Google

Source Google

BCE reports $594M Q4 profit attributable to shareholders, Crave subscriptions up 26%

BCE Inc. reported a fourth-quarter profit attributable to common shareholders of $594 million as its revenue edged lower compared with a year ago. The company says the profit amounted to 64 cents per share for the quarter, compared with a profit of $461 million or 51 cents per share a year earlier.

Operating revenue totalled $6.40 billion, down from $6.42 billion in the fourth quarter of 2024. On an adjusted basis, BCE says it earned 69 cents per share in its latest quarter compared with an adjusted profit of 79 cents per share a year earlier. Analysts on average had expected an adjusted profit of 63 cents per share, according to data compiled by LSEG Data & Analytics.

The company reported 56,124 net postpaid wireless additions last quarter, down 0.8% from 56,550 a year ago. BCE cited a less active market, slowing population growth due to changing immigration policies and a focus on higher-value subscribers as reasons for the dip.

Customer churn—a measure of subscribers who cancelled their service—was 1.49%, the third consecutive quarter of year-over-year improvement. BCE’s mobile phone average revenue per user was $56.72 in the quarter, down 0.8% from a year ago. It said the decrease was due to “ongoing but abating” competitive pricing pressures and greater discounting, lower data overage revenue from customers subscribing to unlimited or larger capacity data plans, and lower roaming revenue amid Canadian customers’ decreased travel to the United States and adoption of Canada-U.S.-Mexico-International plans.

BCE says subscriptions to its Crave streaming service rose 26% in the fourth quarter to 4.6 million as its “Heated Rivalry” original series debuted in November.

The telecom company said its 2026 guidance is consistent with the three-year financial outlook shared last year, adding that it’s on track to hit its financial targets by 2028.

BCE said it’s expecting revenue growth of one to five% year-over-year for 2026. Desjardins analyst Jerome Dubreuil said this year’s outlook “came in modestly below expectations, particularly given management’s stated assumption of improving wireless pricing this year.”

Source Google

Source Google

Canada Goose Q3 profit down from year ago, revenue up 14%

Canada Goose Holdings Inc. reported a third-quarter profit attributable to shareholders of $134.8 million as its revenue rose 14.2% compared with a year earlier. The luxury parka maker says the profit amounted to $1.36 per diluted share for the quarter ended Dec. 28, down from a profit of $139.7 million or $1.42 per diluted share a year earlier.

Revenue totalled $694.5 million for the quarter, up from $607.9 million. Direct-to-consumer revenue totalled $591.0 million for the quarter, up from $517.8 million, while wholesale revenue amounted to $88.3 million, up from $75.7 million. Other revenue totalled $15.2 million, up from $14.4 million a year earlier.

On an adjusted basis, Canada Goose says it earned $1.43 per diluted share in its latest quarter, down from an adjusted profit of $1.51 per diluted share a year earlier. Analysts on average had expected an adjusted profit of $1.66 per share and revenue of $658.5 million for the quarter, according to data compiled by LSEG Data & Analytics.

Source Google

Source Google

MoneySense’s ETF Screener Tool

Read more news:

- Stock news for investors: Rogers sees revenue gain, lifted by Blue Jays’ playoff success

- Unpacking the proposed Canada Groceries and Essentials Benefit

- BMO replaces Air Miles with new Blue Rewards program

- Why 2026 could be a year to rent, not buy

The post Stock news: Dividend hikes, earnings results, and what moved Canadian stocks this week appeared first on MoneySense.

Ayrıca Şunları da Beğenebilirsiniz

What SBI Really Owns in Ripple May Surprise XRP Investors

![[Just Saying] ICC arrest warrant does not need local court imprimatur](https://www.rappler.com/tachyon/2026/02/icc-co-perpetrators.jpg?resize=75%2C75&crop=480px%2C0px%2C1080px%2C1080px)

[Just Saying] ICC arrest warrant does not need local court imprimatur