Bitcoin, Ethereum, XRP rally as crypto market rebounds

- The cryptocurrency market experienced a 2% growth on Wednesday, resulting in $258 million in short liquidations over the past 24 hours.

- Bitcoin rallied above $109,000 following the US trade deal with Vietnam and a rise in the M2 money supply.

- Ethereum, XRP, and Solana rallied by 7%, 3%, and 4%, respectively, as the altcoin market recovered.

Bitcoin (BTC) rebounded to $109,000 on Wednesday as the US agreement with Vietnam and a rise in the global M2 money supply stirred a surge in its open interest (OI), which spiked to 689.78K BTC worth about $75 billion. The broader cryptocurrency market rallied alongside BTC, with top altcoins Ethereum (ETH), XRP, and Solana (SOL) rising 7%, 3%, and 4%, respectively.

Bitcoin, crypto market rally on Vietnam trade deal and M2 money supply surge

The cryptocurrency market saw a rebound on Wednesday, rising 2% to reclaim its $3.5 trillion market capitalization.

The rally follows President Donald Trump's announcement on Wednesday, claiming that the US has secured a trade agreement with Vietnam that would ease certain tariffs previously imposed on Vietnamese exports.

As part of the deal, a 20% tariff will apply to Vietnamese imports into the US, while "transshipping" into the US will face a steeper 40% levy, according to Trump. He further noted that Vietnam will open its market to the US with zero tariffs on all American imports into the country.

"In order words, they will 'OPEN THEIR MARKET TO THE UNITED STATES,' meaning that we will be able to sell our product into Vietnam at ZERO tariff," wrote President Trump in a Wednesday Truth Social post.

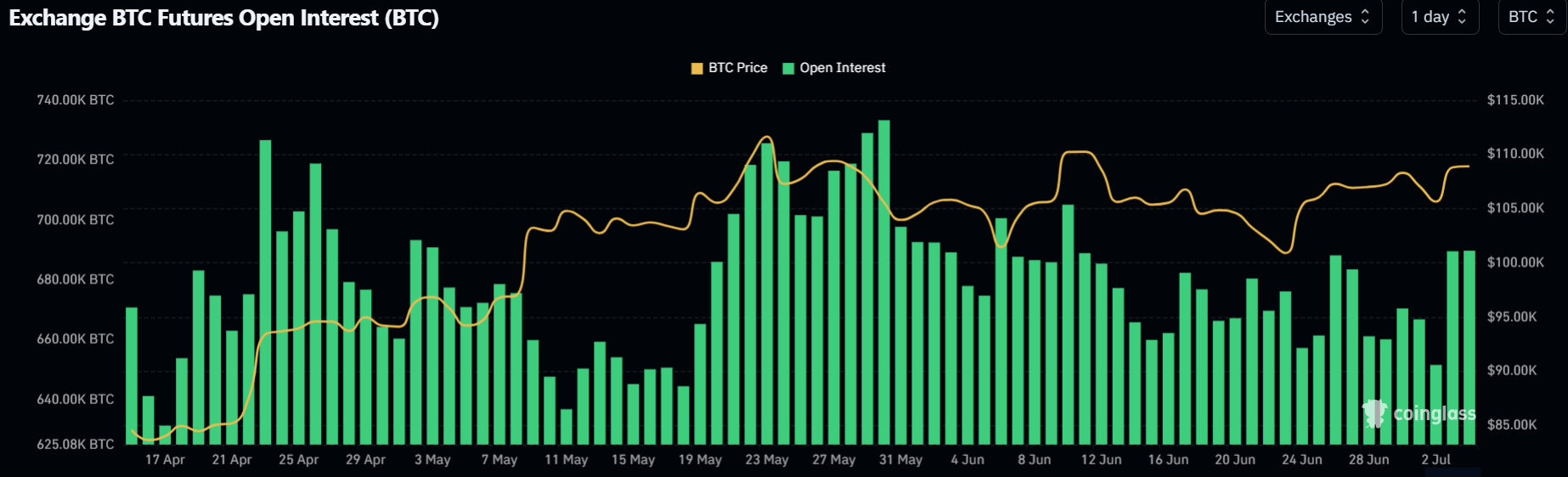

The development sparked a rise in Bitcoin, with the top cryptocurrency rallying 3% over the past 24 hours. The gains pushed BTC above $109,000 — just shy of its all-time high of $111,970 — driving its futures open interest (OI) from 651.66K BTC to 689.78K BTC, according to Coinglass data. Open interest is the total worth of outstanding contracts in a derivatives market.

BTC Open Interest. Source: Coinglass

Bitcoin's rise could also be attributed to the increase in the US M2 money supply, which rose 4.5% year-over-year in May to a high of $21.94 trillion, according to The Kobeissi Letter. The rally marks the US M2's 19th straight month of growth, surpassing the previous all-time high of $21.86 trillion set in March 2022.

The M2 is a measure of the money supply across the global economy, as tracked by central banks, including cash, checking deposits, savings accounts, and certificates of deposit that are available for spending and investments.

Bitcoin tends to track changes in global and US M2 money supply with a lag of three to six months. The global M2 money supply currently lags behind Bitcoin by 3 months, suggesting the top crypto could extend its rally in the coming months.

BTC vs Global M2 Liquidity. Source: Zerohedge

Meanwhile, Bitcoin's push to $109,000 has sparked a rally among altcoins, as Ethereum, XRP, and Solana recorded gains of 7%, 3%, and 4%, respectively, in the past 24 hours. The broader altcoin market also witnessed sizable gains, with most coins in the top 100 seeing an uptick of over 7%.

The surge in the crypto market has triggered $320.6 million in liquidations, comprising $62.8 million in long liquidations and $258.5 million in short liquidations, over the past 24 hours, according to Coinglass data.

Ayrıca Şunları da Beğenebilirsiniz

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon