SBI CEO Calls Ripple Stake A ‘Hidden Asset,’ Hints It Could Be Much Bigger

SBI Holdings CEO Yoshitaka Kitao pushed back on a viral claim that the Japanese financial group holds $10 billion worth of XRP, arguing instead that SBI’s more consequential exposure sits in its equity position in Ripple Labs, a stake he suggested the market may be underappreciating.

The exchange began after an X account described SBI as “a major partner of Ripple” and “holder of $10 billion in XRP,” tying the claim to SBI’s growing footprint in Asia through the acquisition of Coinhako, a regulated crypto platform based in Singapore. Kitao replied directly, disputing the framing and pointing to SBI’s ownership in Ripple rather than a headline XRP number.

“Not $10 bil. in XRP but around 9% of Ripple Lab. So our hidden asset could be much bigger,” Kitao wrote in a Feb. 15 post.

SBI CEO Dials Up Ripple Valuation Speculation

Kitao’s response effectively reframed the conversation from balance-sheet token inventory to private-market ownership. Rather than validate a specific XRP figure, he emphasized SBI’s stake in Ripple Labs, a detail that matters because equity value is ultimately a function of Ripple’s overall valuation, not the spot price of XRP.

In a separate post the same day, Kitao went further, explicitly tying his view to Ripple’s broader footprint. “When it comes to Ripple Lab’s total valuation which obviously include its ecosystem that Ripple has created, that would be enormous,” he wrote. “SBI owns more than 9 % of that much.”

Community member “BankXRP” amplified the implications by referencing recent reports that place Ripple’s valuation at “$50B+,” arguing that such a mark would put SBI’s 9% stake at “$4.5B+,” with “massive future upside as the CEO hints.”

While Kitao did not put a dollar figure on SBI’s stake, the 9% number sets a clean valuation yardstick. If SBI’s Ripple ownership were worth more than $10 billion, Ripple’s implied valuation would need to exceed roughly $111 billion, because $10 billion divided by 0.09 equals about $111.1 billion.

Put differently, at a $90 billion Ripple valuation, a 9% stake would be about $8.1 billion; at $50 billion, it would be about $4.5 billion. The threshold for “more than $10 billion” is therefore not a subtle rounding error, it requires a triple-digit billions valuation for Ripple.

Notably, SBI’s roughly 9% position appears to be the product of a long-running strategic relationship rather than a single headline trade: SBI’s own investor materials describe the Ripple relationship as having been “established” in September 2012, with the group later investing in Ripple in March 2016 and then deepening operational ties through the SBI Ripple Asia joint venture (SBI 60%, Ripple 40%) launched in May 2016.

SBI also participated as an investor in Ripple’s $200 million Series C financing announced in December 2019, a round that included SBI alongside other backers, one of the clearer public datapoints showing continued equity exposure as Ripple raised capital.

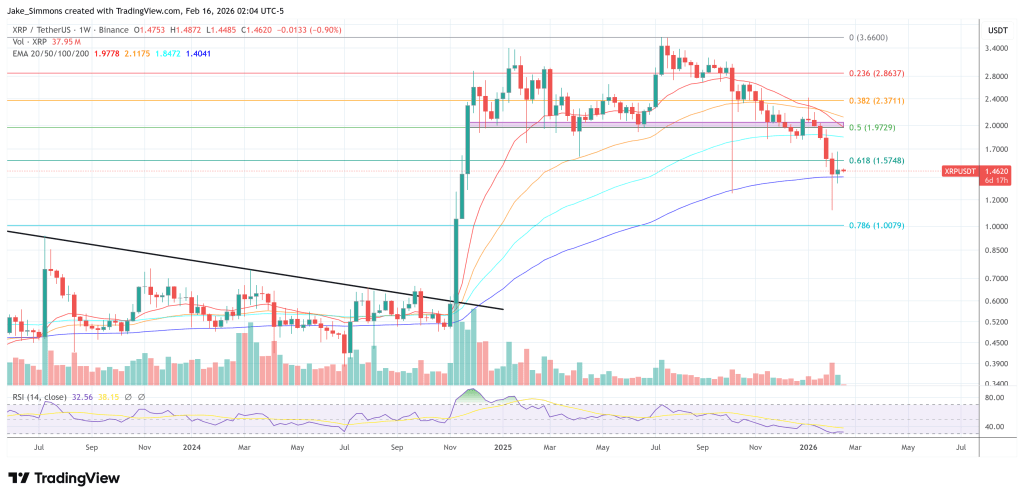

At press time, XRP traded at $1.46.

Ayrıca Şunları da Beğenebilirsiniz

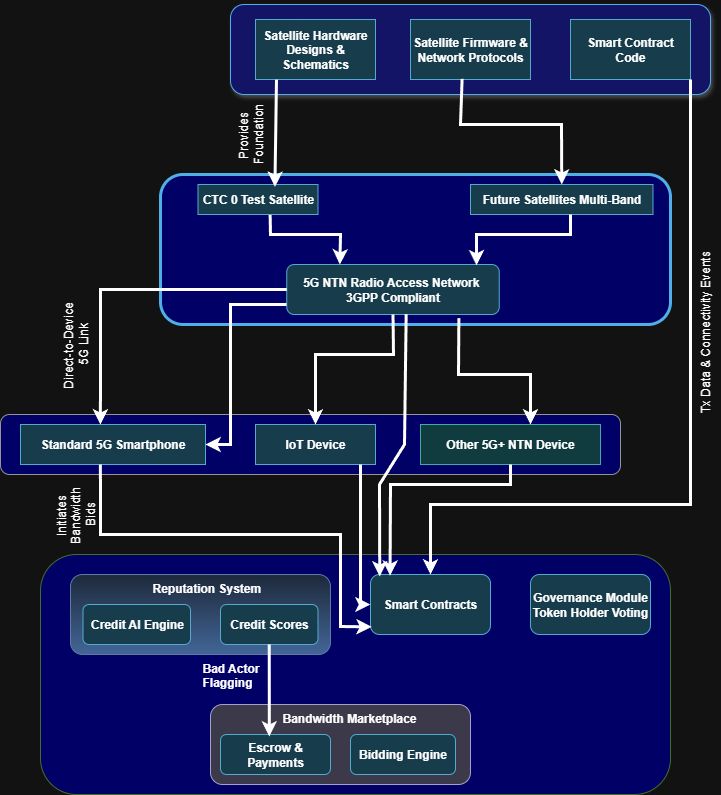

Rizz Network Lands $5M Capital Commitment from Nimbus Capital to Drive Next-Generation AI-DePIN Rizz Wireless Rollout

Spacecoin Saving Lives with Decentralized Connectivity