Strategy purchases another 130 bitcoin for $11.7M as total holdings hit 650,000 BTC; establishes new $1.44B dividend reserve

Bitcoin treasury company Strategy (formerly MicroStrategy) acquired an additional 130 BTC for approximately $11.7 million at an average price of $89,960 per bitcoin between Nov. 17 and Nov. 30, according to an 8-K filing with the Securities and Exchange Commission on Monday.

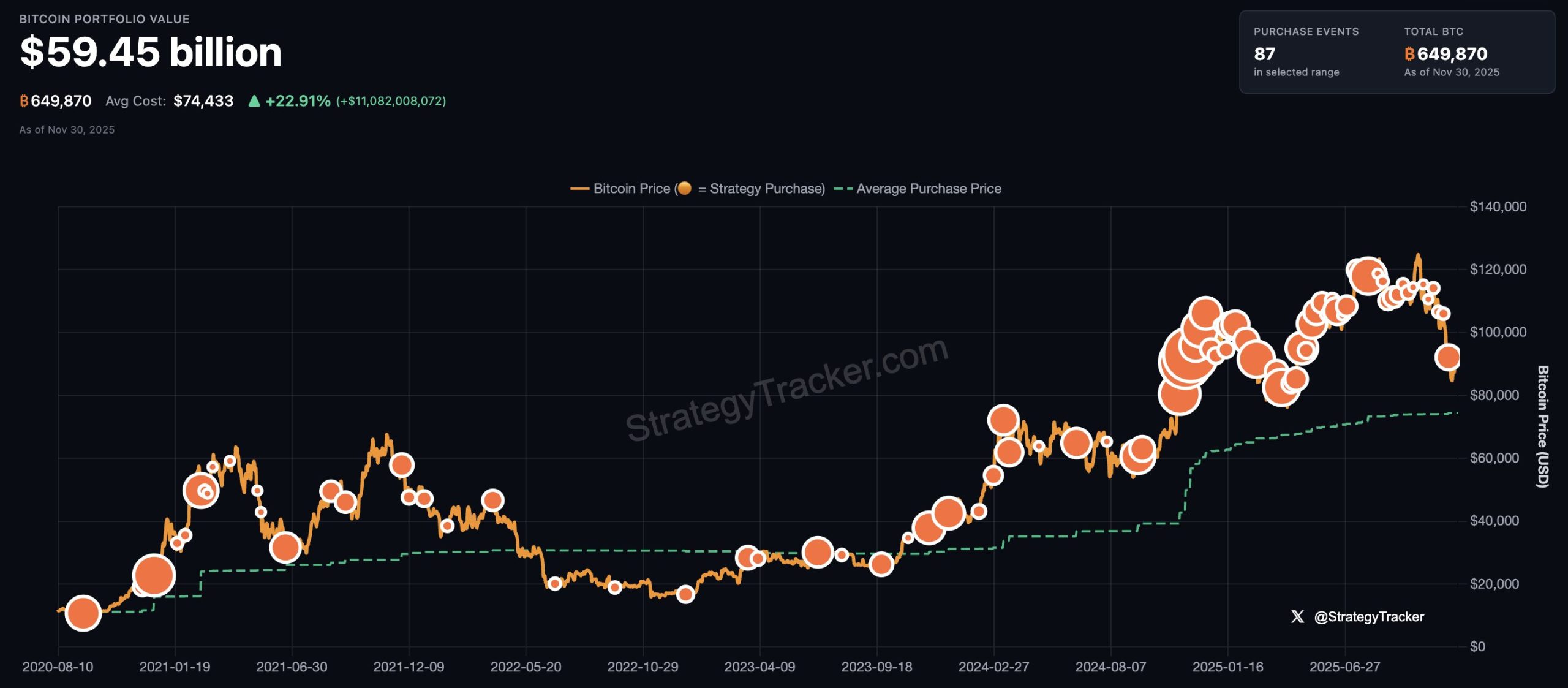

Strategy now holds a total of 650,000 BTC — worth around $56 billion — bought at an average price of $74,436 per bitcoin for a total cost of around $48.4 billion, including fees and expenses, according to the company's co-founder and executive chairman, Michael Saylor. The haul represents more than 3% of Bitcoin's total 21 million supply, and, despite the recent market slump, still implies around $7.6 billion of paper gains at current prices.

The latest acquisitions were made using proceeds from at-the-market sales of its Class A common stock, MSTR. During the last two weeks, Strategy sold 8,214,000 MSTR shares for approximately $1.48 billion. As of Nov. 30, $13.37 billion worth of MSTR shares remain available for issuance and sale under that program, the firm said. No shares of its various perpetual preferred stocks were sold in the period, with a collective $30.2 billion remaining under those ATM programs.

Strategy establishes USD Reserve

Additionally, Strategy announced a U.S. dollar reserve of $1.44 billion to support the payment of dividends on its preferred stocks and interest on its existing debt, funded by the MSTR ATM sales.

"Strategy's current intention is to maintain a USD Reserve in an amount sufficient to fund at least twelve months of Dividends, and Strategy intends to strengthen the USD Reserve over time, with the goal of ultimately covering 24 months or more of its Dividends," the firm said in the filing. "The maintenance of this USD Reserve, as well as its terms and amount, remain subject to Strategy’s sole and absolute discretion and Strategy may adjust the USD Reserve from time-to-time based on market conditions, liquidity needs and other factors."

Last Monday, Strategy appeared to have paused its weekly bitcoin acquisitions after failing to announce any new buys, with its total holdings remaining at 649,870 BTC. However, given the Nov. 17 to Nov. 30 date range in Monday's filing, it's unclear exactly when the latest acquisitions were made. That followed what Saylor described as a "big week" the week prior, announcing the purchase of another 8,178 BTC for approximately $835.6 million — its largest set of acquisitions since July.

Instead of his usual acquisition hints, Saylor posted an update on Strategy's bitcoin tracker on Sunday, stating, "What if we start adding green dots?" — likely referring to the new $1.44 billion USD reserve for dividends and interest payments.

“Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution, and we believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit," Saylor said Monday.

-

Strategy's bitcoin acquisitions. Image: Strategy.

According to Bitcoin Treasuries data, there are now 195 public companies that have adopted some form of bitcoin acquisition model. MARA, Tether-backed Twenty One, Metaplanet, Adam Back, and Cantor Fitzgerald-backed Bitcoin Standard Treasury Company, Bullish, Riot Platforms, Coinbase, CleanSpark, and Trump Media make up the remainder of the top 10, with 53,250 BTC, 43,514 BTC, 30,823 BTC, 30,021 BTC, 24,300 BTC, 19,324 BTC, 14,548 BTC, 13,011 BTC, and 11,542 BTC, respectively.

While the number of bitcoin treasury companies is still increasing, the value of many of the cohort's shares is down substantially from their summer peaks, and their market cap-to-net asset value ratios have sharply contracted. Strategy's common stock is down 61% since July, for example, with its mNAV currently sitting at around 0.9.

Last week, analysts at TD Cowen said that despite Strategy's bitcoin premium "heading toward 'crypto winter' lows" of 2021–2022, they still expect the company to outperform if bitcoin recovers, maintaining a $535 price target for MSTR.

'Our conviction in Bitcoin is unwavering'

Earlier in November, Saylor also struck a defiant tone, pushing back against the idea that it may be removed from MSCI indexes amid the stock's sell-off.

JPMorgan analysts had warned that Strategy could see billions of dollars leave its stock if MSCI removed it from major equity indices.

Strategy is currently included in indices such as the Nasdaq-100, MSCI USA, and MSCI World, effectively allowing bitcoin exposure to seep into both retail and institutional portfolios via passive investment vehicles.

The JPMorgan analysts estimate that roughly $9 billion of its $50 billion market value sits in passive funds that track these indices. "Outflows could amount to $2.8 billion if Strategy gets excluded from MSCI indices and $8.8 billion from all other equity indices if other index providers choose to follow MSCI," they said.

"No passive vehicle or holding company could do what we're doing. Index classification doesn't define us," Saylor said in response. "Our strategy is long-term, our conviction in Bitcoin is unwavering, and our mission remains unchanged: to build the world's first digital monetary institution on a foundation of sound money and financial innovation."

MSCI is scheduled to make its decision on Jan. 15, 2026 — a date the JPMorgan analysts described as "pivotal" for the stock.

MSTR closed up 0.9% on Friday at $177.18 but is currently down 4% in pre-market trading on Monday, according to The Block's Strategy price page. The stock gained 2.6% last week overall, but remains negative to the tune of 41% year-to-date, compared to bitcoin's 7.2% loss.

Updated with additional details throughout.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ayrıca Şunları da Beğenebilirsiniz

Visa Expands USDC Stablecoin Settlement For US Banks

Nasdaq Company Adds 7,500 BTC in Bold Treasury Move