Dow Jones up 500 points on Iran-Israel ceasefire, Powell to wait with rate cuts

U.S. stocks are up as lowering tensions in the Middle East create more positive, risk-on sentiment.

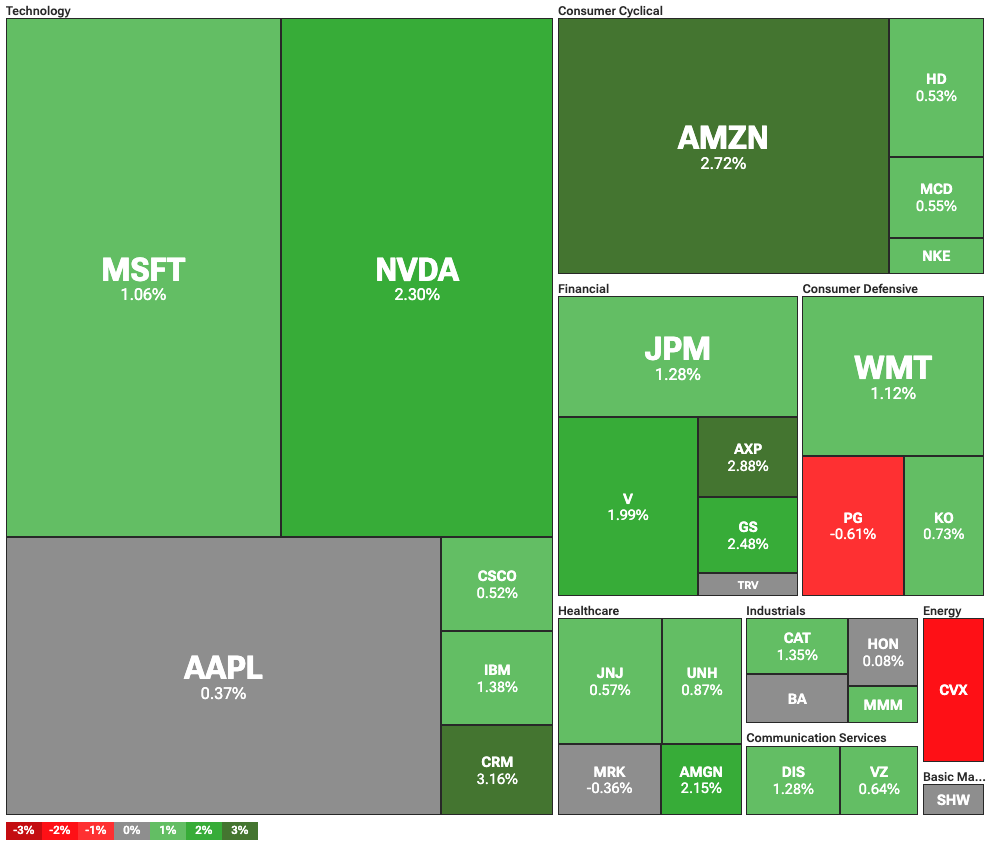

Major U.S. stock indices rose after the announced ceasefire between Israel and Iran. On Tuesday, June 24, Dow Jones was up 470 points or 1.1%, reclaiming its levels before the 12-day war started. At the same time, the S&P 500 was up 1.05%, and the tech-focused Nasdaq was up 1.43%.

Driving the markets were hopes that the conflict between Iran and Israel would cease for now. U.S. President Donald Trump announced a ceasefire between the two countries. Moreover, he pressured Israel to stop its attacks against Iran, which promised hope for an end to the war.

The escalation of a broader conflict threatened the global oil economy. This was particularly true after the U.S. got directly involved with its own strikes on Iran’s nuclear facilities. After these strikes, Iran even threatened to push the price of oil to its historic levels by closing the Strait of Hormuz.

The price of crude oil dropped back down to $64 per barrel, down 5.33% in just one day. Crude oil traded near $75 at the height of the crisis, the highest price since January this year. Lower oil prices are good news for the global macro outlook as they could lead to cooling inflation.

Fed can afford to wait with rate cuts: Powell

With de-escalating tensions in the Middle East, focus is once again on the Federal Reserve and interest rates. In his testimony before Congress, Fed Chair Jerome Powell said that the Fed will wait for more information before making changes to the interest rates.

In particular, Powell is concerned by the potential effects of Trump’s tariffs, which could both push inflation up and lower growth. What is more, effects on inflation could be either short-lived or persistent, which would require a different response.

In any case, Powell stated that rate cuts could come sooner if inflation stays low or if the unemployment rate picks up.

Ayrıca Şunları da Beğenebilirsiniz

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy

Japanese Yen rises on safe-haven demand and intervention concerns