Toyota Unveils $10.8M Vehicle Blockchain Network on Avalanche to Reshape Mobility Trust

Key Takeaways:

- Toyota Blockchain Lab introduces the Mobility Orchestration Network (MON), built on Avalanche (AVAX), to bridge data, regulatory, and industry silos in mobility.

- The system bundles institutional, technical, and economic proofs into a blockchain-based identity for vehicles, enabling financing, insurance, and cross-border use.

- If deployed beyond the prototype stage, MON could transform how automakers, regulators, and service providers coordinate globally, while boosting AVAX’s real-world adoption.

Toyota, the world’s largest automaker with over 10.8 million vehicle sales in 2024, is expanding its blockchain footprint. Through its R&D arm, Toyota Blockchain Lab, the company unveiled a new framework: Mobility Orchestration Network (MON), aimed at creating a trust-first digital layer for global mobility systems.

Toyota’s Blockchain Push: From Cars to Crypto Infrastructure

The mobility business is evolving at a tremendous rate. Electric vehicles (EVs), automated drivers and increasing costs are driving an industry rethink of how value is captured and shared, between car makers, insurers and regulators. The motive behind Toyota using blockchain is to bind what was once a shattered ecosystem together by using the lacking blockchain fabric of trust.

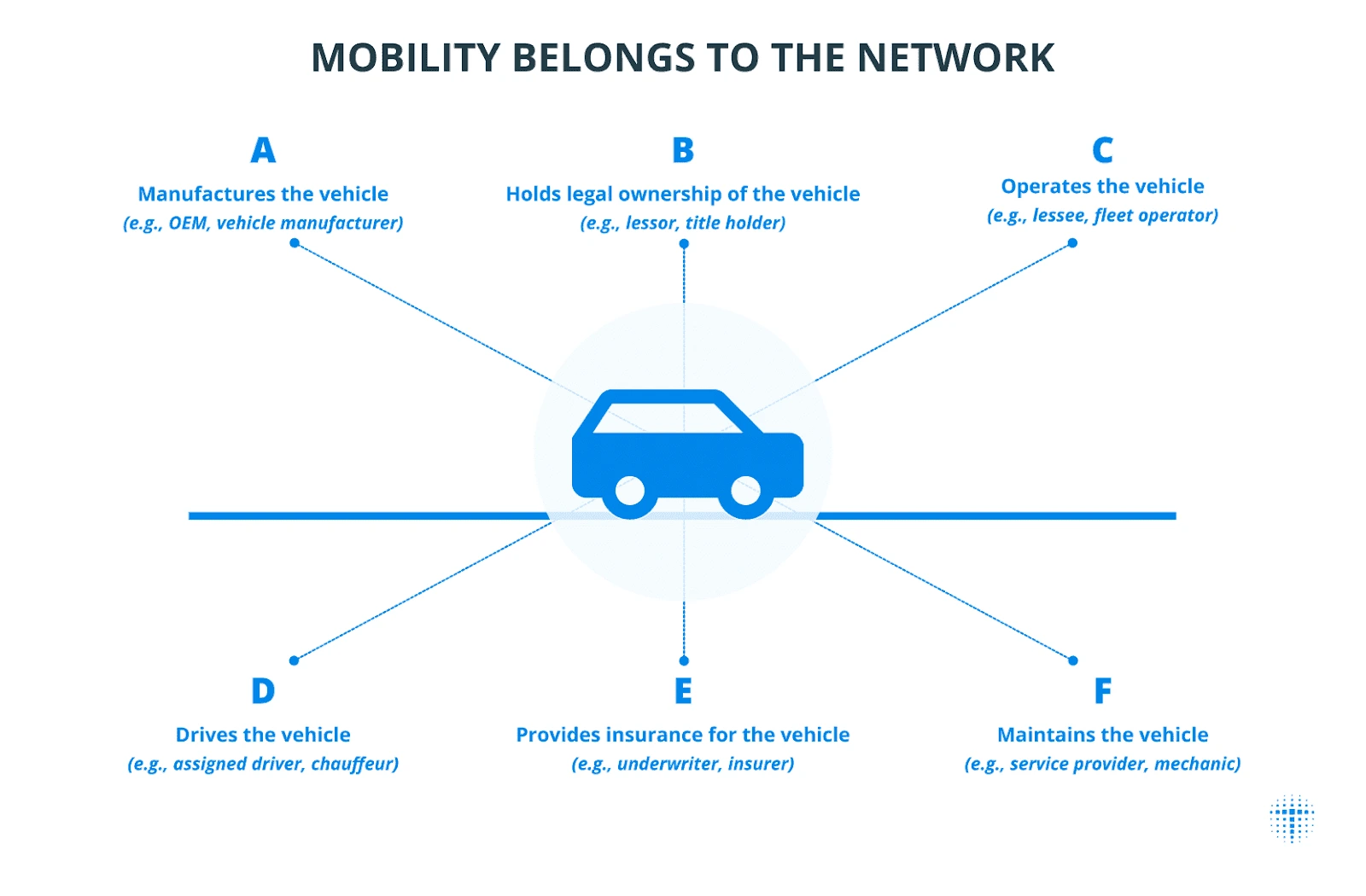

At the announcement date August 20, 2025, the prototype MON is conceptualized to mediate relations that support mobility ownership of vehicles, compliance with insurance, taxation, proof of safety audits, and operational data. Rather than treating cars as isolated objects, MON frames mobility as a network of verifiable relationships among multiple stakeholders.

This system is not just experimental. Toyota emphasizes MON as a response to three structural challenges in mobility:

- Organizational Gap – Vehicle data is locked in separate silos across agencies and corporations.

- Industrial Gap – No open, interoperable network exists to connect automakers, insurers, financiers, and service providers.

- National Gap – Regulations, tax systems, and insurance regimes vary across countries, complicating cross-border asset recognition.

Aiming to automate the interaction of vehicles and services, Toyota is targeting to digitalize the relationships through the implementation use of blockchain-ledger-based “Trust Chains: that minimize the use of paper-based procedures and unseen databases.

Why Avalanche? Speed, Scale, and Multi-Chain Flexibility

Toyota chose Avalanche (AVAX) as a blockchain, under which its “MON” will be built due to its low-latency consensus, multi-chain structure and in-built interoperability solutions. In contrast to the single-chain congestion model of Ethereum, Avalanche allows the creation of Layer-1 (L1) networks specific to use case needs.

For MON’s prototype, Toyota outlined four interconnected L1s:

- Security Token Network – For issuing securitized assets backed by mobility portfolios.

- Mobility Trust Network (MON itself) – For ownership rights and proof aggregation.

- Utility Network – For day-to-day mobility services such as ride-hailing, EV charging, and access rights.

- Stablecoin Network – For payments, service fees, and revenue distribution.

The design makes financial flows, operative data and regulatory proofs to be synchronized modular. These networks are connected via Interchain Messaging Protocol (ICM) created by Avalanche and allow secure, cross-chain messages and also atomic Delivery-vs-Payment (DvP) settlement.

Read More: SEC Pushes Back Decision on Grayscale’s Avalanche and Cardano ETFs

How the Mobility Orchestration Network Works

Fundamentally, MON digitalizes the trust within the cars in three provable areas of proofs:

- Institutional Proof – Titles, registrations, insurance compliance, and taxation status.

- Technical Proof – Vehicle Identification Numbers (VINs), OEM manufacturing data, firmware attestations, and verified maintenance records.

- Economic Proof – Usage rates, revenue performance, and activity record.

The aggregation of these proofs in a so-called Mobility Oriented Account (MOA). MON creates a vehicular identity that is native to a blockchain

The Fungibility Ladder – Turning Cars into Tradable Assets

To liberate finance, MON employs a “Fungibility Ladder”:

- Ownership as NFT – Each vehicle’s MOA is tied to a non-fungible token.

- Portfolios – Bundling multiple vehicles into semi-fungible portfolios for risk assessment.

- Security Tokens – Issuing fungible, regulation-compliant financial instruments backed by these portfolios.

What this transformation means is that capital costs can be reduced by securitizing fleets of electric vehicles, robo-taxis, or logistics vehicles and then trading them in a straightforward and transparent way.

Read More: Best NFT Marketplaces: Top 11 Platforms to Buy and Sell NFTs in 2025

Applications Across Mobility and Finance

Toyota foresees MON to overcome a number of real life mobility-finance obstacles:

- EV Fleets in Emerging Markets – Providing verifiable on-chain records to attract foreign investment into high-cost EV adoption.

- Autonomous Taxis – Offering investors transparent operational and safety records to finance deployment.

- Vehicle-to-Grid (V2G) Services – Monetizing BEV fleets as distributed energy-storage assets, with battery health and green energy proofs.

- Green Logistics – Bundling fleets and their validated emissions data to issue ESG-themed security tokens.

The scenarios are showing how MON can reduce the costs of due diligence and offer standardized data in cross-border financing.

The post Toyota Unveils $10.8M Vehicle Blockchain Network on Avalanche to Reshape Mobility Trust appeared first on CryptoNinjas.

Ayrıca Şunları da Beğenebilirsiniz

Cashing In On University Patents Means Giving Up On Our Innovation Future

Spur Protocol Daily Quiz 21 February 2026: Claim Free Tokens and Boost Your Crypto Wallet